Emperor Metals Drills 52.1 Meters Grading .8 g/t Gold At Duquesne West

My latest conversation with Emperor Metals CEO John Florek focusing on the company's latest drill results

On October 29th, 2024 Emperor Metals (CSE:AUOZ) announced the assay results for the first 3 holes in the company’s 19 drillhole program, focused on the conceptual open-pit at the Duquesne West Project in the Abitibi Greenstone Belt. The results represent 1,452 meters of drilling – 18% of the completed 8,166 meter drilling campaign at Duquesne West in 2024.

I had the opportunity to speak with Emperor Metals CEO John Florek about the latest results, and what to expect from the company over the next several months as Emperor advances to a resource update in Q1 2025.

Goldfinger

Good afternoon John, it’s great to speak with you today. Emperor reported the first set of assays from 2024 drilling on October 29th. The headline is 52.1 meters of 0.8 grams per ton gold. That sounds like a pretty good intercept to me. Please tell us about the results that Emperor announced.

John Florek

That is a good intercept. I guess investors really have to understand what we're trying to do here. We're trying to move towards an updated mineral resource in quarter one of 2025.

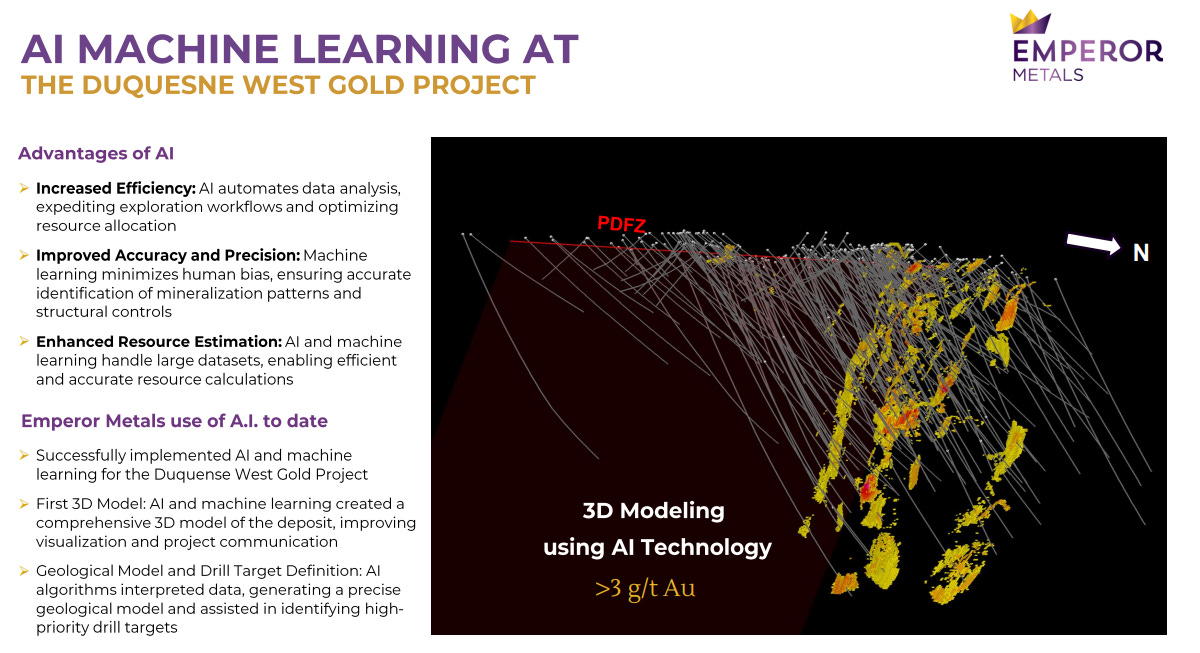

Previously, we have introduced investors that we do have a high-grade gold deposit here. It has a historical mineral resource of 727,000 ounces with an average grade of 5.42 grams per ton. What we liked about it most was that average thickness of 5.7 meters. That was what we know is there. This is important because we were adding independent and expanding on those high-grade ounces in 2023. Now, because of our 2023 drilling, we found that we had unaccounted gold in the host rocks.

