With gold ending last week at another new all-time high, the 2nd time in the last four weeks that gold has closed a week at a new all-time high level, precious metals mining investors suddenly find themselves in a bull market environment.

Before we delve into the bull market charts, let’s first begin with a word of caution. After being an investor in precious metals and mining shares for more than twenty years, I have learned some of the biggest mistakes that can be made in this sector. It never ceases to amaze me how few investors are interested in a gold stock that is trading near 52-week lows, and how many are suddenly interested after its share price has risen 100%+.

One of the biggest mistakes I have witnessed over the years is chasing a stock that has already risen sharply due to the Fear of Missing Out (FOMO).

FOMO is a capital killer.

FOMO represents greed and the desire to take part in an asset that has already seen its price rise significantly. Usually when FOMO is involved it also means that proper due diligence and risk management have been thrown out the window.

Simply stated, just don’t do it. No FOMO.

If we miss it, we miss it. Always remember that there will be another opportunity. In fact, I can assure you that there will be more opportunities tomorrow, and the day after tomorrow. It is simply up to you to find them and wait for the right entry points that make the most sense from a risk/reward standpoint.

Now that we have that out of the way I do want to point out the bull market adjustment that is underway across the gold & silver mining sector.

One must remember, as recently as February there were some gold miners that were making fresh 52-week lows (ahem…. Newmont):

NEM (Daily)

It required gold to rally nearly $200/oz to kick NEM back to life. However, even with gold soaring above $2,200/oz NEM continues to be a lackluster performer. In addition, Newmont has proven to be a serial disappointment when it comes to quarterly earnings results.

It’s no secret that the gold miners have lagged the metal badly in the last few months; the GDX and GDXJ exchange-traded funds are not even back to their December 2023 highs. In fact, the GDX & GDXJ only flipped green YTD at the end of last week:

GDXJ (Daily)

That means that we could still be very early in this upside move. Zooming out to the weekly and monthly charts only serves to confirm the notion of a nascent bull market move in precious metals miners.

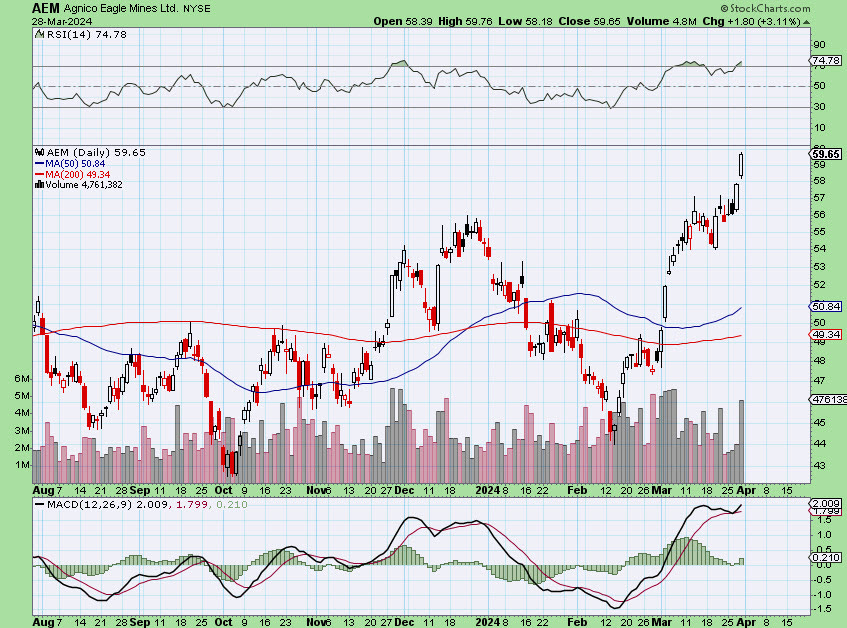

However, even if it does prove to be a broad based bull market in the miners, we should still focus on the strongest stocks with the best fundamentals. I have selected a handful of mid & large cap precious metals producers that I view as the cream of the crop. These five stocks have been selected based on the strength of their respective technical chart structures and fundamental valuation metrics such as operating margins:

AEM (Daily)

AGI (Daily)

ARIS.TO (Daily)

FCX (Daily)

SILV (Daily)

Probably the most important adjustment that traders need to make in the early stages of a bull market run is learning to be right and sit tight. During bear markets, or even rangebound markets, it often pays to take profits on small rallies. However, during a real bull market being too quick to ring the register can result in leaving huge potential gains on the table.

The bull market adjustment is riding the bull and resisting the temptation to cash in too early. As the great trader of the early-1900s, Jesse Livermore, so famously said “men who can both be right and sit tight are uncommon”.

The precious metals mining sector is displaying mounting evidence that a bull market adjustment is in progress. Are you paying attention?

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This video is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.