It Feels A Lot Like July 2003 For The TSX-Venture

After a volatile start to 2025, the resource-heavy TSX-Venture Composite is beginning to find its footing

It’s been a volatile first three months of 2025 for Canadian small/micro cap stocks. After making a new 52-week high in February, the resource-heavy TSX-Venture Composite plunged on tariff fears.

TSX-Venture (Daily)

The violent February downdraft found support at a familiar support level that served to halt a decline in December. There is growing evidence that the market is becoming more comfortable with Trump’s tariff strategy; many of the worst fears are likely exaggerated, and certain sectors of the economy are likely to receive exemptions.

Additionally, the tariff spat has served to awaken Canada, leading to a notable shift in the rhetoric and ideas being brought forth by PM Mark Carney and his adversary, Pierre Poilievre. Regardless of the election results on April 28th, Canada appears to be moving toward a more pro-growth, stimulative government stance.

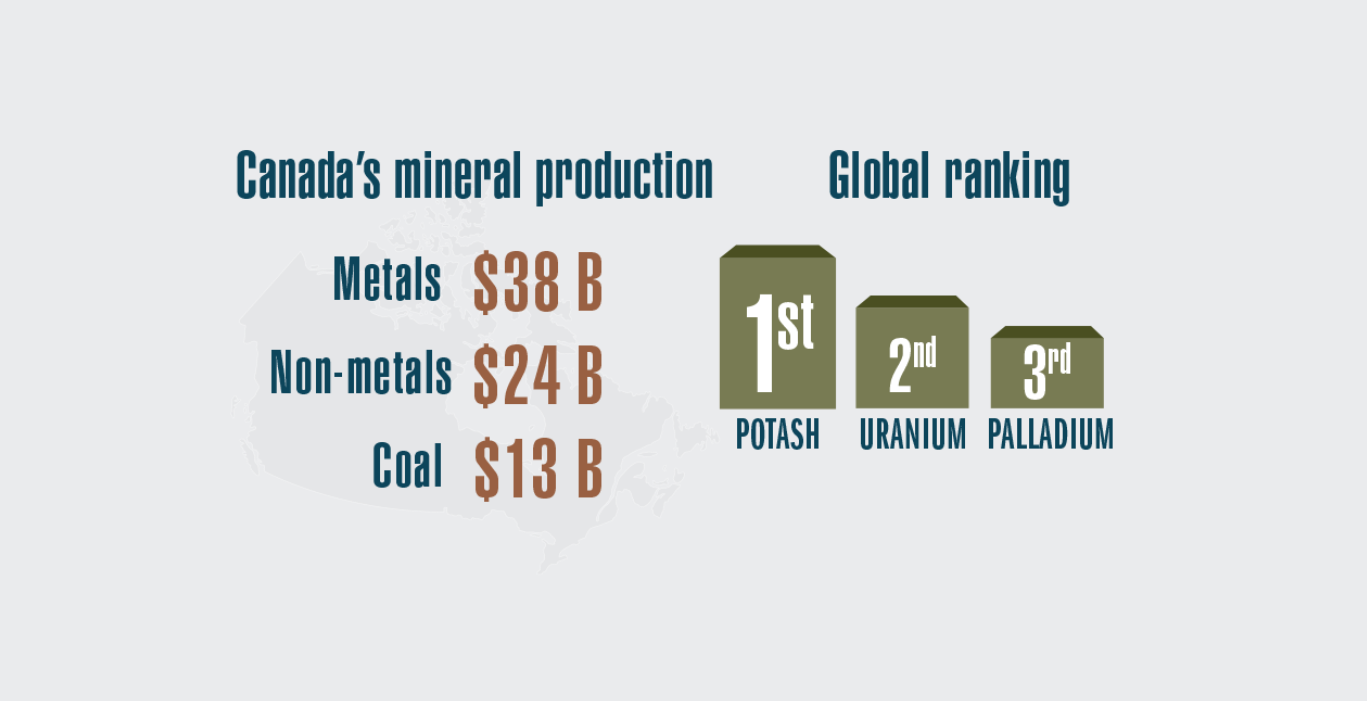

Canada has always been a world leader in minerals exploration and mining. Regardless of what happens in the United States, Canada’s leadership in the natural resources sector is not going to change. If anything, Canada is likely to follow the US government’s lead in supporting its minerals exploration/extraction industry - an industry in which Canada already has a sizeable lead over its much larger neighbor.

In 2022, Canada’s total metals production was $38 billion, slightly eclipsing the USA, which produced $34.7 billion. Additionally, Canadian exchanges accounted for nearly 30% of the global equity financing raised for the mineral sector - more than double the amount raised for the minerals sector on US exchanges.

Canada is a global hub for capital formation for the minerals exploration and mining sectors. Canadian domiciled/listed companies explore the globe to find the minerals that the world needs to build a better tomorrow.

Meanwhile, Canada’s capital markets have been struggling mightily for the last few years. In fact, the TSX-Venture Composite has essentially gone nowhere for the last decade.

I suspect that is about to change.

TSX-Venture Composite (Weekly)

The 30+ month head & shoulders bottom pattern that has formed in the TSX-V weekly chart is on the cusp of confirming. We will want to see a breakout, and a weekly close above 650, to confirm this pattern. The measured move from the completed pattern projects to the 770-800 area, roughly 20% above where we stand today.

After three years of Chinese water torture, the junior mining sector is at an important inflection point. The current setup in the TSX-Venture chart is reminiscent of the summer of 2003, right before one of the biggest rallies in the history of the junior mining sector commenced.

TSX-Venture Composite (2002-2007)

Between April 2003 and February 2004, the TSX-V Composite nearly doubled. The July 2003 TSX-V breakout proved to be one of the first waves of an historic bull market run for the Canadian resource sector that lasted until 2007.

In the last couple weeks, we have begun to see evidence that institutional investors are realizing how underweighted they are to resource sectors. While we have seen some breakout moves in a select list of juniors in the last week (including some I have highlighted on this blog), I don’t believe it’s an exaggeration to state that the opportunity in the metals & mining sector has never been greater than it is today. Meanwhile, public market equity valuations for mining & minerals exploration companies have rarely been lower.

FCX (Daily)

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SedarPlus.ca for important risk disclosures. It’s your money and your responsibility.