Collective Mining CEO Ari Sussman: This Is The Most Unusual Bull Market Cycle

Ari Sussman had several notable observations from his latest investor presentations and meetings in New York City

Earlier this month at PDAC, Collective Mining (NYSE:CNL, TSX:CNL) CEO Ari Sussman spoke with Paul Harris of Kitco. Ari had some interesting comments on a number of topics including Canadian companies listing in the US, generalist investor interest in the resource sector, and M&A.

On generalist funds being an important source of capital for the junior mining sector:

“We’re going to see these financings grow in size, and broaden out. Broaden out big time. This is the most unusual cycle. It’s the first time I’ve ever seen resource-focused funds not leading it, they don’t have inflows. The flows are into generalist funds, they are picking up the mantle and they are going to take this space forward.”

On the importance of companies listing in the US:

“80% of global capital in stock markets is in the United States. How do you not list there and access it? When you go into the United States and you say “hi we're listed in Canada”, the majority of individuals say “how do I buy in Canada? it's too complicated”. I'm the firmest believer that every company should US list, it's changed drastically over the last 10 years, and so that's where you need to be. The money is there, chase the money, and that trend is only going to continue.”

On how junior resource financing has changed over the years:

“I went to New York a few weeks back and I did a combination of institutional and retail marketing and there's a change. My retail presentations were oversold, they were overflowing out of the rooms. I was getting meetings with generalist investors for the first time. They aren’t buying Collective Minings (junior miners) yet, but they’re now starting to learn, and they’re seeing the enormous margin expansion that’s going on at the production end of the business and getting interested.”

On the M&A cycle in the gold mining sector and what his company Collective Mining could be worth:

“I think the M&A cycle right now is still in the early phases where producers are buying producers, that will eventually evolve into producers buying high quality projects. Our phones and our doors are open. If that comes, I don't know if it'll be Agnico Eagle or someone else, I don't care. If someone wants to buy us for the right price, they will. But your point, you mentioned that we were bought for C$2 billion at Continental Gold, the gold price was more than $1,000 lower than it is today and margins have expanded. I'm a believer that the M&A of this cycle, if you get it right, we're looking at numbers between $2 billion and $5 billion, not $500 million to $2 billion dollars, and if we’re going to be in it let’s get that price.”

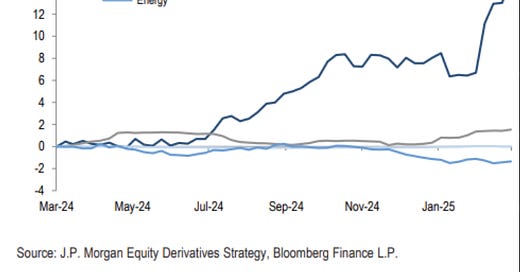

CNL.TO (Daily)

Disclaimer The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The stocks discussed in this video are high-risk venture stocks and not suitable for most investors. Consult Company SEDAR profiles for important risk disclosures. This interview contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SedarPlus.ca for important risk disclosures. It’s your money and your responsibility.