IDEX Prepares For Maiden Drill Program With 2nd Largest Land Position In Idaho Copper Belt

IDEX Metals Corp has quietly assembled more than 30,000 acres of mineral claims & leases in the emerging Idaho Copper Belt - Article Disseminated On Behalf of IDEX Metals Corp.

Nearly two years after the Hercules hole 23-05 discovery at the Leviathan Copper Porphyry Project, America’s newest copper belt is rapidly progressing. 2024 was a year of important preparations for most of the players in the district, only Hercules conducted drilling in 2024. Other companies such as Barrick, IDEX, and Zeus conducted geophysical surveys, and fieldwork such as mapping and rock/soil sampling.

Those who have been closely following the emerging Idaho Copper Belt will understand why this year is the biggest year ever for this emerging American copper belt. The reason is that there will be several drill programs conducted across the belt this year. More drilling means more potential discoveries. One of the companies that will be drilling in Idaho this summer is newly public IDEX Metals Corp. (TSX-V:IDEX).

IDEX’s flagship Freeze Project is located in Washington and Adams Counties, Idaho. Freeze consists of a portion of US Forest Service claims, and a much larger land package consisting of an Idaho Department of Lands mineral lease. In total, IDEX controls over 31,000 acres at Freeze, an impressive land position in this emerging American copper belt.

Before we delve into IDEX and Freeze, let’s refresh the reasons why this area of the US is so relevant for copper exploration today.

Idaho’s Copper Mining History

Idaho has a rich history of copper mining dating back to the 1860s, but the state essentially went completely dormant for copper mining and exploration in the 1980s and 1990s. An extended copper bear market in the mid-1980s snuffed out copper exploration in Idaho. Then in the 1990s, the introduction of very strict environmental regulations by the EPA under the Clinton Administration in the 1990s killed any holdout copper mining activities in Idaho.

The state didn’t see any new copper exploration activity until Hercules Metals (TSX-V:BIG, OTC:BADEF) decided to test a new geological concept based upon a modern geophysical IP survey that showed a larger, deeper target area below the shallow silver mineralization in the Jurassic age Hercules Rhyolite.

Hole HER23-05 may have changed the course of history when it delivered 185 meters grading .84% copper and 111 ppm molybdenum in a new blind porphyry discovery in Triassic-age rocks. The ensuing staking rush was the largest US staking rush since the Nevada gold rush of the 1980s. Major global copper/gold producer Barrick staked more than 100,000 acres of mineral claims across what it has now dubbed “The Idaho Porphyry Belt”. In addition, #2 global mining company Rio Tinto staked a chunk of ground to the south of Hercules:

Privately held Idaho explorer Scout Discoveries already held its Cuddy Mountain project before the staking rush took off. Enter IDEX Metals and its staking of US Forest Service ground along a series northeast-trending occurrences of Triassic-aged quartz-rich copper-bearing porphyry prospects.

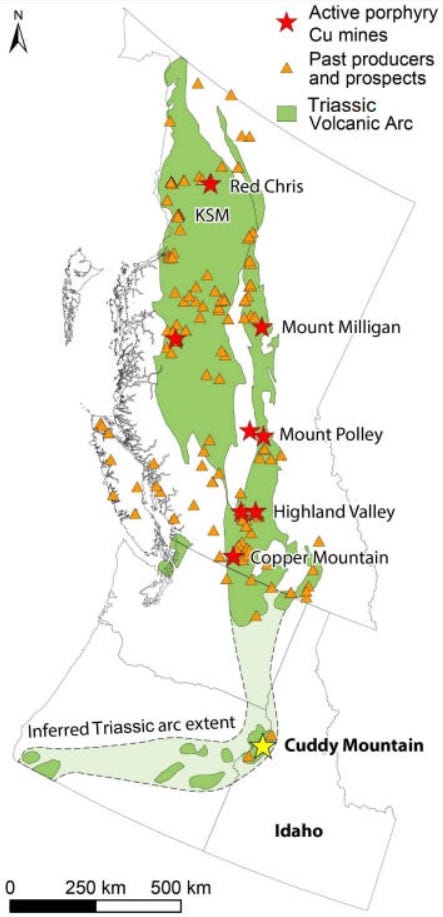

The 2023/2024 staking by Hercules, Barrick, and IDEX followed the trend of a specific volcanic arc that was responsible for forming the Triassic-aged porphyry discovered by hole HER23-05, the Olds Ferry Arc Terrane:

