Gold Miners Are The Best Performing Sector Of 2025: Be Right And Sit Tight

After a tumultuous week, markets ended on a high note after cooler than expected CPI/PPI data and soothing comments from Boston Fed President Susan Collins

After a tumultuous week filled with headline-driven whipsaws, markets ended on a high-note after Boston Fed President Susan Collins stated that the Fed is “absolutely prepared to deploy various tools” as needed in order to maintain orderly market functioning.

These sorts of regional Fed President comments on a Friday afternoon don’t appear randomly. While Collins certainly didn’t commit to anything, the timing of today’s comments were clearly designed to soothe a shaken Treasury bond market; reminding a jittery market that the Fed stands ready to take action and intervene to ensure orderly market functioning and effective transmission of Federal Reserve monetary policy.

Since the market turmoil kicked off on the afternoon of Wednesday April 2nd (“Liberation Day”), the Fed had preferred to remain relatively quiet. However, after much cooler than expected March CPI & PPI reports the Fed must have decided it was time to send a signal to markets heading into the weekend:

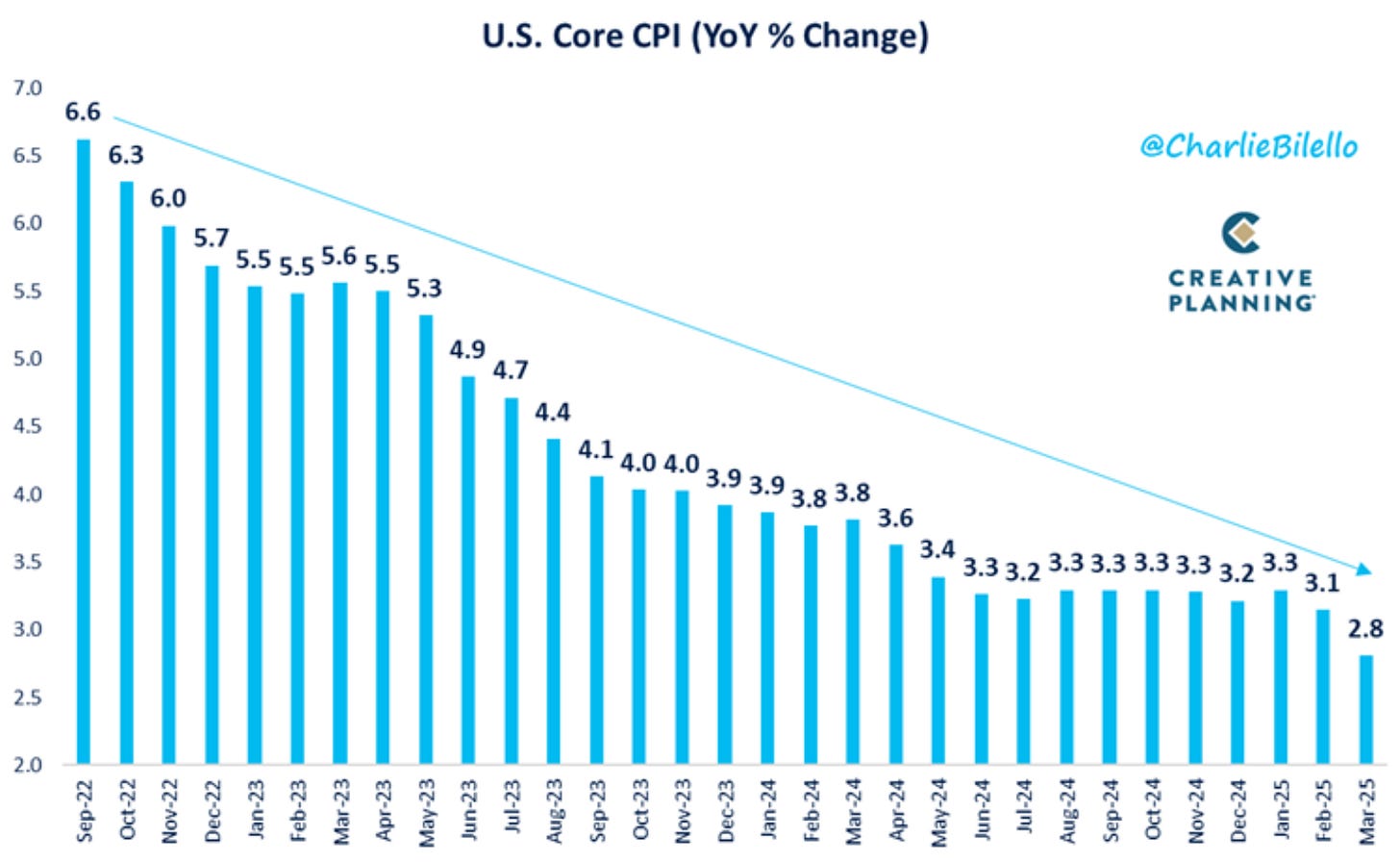

After seven months of stabilization above 3%, the long-term trend lower in CPI appears to be reasserting itself in decisive fashion. March CPI fell .1% on the headline vs the estimate of a gain of .1%. The core rate was higher by .1%, also two tenths below expectations. Weighing on the headline CPI number was the 2.4% drop in energy prices in part due to the drop in gasoline and fuel oil prices. Energy prices are down 3.3% year-over-year.

Meanwhile, the March PPI data was downright recessionary:

The March PPI headline number came in six tenths of a percent below the consensus estimate; -.4% vs the estimate of a rise of .2%. The PPI report showed prices falling across the economy - this is perhaps the first evidence from hard data confirming what we’ve been seeing in all the deeply negative ‘soft’ data (survey data).

If sticky inflation data was keeping the Fed on hold, it now has its first strong evidence that inflation is not the paramount concern. Moreover, the tariff hangover in April should provide a sufficient amount of weak economic data to give the Fed cover for a May rate cut.

Given the fluidity of the situation, the Fed appears to be intentionally alright with being behind-the-curve and slow to act. More dysfunction in the Treasury market would force the Fed’s hand and likely result in some form of yield-curve control (YCC).