The strategy for 2024 was to understand the near-surface low-grade bulk tonnage gold mineralization. That's very important because we did some pit optimization studies at the end of 2023. I put together a conceptual open pit that's 1.8 kilometers long, down to 400 meters deep, and within 800 meters width. We have these high-grade discrete lenses within it, but we also want to see low-grade bulk tonnage gold. This is what we're seeing here. This is fairly exciting because with this stuff, you're going to optimize your pit during mining.

You're going to have stockpiles at the mine site that are running high-grade, like 4 or 5 grams per ton, or they can be 0.5 or 0.8 g/t. This is for future development. What we want to see here is intercepts like we have of 52 meters of 0.8 g/t Au. We know that when I was up at Detour Lake Gold, the cutoff grade was down to 0.3 g/t. We were mining 0.3 grams per ton gold in these open pits. It's about mining at scale, putting tonnes through the mill, grabbing those incremental ounces as well as the high-grade ounces.

That's the vision. We're building an asset here.

Goldfinger

In 2024, you drilled 19 holes in total, and you just reported on three of those. There are four objectives of the 2024 program. A couple of those objectives were to increase the thickness of the high-grade lenses, expand some of the known zones, the lateral footprint, maybe to the east or down dip of the known pit model, and then to make new discoveries of some new zones of gold mineralization.

What can you tell us about the holes that are still to be reported and how well they're accomplishing some of those objectives?

John Florek

We need to wait for the assay results to get back. Things are looking good. We only reported the first three.

There's more coming in now, so we're having that steady flow. It's important to know that the initial 1,452 meters that we reported in this press release was about 18 percent of the drilling that we've done. But if you recall, we're also doing 8,000 meters of historical core sampling to capture those low-grade bulk tonnage ounces that were no one sampled before in the historical core.

We're doing that, so we've only reported about 8 percent of the assays. And like you said, we are trying to see if we can expand the pit boundaries eastward in this program. In the Nip Zone, which is over a kilometer away, we had some really good, great 16 meters of 6 grams or something like that.

How does that fit into the overall gap between what we conceive as our conceptual open puddle and also this new zone further east? So that was part of the objective, like you said, to explore the boundaries of the open pit, then add incremental ounces in the open pit. Even in this press release, we're seeing new zones in the footwall that were not identified previously with these holes.

So yeah, we're quite excited to see the rest of the results. And like I said, that's all going to contribute to building Emperor's first ever mineral resource estimate in quarter one of 2025.

Goldfinger

That's very exciting. The resource estimate in Q1 is going to be a big catalyst for the company. So of the 16 holes still pending, can you tell us how many were intended to test that gap zone or the high-grade Nip Zone that you just talked about?

John Florek

Yeah, so the next set of holes we'll probably release are going to be primarily holes trying to understand some of our satellite pits. Heading out towards the Nip Zone, we had an IP anomaly that there was some 3D geophysics that was done on the property historically, and there was this large IP anomaly. And so we wanted to test that, and that was just south of the drill in the Nip Zone.

So we wanted to see if maybe that identifies some low-grade tonnage gold as well that people didn't care about previously. So that's what we're doing. We're trying to connect the dots.

So now, at the end of the day, we picked up this property at just over 100,000 meters of drilling. Now Emperor's probably added about another 25,000 plus meters to the database for assays. And when you look at these types of deposits, well, our analogs just right here in the district there are several very similar projects.

They're ranging from like 300,000 to 600,000 to 800,000 meters of drilling. So we're only at 125,000 meters. We have a long way to go and it’s still early days at Duquesne West.

Overwhelmingly, we're hitting the majority of our holes. And so this is exciting news. This pervasive mineralization that we're seeing is so crucial to development of an open pit deposit.

So we're excited about what we're seeing. We're excited about the potential to expand. But we still have a lot of unaccounted potential discoveries because this is significant strike length.

So what does it mean for stuff at depth? We just don't have a lot of drilling yet. But we're showing and we're demonstrating that we have something pretty exciting here, especially with gold at $2,700. People were excited about this deposit when the gold price was at $1,100/oz But now we're at $2,700/oz.

