Gold Is Due For A Correction, Why I'm Not Selling

The emergence of fiscal dominance means Fed sanctioned financial repression is upon us

Gold finished the month of August at another all-time monthly closing high above $2,500/oz, its 2nd consecutive monthly closing all-time high:

Gold (Monthly)

Gold’s persistent strength continues to impress; there is no single proximate cause for the relentless bid beneath the gold price and a single Fed rate cut is still yet to materialize.

Fed Chair Powell’s Jackson Hole speech undoubtedly confirmed that Federal Reserve rate cuts are coming beginning in September. However, despite current market expectations it is by no means clear just how far the Fed will cut interest rates. While Fed Fund Futures are pricing in a probable reduction to below 4.00% on the Fed Funds Rate in 2025, there is still plenty of uncertainty regarding the future path of employment and inflation in the US economy.

On a recent episode of Odd Lots, economist Adam Posen (President of the Peterson Institute) sees a high probability of upside to consensus inflation forecasts in 2025. Posen’s base case is that one year from now inflation will be up between 1.00% and 1.50% from current levels near 2.50%. This could mean that the Fed is embarking on an aggressive rate cutting cycle just before inflation begins to rebound.

In a recent tweet, Lawrence McDonald highlighted the fact that the Fed is kicking off a rate-cutting cycle with core-PCE far above its pre-pandemic norm levels:

