Core Assets: Honing In On The Valley Zone Porphyry Target At Laverdiere

Catching up with CRD-Porphyry explorer Core Assets and its recent update from the Valley Zone at the Laverdiere Project - Sponsored Post

In order to make new discoveries, we have to be optimistic and take big risks. The incredible Fruta Del Norte high-grade epithermal gold-silver discovery (roughly 10 million ounces averaging 10 g/t gold) by Aurelian Resources came on the 51st hole into the project. The discovery hole intersected 237.2 meters averaging 4.14 g/t gold and 8.5 g/t silver beneath ~200 meters of barren conglomerate cover. Drilling the discovery hole required a strong geological model, some imagination, and optimism. Without those ingredients, Fruta Del Norte might still be waiting to be discovered today.

Before the discovery hole at FDN, Aurelian was just like any other penny junior exploration stock struggling to raise money and keep investors engaged. With the discovery hole everything changed and two years later Aurelian was acquired by Kinross Gold in a $1.2 billion transaction.

It is these sorts of 100x returns that make the junior mining sector fun and exciting from an asymmetric return standpoint. Of course, it’s not often that a situation like Aurelian comes along. But when it does, it makes all the other mediocre/poor investments worth it.

The key ingredients for big upside in a discovery stock are usually some combination of the following:

Low share price and tiny market cap

High potential project that doesn’t have a lot of historical drilling, with large footprint and scale potential

A management team that is willing to dream and take risks

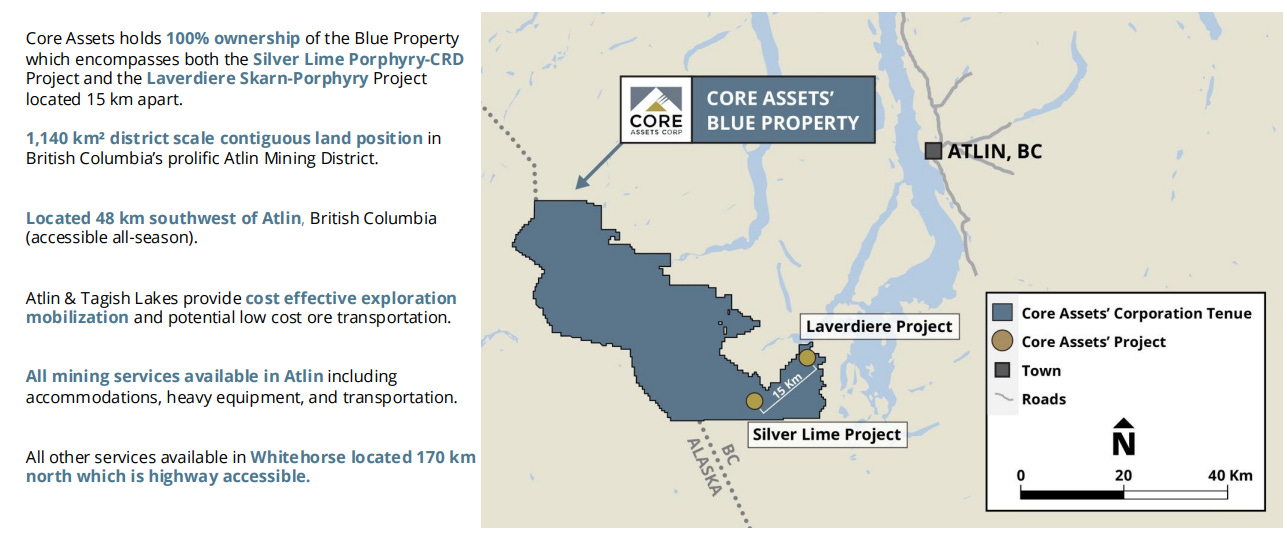

The situation today in Core Assets (CSE:CC, OTC:CCOOF) fits this criteria nicely. But that is certainly not a guarantee of discovery success. Core’s Blue Property in the Atlin Region of British Columbia offers compelling geology, and a unique location for a district-scale CRD/Porphyry project.