Olds Ferry Arc Terrane

The Olds Ferry Arc Terrane, an area of the Blue Mountains region of the western United States, specifically in Oregon and Idaho, representing a piece of an ancient volcanic arc that collided and accreted onto the North American continent during the Late Triassic to Early Jurassic period. It is characterized by a sequence of volcanic and sedimentary rocks called the Huntington Formation and is considered "fringing arc" terrane due to it being situated close to the edge of the continental margin at the time of its formation. One can imagine a modern day volcanic arc such as Indonesia or the Philippines being accreted (or smashed onto) onto the western side of the continent – this is what occurred hundreds of millions of years ago with the Olds Ferry Terrane.

The Olds Ferry Terrane appears to preserve parts of an arc system that was fringing the North American margin in Late Triassic time. It was during this period of the Earth’s history, in Late Triassic time, that the Olds Ferry was volcanically active and formed a series of porphyry deposits:

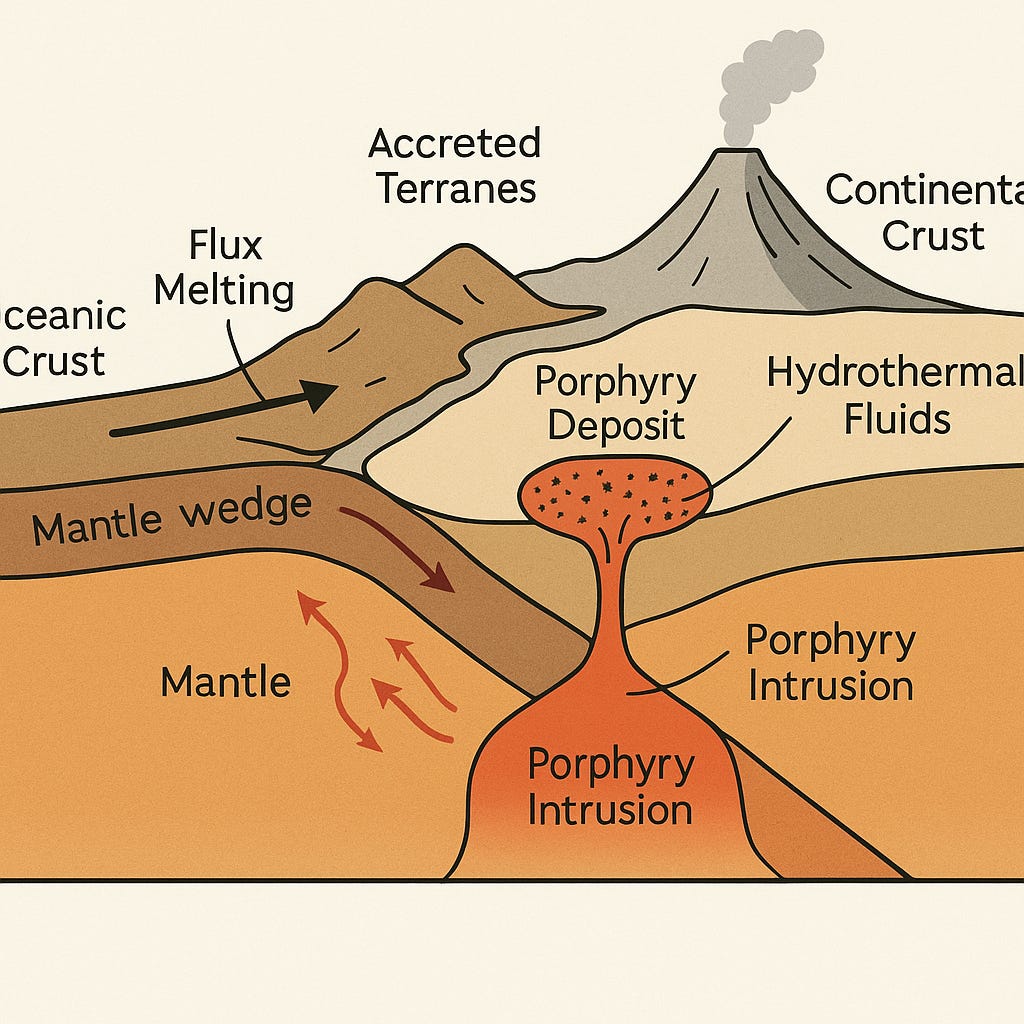

The following illustration depicts what was happening in what is now Western Idaho approximately 200 million years ago:

In the graphic above, an oceanic island or continental fragment (incoming terrane) approaches a subduction zone, where it will eventually attach (accrete) to the edge of the continent. An active volcanic arc develops on the crust of an older accreted terrane. Extinct volcanic arcs on still-older accreted terranes reflect the positions of earlier subduction zones. Suture zones mark the boundaries between different terranes. The Salmon River Suture Zone is to the east of Cuddy Mountain.