Trouble in the US Treasury market combined with a weakening global economic backdrop and a behind-the-curve Federal Reserve have helped propel gold to more new all-time highs:

Gold (Daily)

Gold’s strength is uncanny. The ‘V+ bottom’ that gold experienced last week in US dollar terms was clearly exacerbated by the intense selling pressure that the USD faced at the end of the week.

The US Dollar Index peaked in January. It has since come under heavy selling pressure, closing under 100 for the first time since the summer of 2023:

USD Index (Weekly)

A weakening US dollar, strong gold price, and falling energy prices is literally the perfect recipe for a bull market in gold miners. Therefore, it is not an accident that the gold mining sector is the best performing equity market so far in 2025, with a YTD gain of nearly 50%:

GDX (Weekly)

Yesterday, I pounded the table on the gold miners, explaining why we are still relatively early in this bull market. Based upon today’s price action across the sector, it appears there are other market participants who feel the same way:

AEM (Daily)

IAG (Weekly)

NEM (Daily)

Integra Resources (TSX-V:ITR)

Sitka Gold (TSX-V:SIG)

Sitka Gold is up eight consecutive weeks, and 11 of the last 12. After last week’s 11.11% gain, Sitka closed at an all-time high share price with a market cap surpassing C$200 million for the first time. Based on the company’s most recent updates, drilling is ongoing at Sitka’s Blackjack Deposit in the Yukon, and assays are pending from hole 75 at Blackjack (drilled to a length of 715.97 meters, encountering over 130 instances of visible gold over the entire core length in hole 75).

After this week’s gains in gold and gold miners, I am reminded of the following Jesse Livermore quote:

“Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money.”

The temptation to sell and take profits is always strong. However, imagine the regret of selling too early in an historic bull market move and missing out on the vast majority of the gains.

For my part, I will not consider exiting my gold positions in any appreciable size until the Fed has panicked by resuming its interest rate cuts and market interventions.

Disclosure: Author owns shares of IAG NEM and SIG.V at the time of publishing and may choose to buy or sell at any time without notice.

DISCLAIMER: The work included in this video is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This video is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDARplus.ca for important risk disclosures. It’s your money and your responsibility.

When you say you will not sell any gold positions until the FED starts to cut what do you mean? Isn't it best to hold gold/gold stock into a cutting cycle, it's known to be a positive for the pet rock?