How Bubbles Are Formed: Leverage & New Paradigms

The formation of bubbles and why they are the greatest source of investment risk

Bubbles occur when price rises, rather than deterring investors, lead to more money coming in. The rising price convinces investors that they are right, and that they should buy more. To them, the price of the asset is the #1 most important fundamental.

In the eyes of the bubble-intoxicated investor, a higher price means that the asset in question is better, a lower price means it’s worse.

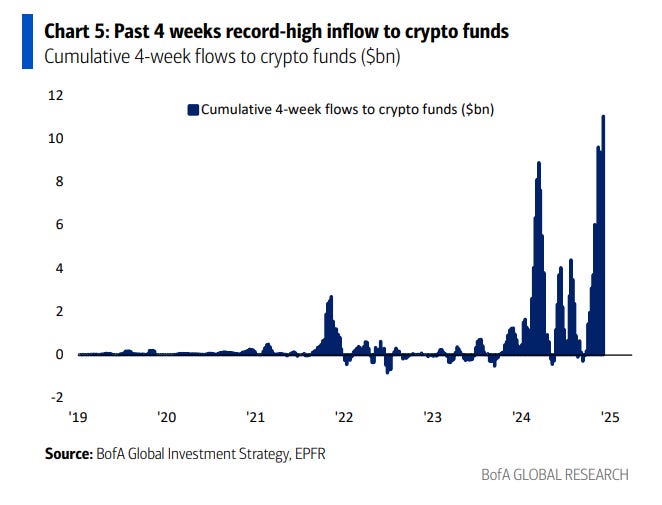

A notable example of investors pouring money into an asset class that has generated large returns in recent history:

There is nothing that investors love to see more than a rising asset price and a line on a chart moving from the lower left to the upper right.

All the great financial bubbles in history have shared some key characteristics:

An asset that has delivered enormous returns.

A belief among participants that the best was still to come and the market in question could only appreciate further.

Euphoric sentiment among investors, an “irrational exuberance”.

A herd mentality that results in a high degree of FOMO (fear of missing out) for anyone not participating in the bubble.

A new phenomenon with an intoxicating investment rationale - this bullet point can be summed up with these infamous words “This time it’s different”.

Suspension of disbelief - what was previously impossible is now possible because of this new paradigm.

Easy access to credit, AND the use of leverage (margin) by greedy market participants who can only envision the prospect of higher prices and bigger profits.

It is this last bullet point that is the crucial ingredient that defines a true bubble. Without cheap money and the use of leverage, inflated asset prices can simply be called bull markets.

The use of leverage to speculate in crowded and inflated assets sets the clock ticking for the inevitable unwinding of the bubble - the panic and market crash.

Market bubbles convince the masses that they should embrace irrational and reckless risk-taking, because it is different this time. Bear markets come and go, it is bubbles that represent the greatest source of investment risk. Bubbles convince investors to throw caution to the wind, and that this is their opportunity to get rich.

As I look around today I see many pockets of financial markets that have some of the key characteristics of bubbles. However, we never know for sure that they were bubbles until we have the benefit of hindsight to add a level of certainty to our assessment.

“We look at Bitcoin as the cyber Manhattan.” ~ Michael Saylor

In the above CNBC interview, Michael Saylor manages to touch on every single key characteristic of a financial bubble over the span of 222 seconds.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.