Porphyry Copper Deposit Formation

Porphyry deposit formation is closely tied to subduction-related magmatism in accreted terranes. Porphyry deposits in accreted terrains form due to subduction-driven magmatism. As the oceanic plate subducts beneath the accreted terranes and continental crust, it releases water and volatiles into the overlying mantle wedge. This flux melting of the mantle produces calc-alkaline magmas rich in water and incompatible elements (e.g., Cu, Au, Mo, K, and Si). These magmas are oxidized and metal-rich, rising through the crust and evolving chemically as they ascend.

Magmas stall at various crustal levels, especially in the mid- to upper crust (5–15 km depth), forming plutonic complexes. Through processes like fractional crystallization, magma mixing, and crustal assimilation, the magma evolves and concentrates metals and volatiles. Eventually, hydrous, metal-rich melts intrude as porphyritic stocks and dikes, often near the interface of brittle and ductile crust (aided by regional faults or structural traps).

As the porphyritic intrusions cool, they exsolve fluids due to volatile saturation—this is critical for ore formation.

These hydrothermal fluids are:

Hot (>400°C)

Saline (NaCl, KCl)

Rich in metals (copper, gold, molybdenum)

They migrate along fractures and vein networks, depositing ore minerals in stockworks, disseminations, and veins due to changes in temperature, pressure, and chemistry.

Metal and volatile enrichment during magma evolution,

Intrusion of porphyritic stocks,

Hydrothermal fluid release and ore deposition,

Often structurally controlled by the complex architecture of accreted terranes.

In Idaho, the Olds Ferry Terrane has been identified as an ideal terrane for porphyry deposit formation due to the tectonic processes that were at work during the period of time in which this terrane accreted onto the North American Continent. In addition, the Olds Ferry is roughly the same age as British Columbia’s prolific Stikine and Quesnel Terranes (225 million to 180 million years old):

The Idaho Copper Belt (ICB) is the southern extension of BC’s Late Triassic to Early Jurassic porphyry belt.

Cuddy Mountain Area

Previous exploration efforts in the Cuddy Mountain area in the 1960s offered strong evidence that this was fertile terrain for porphyry deposit formation, however, conventional geological wisdom had it that Idaho did not host economic copper porphyry deposits. With the results from drilling to date at Hercules, and the entrance of major global mining companies like Barrick and Rio Tinto, there is now a concerted effort—backed by tens of millions of dollars in exploration expenditures—to put conventional geological wisdom to the test in western Idaho.

Enter IDEX Metals (TSX-V:IDEX) and its Freeze Project. Due to its enormous size (> 30,000 acres), Freeze offers a district-scale discovery opportunity in the Idaho Copper Belt. Due to a combination of factors, including the longheld conventional wisdom that this area of Idaho didn’t contain economic porphyry deposits, the Freeze ground has seen less historical exploration activity than the neighboring Hercules and Cuddy Mountain properties.

Before the Hercules hole 23-05 discovery hole was announced on October 10th, 2023, IDEX staked 3,200 acres of US Forest Service ground and applied for a 1,000 acre IDL exploration license. After spending $500,000 on exploration in 2023, IDEX decided to apply for a much larger IDL minerals lease (~27,000 acres). The state of Idaho decided to put the larger lease up for auction and IDEX won the auction in November 2024.

The larger IDL lease was granted in early 2025. The addition of ~28,000 acres to IDEX’s property package means that only 13% of the total Freeze Property has been explored to date. Moreover, there has been no modern exploration or drilling in the Cuddy Mine or Freeze areas.

The fact that a significant percentage of the Freeze Property is covered by post-mineral basalt means that modern geophysical tools will be very useful in understanding the potential that lies beneath the surface. However, at Freeze IDEX has multiple prominent erosional windows into Triassic-aged rocks:

Both of IDEX’s priority target areas represent erosional windows into Triassic Granodiorite.

