Analyzing Insider Buying & Selling In The Gold Mining Sector: Finding Signal Amid The Noise

The value of insider buying & selling is often misunderstood by many investors with most insider transactions falling into the 'noise' category - in this video I identify signal amid the noise.

The vast majority of insider buying & selling can be classified into the 'noise' category. However, there are times when insider transactions can offer important signal for those who are paying attention.

In this video, I discuss a notable uptick in insider selling across the gold mining sector and why insiders are typically not better market timers than the rest of us.

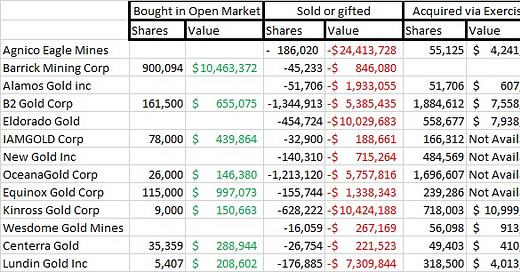

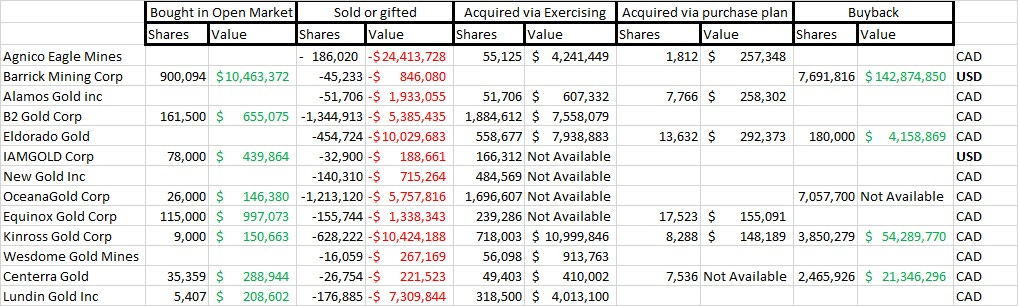

It’s notable that Barrick (NYSE:B, TSX:ABX) stands out from the rest of the Canadian gold producers in terms of both its insider buying activity and the size of its corporate buyback program. Meanwhile, Agnico Eagle (NYSE:AEM, TSX:AEM), Eldorado Gold (NYSE:EGO, TSX:ELD) and Kinross Gold (NYSE:KGC, TSX:K) have seen the largest volumes of insider selling so far in 2025.

I also delve into several examples of ‘signal’ from insider transactions and what made them stand out from the rest. Finally, I review a couple of examples that help to illustrate what I look for in a SEDI report.

Disclosure: Author owns shares of Endurance Gold at the time of publishing this video and may choose to buy or sell at any time without notice.

DISCLAIMER: The work included in this video is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This video is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDARplus.ca for important risk disclosures. It’s your money and your responsibility.