Goldfinger

Well, I think that's an important point you make there about the $2,700 gold price environment. Even if we're conservative and use a $2,100 or $2,200 gold price, the economics of an ore body like this one, where you potentially have over a million ounces at multi-grams per ton, it's pretty compelling. And if Emperor can prove up scale to beyond 2,000,000 ounces, in a tier one location, you suddenly have a very attractive asset that could generate interest from the major producers.

John Florek

Absolutely. And just to recap, our conceptual open pit model was built on $1,650 gold. So those dimensions that you see in those press releases were based on everything that is profitable within that pit.

It's basically the break-even point at $1,650 gold. But that didn't account for these low-grade bulk tonnage intervals like we see in this press release. So we want to push that $1,650 basically operating cost down to $1,100 for all-in sustaining costs or something like that.

So we're trying to make the economics of this pit viable, even if gold drops down to $1,800 again. So yeah, we understand this because even our conceptual open pit model is well below the current market price of gold by like $1,000. So yeah, we feel comfortable with what we have here as an asset.

And we're happy to continue messaging this to investors where in that tier one district, we have majors all around us. This is an eco-ego camp. There's mills that are under capacity, like you said, that are starving for mill feed.

We see this as one of those opportunities to feed ore to the existing infrastructure in the region.

Goldfinger

So with 16 holes pending, do you think that you'll be announcing them in batches, three to four holes at a time, maybe once a month?

John Florek

Yeah, well, we're trying to have a press release out every two weeks. That's the goal. They're coming in.

You have to do the QA/QCs and sometimes certain holes, they might not pass. And so you have to send it back to the lab. So there's a whole process to just do your due diligence.

And when you publish the assay results, make sure they're in good shape. And so we're just following our protocols, which we outlined in our press releases. So I would think that the next batch of holes will probably have about five or six holes contained in the release.

That's what I'm anticipating. Five more holes, that would bring us up to eight holes, which is getting close to half of the drilling that we did, but still only about 25% of the total assays coming back.

Because we have that 8,000 meters of historical drilling. We're sampling the host rock for these high-grade lenses that no one's sampled before.

Goldfinger

Perhaps there will be some pleasant surprises in that historical core.

On October 24th, the company announced a financing of 7.5 million flow-through shares at 11 cents per share for gross proceeds of $825,000. What was the purpose of doing that financing at this point in time?

John Florek

Yeah, at this point in time, we're going into the winter season. So there's targets that we couldn't actually tackle because they're in more swampy areas. The only way you can tackle them is potentially at the winter time when everything's frozen over.

And so the goal was to raise some money now so we can get an earlier start to our 2025 drilling program. So we have some flow-through money in the bank. I didn't want to dilute that much because I think we're highly undervalued.

With Q3 results coming out from all these major miners, people are going to see how much profit these companies are making. And hopefully it's going to be trickling down to us. Emperor is at a C$10 million market cap and comparable projects to us have a $50 to $200 million market cap.

We think we're highly undervalued. So it was just a small enough amount so we can get a leap or a jump on the 2025 season where we can tackle some of these targets that are basically when we're on the surface or in more swampy areas.

Goldfinger

Yeah, that makes sense. And final question, John, how can investors contact you if they want to give you a few questions, if there's something that they don't quite understand about the company, what's the best way to contact you?

John Florek

In our press releases it has that info, I’m at johnf@emperormetals.com or alexh@emperormetals.com. That's Alex Horsley.

He's our corporate development guy. Just go ahead and call one of us, our phone numbers are listed in the press releases as well.

So that's the best way. And we look forward to speaking with any investor out there who wants to take a position in the company. Yeah, please call.

Goldfinger

All right, John. Thank you so much. And I look forward to more results from Emperor, and speaking again next month.

John Florek

Fair enough. Thank you, Robert.

Disclosure: Author owns shares of Emperor Metals at the time of publishing and may choose to buy or sell at any time without notice. Emperor Metals is a sponsor of Goldfinger Capital.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The stocks discussed in this article are high-risk venture stocks and not suitable for most investors. Consult Company SEDAR profiles for important risk disclosures. This interview contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information.