Billionaire Silver Investor Eric Sprott Owns 25% Of This Critical Minerals Triple-Threat

Aftermath Silver offers investors exposure to a large, near-surface silver-manganese-copper deposit with substantial property-wide exploration potential.

Aftermath Silver's Berenguela Project in Peru offers investors exposure to the critical metals silver, copper and manganese in one of the world’s top mining jurisdictions. Led by respected Chairman Mike Williams, who has engineered past successful exits and buyouts for shareholders, Aftermath has assembled the right combination of talent, properties, strategy, risk management and timing for investors seeking quality opportunities in today’s energy metals markets.

Aftermath's flagship Berenguela Project in Peru hosts a 43-101 mineral resource totaling 140 million ounces of silver, 3.25 million tonnes of manganese and 793 million pounds of copper.

This is my first on camera conversation with Aftermath Silver (TSX-V:AAG, OTC:AAGFF) Executive Chairman Mike Williams.

Here are some of the highlights of the conversation:

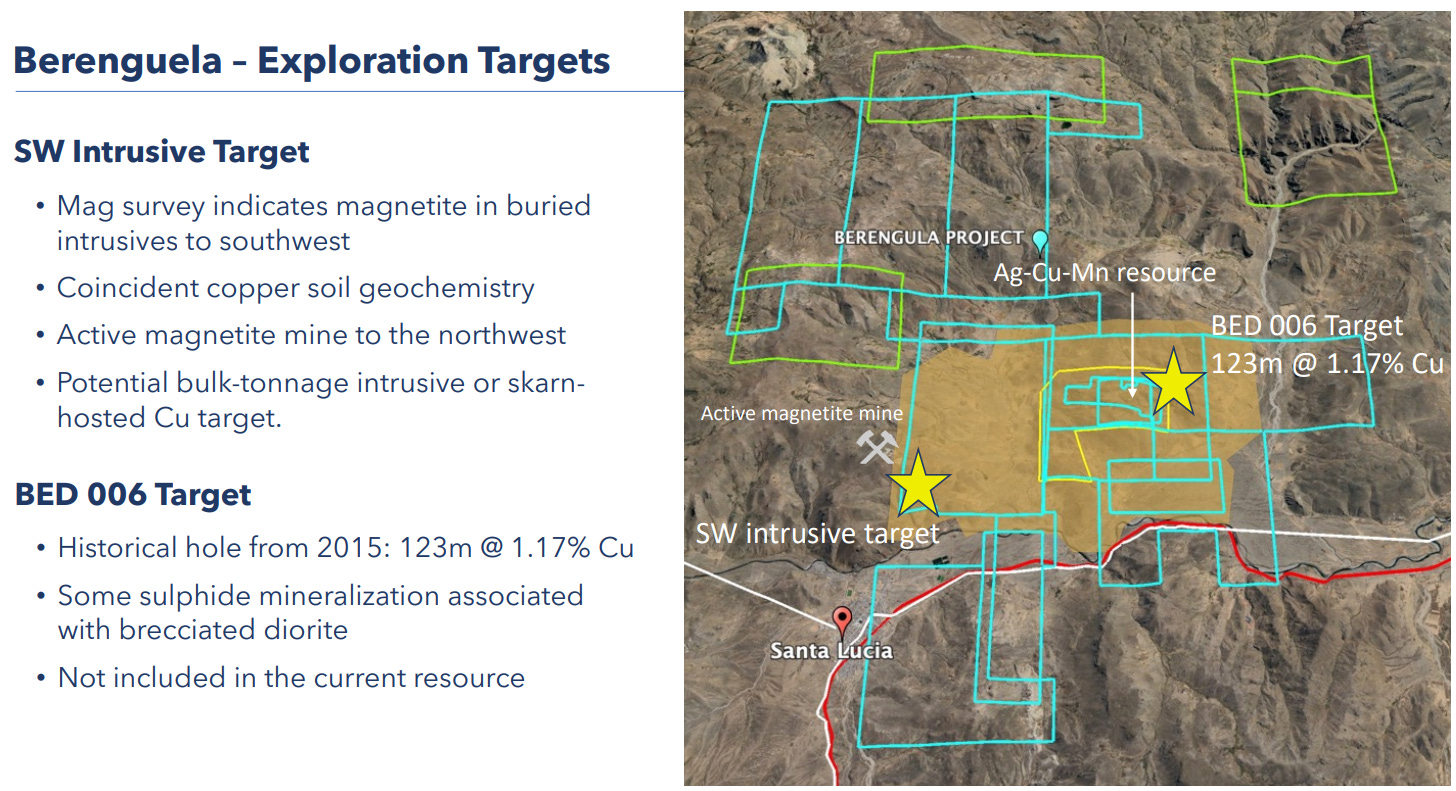

Copper and Exploration Upside - I inquired about the high copper grades, Mike explained that the copper grades increase towards the east, indicating proximity to a heat source or intrusive (00:08:25). Michael Williams noted a significant drill intercept of 153 meters of 1.26% copper, 7% manganese, and 290 grams of silver, suggesting potential for a world-class project if a skarn or porphyry deposit associated with the Carbonate Replacement Deposit (CRD) is found. Mike also highlighted a geophysical anomaly located four kilometers away from the main deposit, which is expected to be drill-tested next year, presenting significant exploration potential (00:09:45).

Strategic Importance of Manganese - Mike Williams emphasized the blue sky potential of the manganese market, noting that institutional investors are starting to recognize its value in critical metals (00:13:42). He also stated that for EV batteries, manganese needs to be 99.98% pure, and Aftermath Silver has achieved 99.9% purity in initial metallurgy, requiring scale-up for OEM specifications (00:15:35). We also discussed that the US and Europe pay significantly more for manganese than China, and the US government is likely to offer grants or loans to secure critical metals, providing a favorable market for Aftermath's product (00:16:54).

Infrastructure and Permitting - Michael Williams detailed the Berenguela Project's favorable location in southern Peru, close to a rail line, highway, and power, with a local workforce from the nearby town of Santa Lucia (00:18:44). Regarding permitting, Michael Williams indicated that while much of the permitting around Berenguela is complete, the company is currently permitting the skarn target and has started water and air test work. He projected that the project could be in production within six years, with permitting typically taking two years in Peru and a two-year build time (00:21:09).

Share Structure and Team Michael Williams shared that Eric Sprott, a prominent silver investor, increased their holding in Aftermath Silver to 25%, demonstrating strong confidence in the project's silver and manganese potential (00:22:52). Michael Williams highlighted key team members, including CEO Ralph Rushton, who has 35 years of experience in the industry, and Michael Parker, former country manager for First Quantum in Peru (00:30:33). He also mentioned Victor Grande, former World Bank development officer, who manages community relations and permitting, reinforcing the company's commitment to advancing the project efficiently (00:31:08).

Future Plans and Financing Strategy Michael Williams projected an updated resource in mid-September 2025, incorporating around 140 drill holes, which is expected to increase the resource size (00:27:54). He discussed the potential for an uplisting to the NYSE once economic numbers are released, which would be beneficial for American shareholders who are keen on silver (00:28:59). Michael Williams also discussed the company's financing strategy, which includes presenting two tracks in the economics: a full-scale silver, copper, and manganese project requiring about a billion dollars, and a smaller, modular silver and copper project at $600 million, making it more feasible for a junior company (00:37:28).

Disclaimer

The video is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Viewers are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The stocks discussed in this video are high-risk venture stocks and not suitable for most investors. Consult Company SedarPlus profiles for important risk disclosures. This interview contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SedarPlus.ca for important risk disclosures. It’s your money and your responsibility.