Drubbing In Newmont

After reporting a Q3 earnings miss, Newmont had its worst trading day since 1997

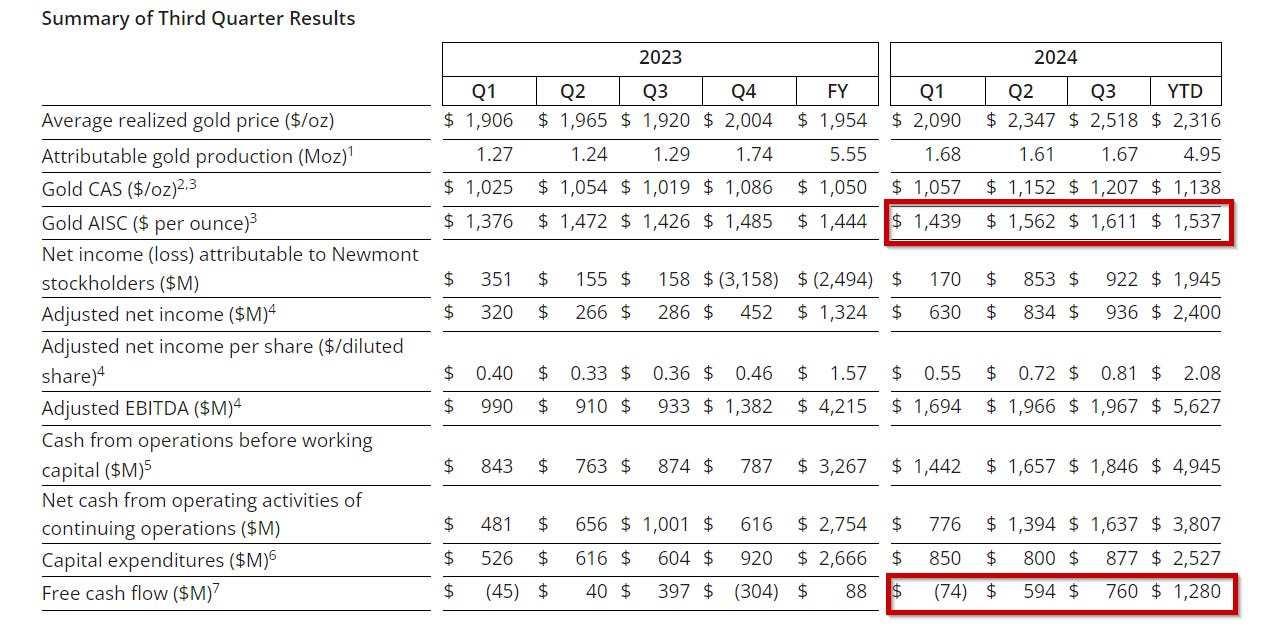

Yesterday after the market close, Newmont (NYSE:NEM) delivered a disappointing 3rd quarter report that included an increase in all-in sustaining cost (AISC) per ounce of gold produced to US$1,611/oz:

Free cash flow increased to $760 million, but fell short of what would have normally been possible with a $2,518 average realized gold price (without a labor strike at Penasquito, tailings remediation costs at Telfer, and other increases in capex).

Canaccord Genuity mining analyst Carey MacRury commented on Newmont’s quarter and the market’s vicious response:

“The street expectations were too high……It was negative, no doubt, but I don’t think it’s as negative as what the market’s telling us today.”

NEM (Daily)

Watching the world’s largest gold producer tumble 15% in a single trading session while gold trades above $2,700/oz is a bit surreal. However, Mr. Market decided that Newmont’s continued inability to control costs means that it does not deserve a premium multiple.

It’s really that simple.

I also viewed today’s drubbing in NEM as excessive, but I have learned to respect Mr. Market.

Newmont says that it will deliver attributable production of 1.8 million gold ounces at an all-in sustaining cost of $1,475 per ounce in the fourth quarter. If this forecast proves to be true, and gold prices stay near current levels through year end, then Newmont could deliver a spectacular Q4 report at the end of January.

However, after yet another quarter of rising costs the market is clearly in a “show me” mode when it comes to Newmont. The Newcrest acquisition was supposed to deliver “synergies” and help Newmont to contain costs across its tier-one portfolio. So far those synergies have not appeared, but I believe they will. Integrating two companies of the size of Newmont and Newcrest into one cohesive entity is a 2-3 year undertaking, at minimum. We are 12 months into this integration process.

On the bright side, Newmont is continuing the process of divesting non-core assets and plowing the cash generated by asset sales into the largest share buyback announcement in the history of the gold mining sector (US$2 billion).

Today’s wound is still fresh, and there could be some more downside in NEM shares over the next week or so. That means I am not rushing to buy NEM hand over fist, but I am looking out into the future and see the potential for an attractive trade setup forming in November.

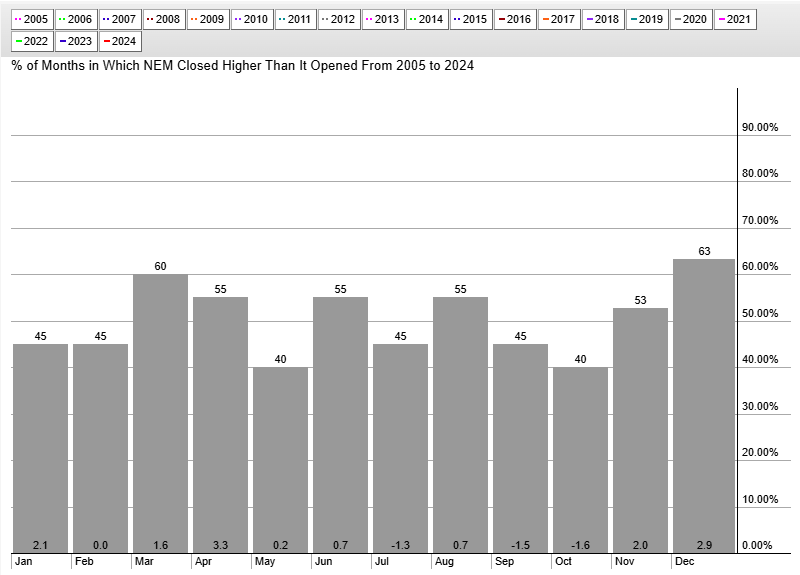

Historically, NEM has its strongest seasonal stretch of the year from November through January (rising an average of 7%). Toss in soured investor sentiment, the potential for a strong Q4, a massive share buyback, and we have the ingredients for a nice trade setup once NEM bottoms out.

It’s not here yet, but let’s keep NEM on the radar and see what sets up over the next couple weeks.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.