Besides drilling, three of the key objectives for 2025 will be:

Property-wide mapping across 27,000 acres of newly leased Idaho Department of Lands (IDL) ground

Completion of property-wide magnetotelluric (MT) geophysical survey with follow up ZTEM survey (MT survey expected to commence within the next two weeks)

Collection of ~5,000 soil samples and additional rock sampling

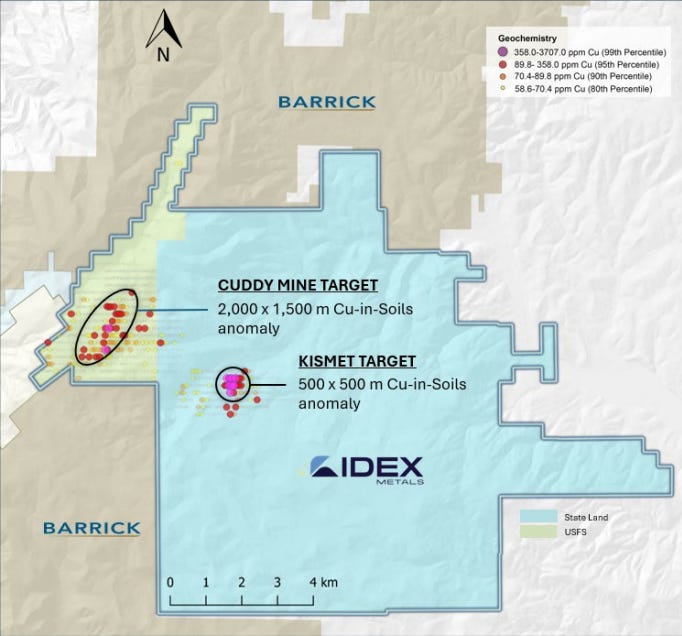

Reconnaissance rock and soil sampling by IDEX in 2023 in combination with a 2024 DIAS geophysical survey identified two priority target areas.

The Kismet Target on IDL ground

The Cuddy Mine Target on USFS ground

The Cuddy Mine and Kismet Targets represent erosional windows into the Triassic plate mineralization. Much of the Hercules Property is covered by Jurassic volcanic rocks including the namesake Hercules Rhyolite that is so well known for its silver mineralization. Vast areas of the Idaho Copper Belt are also covered by post-mineral basalt.

Erosional windows into the Triassic rocks are rare and offer a unique advantage to explorers. In the northern portion of the IPB, there are 3 prominent erosional windows into the Triassic plate rocks in an area that is otherwise covered in basalt. Hercules controls one, Scout Discoveries controls one, and IDEX controls one.

Reconnaissance rock and soil sampling by IDEX in 2023 returned a significant copper-in-soils anomaly (> 95th Percentile) that is 500 x 500 meters in diameter. The copper-in-soils anomaly is coincident with a tourmaline Breccia Pipe with chalcopyrite, azurite and malachite mineralization at surface. This is the Kismet Target:

In the mid-1960s, Bear Creek (later Kennecott, and now Rio Tinto) drilled four holes at Kismet. The four historic holes were referred to as having an average grade of 1.50% copper, however, IDEX only has the drill log for one of the holes. This hole went to a depth of 127 meters, which contained 41.15 meters at 0.853% Cu (beginning at 9 meters from surface), and 15 meters at 1.26% Cu. This hole was drilled vertically, and knowing that the district is tilted anywhere between 45-60 degrees, they entered and then exited the tourmaline breccia pipe.

IDEX believes that the Bear Creek drill hole entered the oxide zone, clipped the phyllic zone (41 meters at .853% Cu), and then exited the breccia pipe ultimately terminating in unaltered monzonite grading .10% Cu. IDEX has created a conceptual diagram showing the tilting of the Kismet Tourmaline Breccia Pipe:

IDEX plans to drill the Kismet Target at an optimal orientation to account for the well understood tilting in the district. Additionally, IDEX knows where the collar for the Bear Creek hole is, and it is actually to the south of the 500 x 500 meter copper in soils anomaly. This is exciting, because that means that the anomaly has not been tested yet.

In addition, the MT survey will be centered around Kismet (with survey stations throughout the property). IDEX will then incorporate the IP data from the Cuddy Mine Target (USFS) and invert everything with the aim of creating a solid model of both targets at once - ultimately, the IDEX technical team are hoping to better understand the depth and orientation of the Kismet Tourmaline Breccia Pipe to make drilling more efficient.