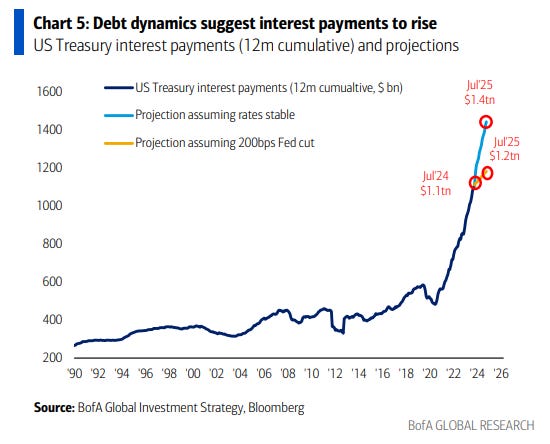

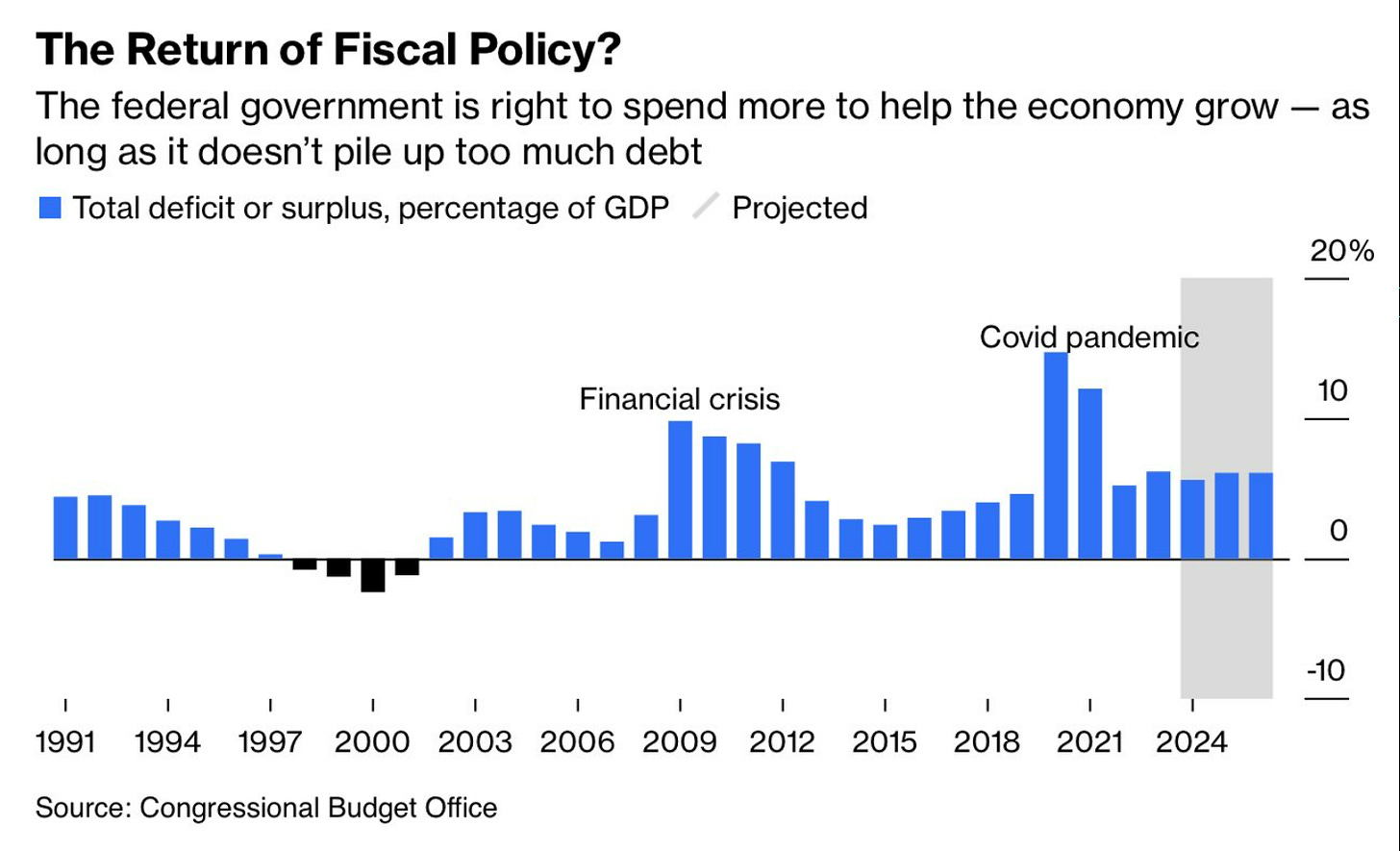

As fiscal dominance emerges, monetary policy concerns take a backseat; the currency inevitably becomes the outlet for the fiscal largesse of government. Interest expense as a percentage of government tax receipts is approaching 25%, giving the Fed little choice but to support the Treasury in financing itself:

As McDonald succinctly explains it:

“When you have a $35T debt load - adding $1T of new debt on every 100 days, the only way out of that hole without a default is financial repression. They must get interest rates BELOW the rate of inflation. This is their ultimate goal, the ONLY mathematically sustainable exit.”

By reducing interest rates to below the inflation rate, the central bank punishes savers and gradually transfers wealth from the private sector (reducing the value of savings) back to the public sector (reducing the value of the public sector debt through inflation). This form of financial repression will inevitably result in investors fleeing to the perceived safety of hard assets (real estate, gold, bitcoin, etc.).

I believe that Mr. Market has begun anticipating what it is to come, and that can help to explain why gold has so markedly diverged from real interest rates over the last couple years.

Regardless of who becomes President of the United States in November, the trends in US government debt and budget deficits are unlikely to shift much. We are simply too far along and closing in on the endgame. The only difference between the two candidates in terms of the monetary policy/debt bust endgame is that one candidate may usher in a breaking of the system faster than the other one.

While I am wildly bullish on gold longer term, I am secretly holding out hope for one more correction in the near term. It will be this correction, if it materializes, that I believe will give investors one final great buying opportunity before a rally to $3,000+ transpires.

There are plenty of factors that would normally indicate gold bulls are cruising for a bruising imminently….