Core holds a commanding 1,140 square kilometer district scale land position. The Blue Property contains one of the largest and highest grade documented surficial expressions of any early stage CRD project, with indications of a potential large porphyry feeder stock nearby. The Project continues to display characteristics like that of the largest Porphyry-CRD systems globally and covers the full mineralization spectrum from copper-molybdenum porphyry through to silver-lead-zinc carbonate replacement over a 6.6 kilometer x 1.8 kilometer mineralized area.

Core Assets recently completed an updated 3D geological model from the Laverdiere Copper Project at the eastern Blue Property in the Atlin Mining District of NW British Columbia. In addition, Core reviewed historic assay results from Laverdiere, with some notable findings.

At the Blue Property, three copper-molybdenum-silver-bearing porphyries and their associated high-grade massive sulphide skarn showings record at least 50 million years of hydrothermal activity over a 30-kilometer trend. In particular, the Laverdiere Project is located on the Llewellyn Fault, a major regional structure with numerous occurrences of mineral deposits along a 365 kilometer trend (Mesothermal, Epithermal, Transitional, Porphyry, Skarn, etc.).

The Laverdiere Copper Project contains 5 kilometers x 8 kilometers of highly prospective, under-explored Cretaceous copper porphyry mineralization situated at the tip of the Stikine Terrane in northwest BC. Honing into the Laverdiere Project, Core has identified the Valley Zone as being particularly prospective.

Valley is a donut-shaped magnetic low geophysical anomaly measuring approximately 1,000 meters by 1,200 meters across. This magnetic low is surrounded by steeply dipping high-grade porphyry veins. Valley is located 2 kilometers southwest and 700 meters up-elevation from the Main Zone (drill-tested in 2022).

Both the Main and Valley Zones at Laverdiere are located just to the west of a major fault structure, the Llewellyn Fault. Magnetic lows may correspond to deep-seated faults or fractures that acted as fluid conduits, leading to mineralization. Many porphyry deposits are structurally controlled, with mineralized centers often aligning with regional fault zones visible in magnetic surveys. In some cases, a magnetic low can result from thick sequences of non-magnetic cover rocks overlying a mineralized porphyry system.

The Valley Zone sits in a valley located along a splay-fault of the larger Llewellyn Fault:

At the Valley Zone, a series of sheeted mineralized porphyry veins and fractures hosted in altered granodiorite have been mapped and sampled over a 1-kilometer east-west trend. Rock samples from a 2022 field program at Valley returned up to 3.24% copper (with 82 g/t silver, 0.56 g/t gold and 0.053% molybdenum) and 0.32% molybdenum (with 1.03% copper, 4 g/t silver) in 2022, and a 2024 sampling program returned 0.83% copper, 47 g/t silver, 0.44 g/t gold and 0.007% molybdenum.

2024 mapping at Valley uncovered outcropping veins (copper-gold-silver-molybdenum) up to 20-centimeters-thick that are concentrated in an area of increased structural complexity coincident with the edges of a 1-kilometer-wide donut-shaped magnetic low geophysical anomaly. Mineralized porphyry veins sampled at surface and in 2022 drill core show an overall increase in grade toward the center of the anomaly.

Laverdiere is low elevation, drill-ready, and easily accessible.

The better access should translate to lower-cost drilling at Valley. I would like to see Core raise enough money to test the Valley Zone with 3-4 ~500 meter drill holes.

Disclosure: Core Assets is a sponsor of Goldfinger Capital so some information presented should be considered biased. It is crucial that readers conduct their own research prior to investing. This includes reading the companies' SEDAR and SEC filings, press releases, and risk disclosures. The information contained in this article is based on data provided by the companies, extracted from SEDAR and SEC filings, company websites, and other publicly available sources. . Author owns shares of Core Assets Corp. and may choose to buy or sell at any time without notice.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SedarPlus.ca for important risk disclosures. It’s your money and your responsibility.