Additional breccia pipes mentioned in historical reports to the northwest of the Kismet Prospect offer further opportunities for discovery.

Drilling is expected to commence at Kismet in July with 3 holes (~1,000 meters) planned to test the Breccia Pipe at different orientations.

IDEX expects to receive drill permits from the US Forest Service by the end of August, with drilling to commence at the Cuddy Mine Target shortly thereafter.

The Cuddy Mine Target was identified through reconnaissance rock and soil sampling by IDEX in 2023. The soil sampling program identified a significant copper-in-soils anomaly (> 95th Percentile) that is 1,500 x 2,000 meters in diameter. The geochemical anomaly is coincident with sericite-altered rocks and strong IP chargeability response (2024 DIAS geophysical survey). In addition, the surface sampling program discovered rock samples up to 3.5% copper and 33 g/t gold in vuggy quartz-pyrite-specularite veining. The Cuddy Mine target remains unexplored at depth and 3 diamond drill holes are planned in 2025:

Idaho Project Portfolio

While my focus in this introductory article is IDEX’s position in the Idaho Copper Belt, it should be noted that the company has two other Idaho projects:

In particular, the Amie Project occurs in the same NW-SE trending Miocene-age epithermal gold-silver mineral belt that hosts the DeLamar deposit, owned by Integra Resources, which hosts significant resources of approximately 2.6 million ounces of gold and 127 million ounces of silver (M+I).

IDEX has located 11 adits, 4 shafts and 46 test pits across the property, including the past producing Amie No. 1 & 2 shafts, and the Big Shot and Roadside Mines. The property displays granite hosted, gold, silver and base metal mineralization within epithermal quartz veins and hydrothermal breccias, within and adjacent to structural trends. Reconnaissance rock sampling has returned significant values with assays up to 106.8 g/t gold.

While the Freeze Project is IDEX’s sole focus in 2025, Amie and Mineral Mountain will receive attention in 2026 as the company grows and builds momentum.

Management

IDEX is led by CEO Clayton Fisher. Clayton has over 15 years in the capital markets sector and has played pivotal roles as CEO, director, and strategic advisor for both private and public corporations, with a focus on advancing mining ventures. Clayton holds a degree in Economics and Finance from the University of Victoria.

Directors Anne Labelle and John Dewdney add a wealth of experience and success to the IDEX team. Mr. Dewdney is the CEO of Crowsnest Advisory Services, a company which provides M&A and other strategic advice to mineral exploration companies. He is a co-founder of IDEX Metals with significant experience in financing and advising mineral exploration initiatives throughout the state of Idaho. John holds a BCom in Finance from McGill University.

Mrs. Labelle is an accomplished geologist, lawyer, and corporate director with extensive experience in mineral exploration and development since the mid-1990s. With a strong background in managing legal, sustainability, and regulatory affairs, Anne oversaw operations at Perpetua Resources and the Stibnite Gold Project in Idaho from 2011 to 2018 and previously handled permitting at Capstone Mining for the Minto Mine in the Yukon, Canada. Anne was formerly a director of Fiore Gold Ltd., a Nevada gold producer, and played a key role in the sale of the company to Calibre Mining (TSX: CXB) for $151 million (44% premium) in 2022. Most recently, Anne was lead director of HighGold Mining Inc., an Alaska-based explorer, until completion of the company’s sale to Contango Ore (NYSE: CTGO) for $51 million (59% premium) in 2024.

Conclusion

The year 2025 is shaping up to be transformative—both globally and for critical minerals exploration in the United States. As supply chain security for critical minerals and raw materials becomes an increasingly urgent issue, the reawakening of the Idaho Copper Belt could not have come at a more opportune time for the nation and for the great state of Idaho. IDEX Metals stands at the forefront of this revival, helping to lead the resurgence of the American mining industry and supporting a nation of 340 million people whose livelihoods and security depend on a reliable, abundant domestic supply of copper.

Esto Perpetua.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. IDEX Metals Corp. is a high-risk venture stock and not suitable for most investors. Consult IDEX Metals Corp’s SEDAR profiles for important risk disclosures.

EnergyandGold has been compensated to cover IDEX Metals Corp and so some information may be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.sedarplus.ca for important risk disclosures. It’s your money and your responsibility.

has anyone found the symbol for idex metals on otc nasdaq or pink sheets