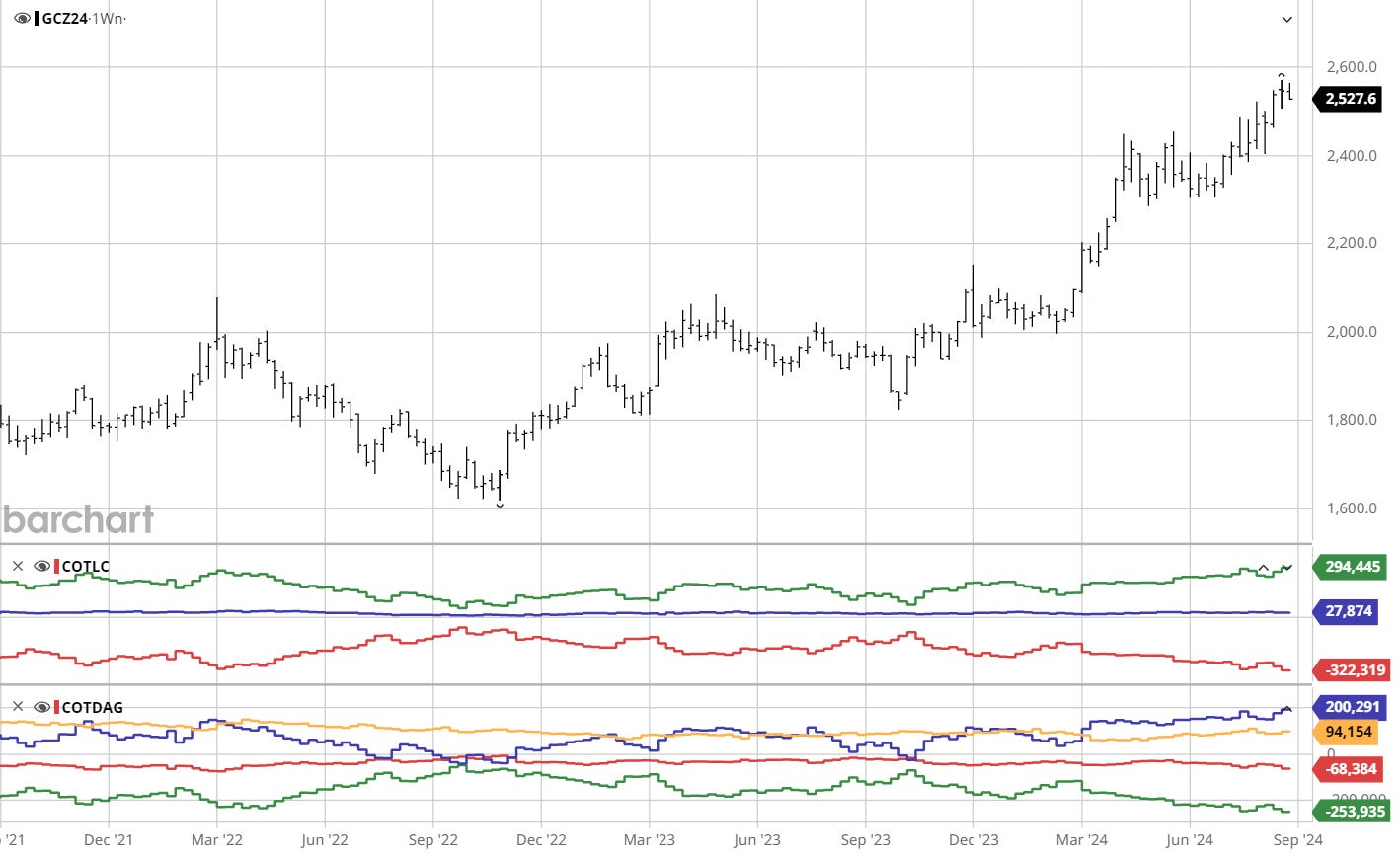

CFTC Commitments of Traders positioning is very extended:

Swap dealers are holding the largest net notional short position in gold futures in history - CoT data is never a perfect market timing tool, but it’s safe to say the risk of a correction is elevated.

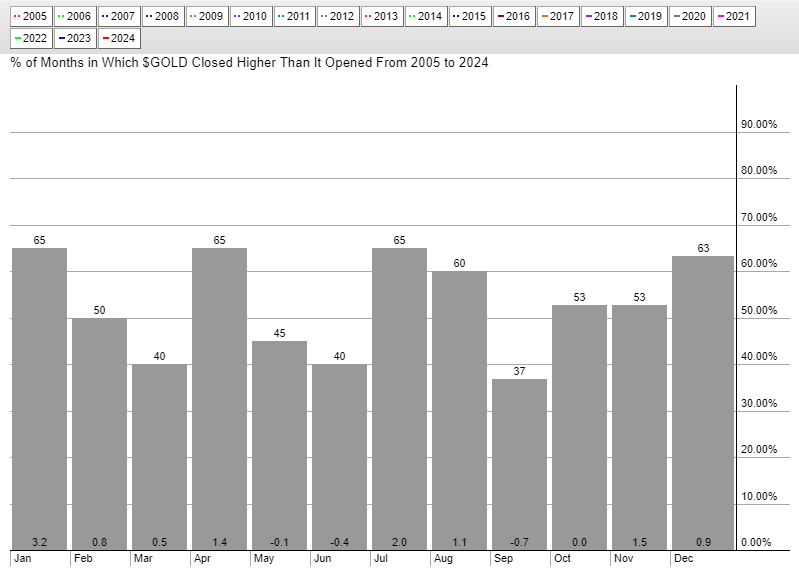

And seasonality turns less favorable as September commences:

While positioning and seasonality are standard reasons to expect some near term downside for the yellow metal. It is also quite possible that gold is on the cusp of reaching ‘escape velocity’. This could mean that any near term downside price action will be extremely short-lived.

This is my way of saying that normally we should be expecting $150-$200/oz of near term downside to reset the CoT positioning. However, given the gravity of the tectonic forces at play today, perhaps extreme can get extremely extreme before the gold market sustains a violent reset.

In a world in which long-held public delusions are being shattered at a rapidly accelerating rate, gold stands True as a timeless store of value. As a great reset of the global economic system evolves, the global fiat edifice stands to crumble to its knees. Gold will stand unblemished, timeless, and invaluable.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This video is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.