Citi Delivers A Bearish Call On Gold, A Good Try But Filled With Flaws

Citi downgraded its gold price targets across multiple time frames, the investment bank cited a miraculous growth sans inflation scenario as their rationale.

Earlier this week Citi downgraded its short- mid‑ and long‑term gold price targets, citing weaker investment demand and a stronger global economy. Citi is anticipating a cooling-off phase for gold: after a strong run, a combination of fading safe-haven demand, economic resilience, and technical supply factors may push prices below $3,000 later in 2025 into 2026.

In the last couple weeks, I have noticed many investors becoming more bullish and more confident that gold will continue to rise. Whenever this sort of surge in sentiment occurs, it makes me a bit uncomfortable. Therefore, the Citi downgrade caught my attention and prompted me to study the investment bank’s rationale in more detail.

Let’s take a look at the key points in the Citi report:

Target Revisions

Short-term (0–3 months): Trimmed to $3,300/oz from $3,500.

6–12 months: Lowered to $2,800/oz from $3,000.

Their base-case (60% probability) projects a consolidation between $3,100–$3,500/oz through Q3 2025, followed by a gradual slide below $3,000 into late 2025 or early 2026.

🔍 Why Citi Sees a Correction

Fading investment demand

Retail and institutional interest in gold (via ETFs/futures) is expected to diminish as “risk-off” sentiment wanes.

Stronger economic growth outlook

A brightening U.S. and global economy reduces gold’s appeal as a safe-haven asset.

Resolution of global risks

Easing geopolitical tensions or tariff disputes would lessen the impetus for gold. These risks include a resolution to the Ukraine War and reduced Middle East tensions. Overall Citi sees lower geopolitical risk premiums in the gold price.

U.S. political dynamics

With the 2026 midterms approaching, Citi anticipates a “growth put”—a stimulus or policy pivot that supports markets and diminishes gold demand.

Supply-side dynamics

Citi sees increased mine supply with new and expanded operations coming online, particularly in West Africa, Latin America, and Australia.

High gold prices (above $2,300/oz) incentivizing producers to extend mine life or process lower-grade stockpiles profitably.

Citi expects that recycled gold volumes will rise in 2025; high prices typically stimulate jewelry recycling, especially from Asia and the Middle East.

📈📉 Citi outlines three scenarios:

Base (60%) $3,100–$3,500 → below $3,000

Catalyst: Growth improves, investment flows slow

Bull (20%) > $3,500

Catalyst: Escalating geopolitical or economic risks boosting haven demand

Bear (20%) < $3,000 (possibly a correction to as low as $2,500–2,700)

Catalyst: Rapid easing of fears with strong U.S. growth

Gold (Weekly)

Gold continues the consolidation phase it has been in since April. A bid in the U.S. dollar has helped cool the gold price this week. However, I am not seeing anything to suggest that a major top is in place for gold. In fact, I view the current consolidation as extremely healthy, and downgrades like the one from Citi help to reconstruct a much-needed wall of worry.

🧠 How Interest Rates Play a Role

Citi notes that each 100 bp decline in interest rates might mechanically reduce gold’s forward valuation by ~$200/oz. If the Fed pivots to easing, yet growth is strong, gold could lose its shine despite lower rates.

The interest rate aspect of Citi's gold downgrade is the most intriguing to me because it seems counterintuitive. Why would stronger economic growth—and presumably higher inflation—combined with falling interest rates, result in a bearish outlook for gold?

Citi’s view: A “growth-friendly easing” by central banks is not bullish for gold — it’s actually bearish.

If the Fed cuts rates into a strong or improving economy (a "soft landing" or re-acceleration), investors rotate into risk assets like stocks and credit, not gold.

In that context, lower rates don't boost gold because fear and uncertainty are declining, which reduces gold's safe-haven appeal.

Lower interest rates often come when inflation is under control.

If real rates (nominal minus inflation) remain positive or stable, gold loses out to interest-bearing assets like bonds.

Citi notes that gold's strong performance in 2023–2024 was partly driven by fears of persistent inflation, which may now be subsiding.

In summary, according to Citi rate cuts without fear and volatility are actually net bearish for gold.

🪙 Goldfinger’s Take

Now to pour some cold water on Citi’s view. According to Citi, a nirvana scenario is about to unfold with growth rising sharply, inflation moderating, and geopolitical risks immaculately abating. Moreover, all of this will occur as interest rates are declining sharply.

This is an optimistic view to say the least; especially the part about a big surge in growth while inflation cools. I also don’t view ‘safe haven demand’ being as big a factor in the gold price today as Citi seems to believe it is. The Russia/Ukraine conflict has largely been in a stalemate for more than a year and I don’t know of anyone who has been buying gold because of a war that most are numb to.

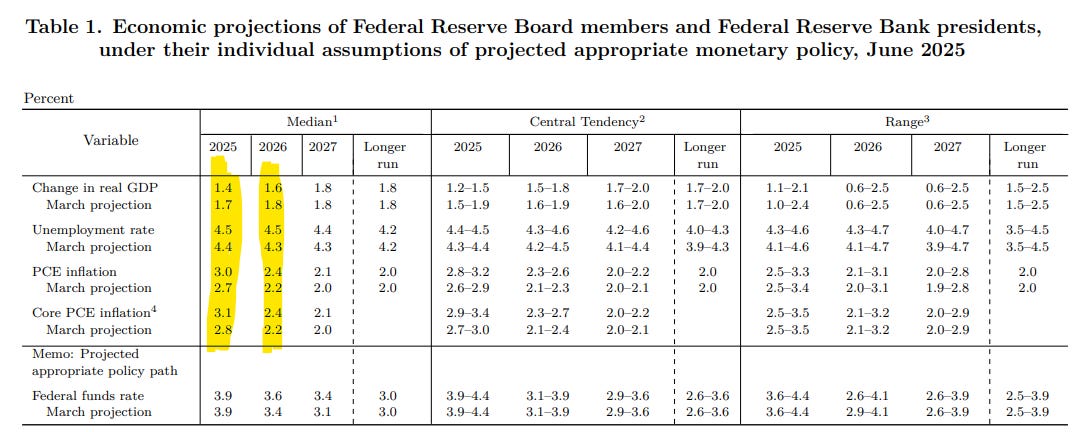

The irony of the Citi report is the Federal Reserve continues to reduce its real GDP forecast, while raising its unemployment and inflation forecasts:

The Fed's 2025 inflation outlook is now up three FOMC meetings in a row:

September: 2.1%

December: 2.5%

March: 2.7%

June: 3.0%

And the real growth outlook is down two meetings in a row:

December: 2.1%

March: 1.7%

June: 1.4%

Other flaws in the Citi report include a belief that growth can surge as interest rates decline, without inflation moving higher. In addition, the Fed sees real GDP continuing to undershoot. The only scenario I can envision that would create a strong growth boost would be one involving a combination of aggressive Fed rate cuts and a big fiscal boost (‘Big beautiful bill’). However, such a scenario would surely sink the US dollar and result in rising inflation levels.

It is also worth noting that despite an overall bearish call on gold, Citi still sees a 20% probability of a bullish scenario with gold rising well above $3,500/oz over the next year.

While I applaud the Citi analysts for going against the grain and thinking outside the box, there are some glaring flaws in their bearish gold thesis. The biggest of which is an apparent belief that a heavily debt-laden economy can generate a growth surge without rising inflation and a falling currency.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDARplus.ca for important risk disclosures. It’s your money and your responsibility.

Good stuff, Robert.