JOLTs Data Opens The Door To 50bps Fed Rate Cut In Two Weeks

The US job openings rate continues to decline precipitously, opening the door for a 50 basis point Fed rate cut in two weeks

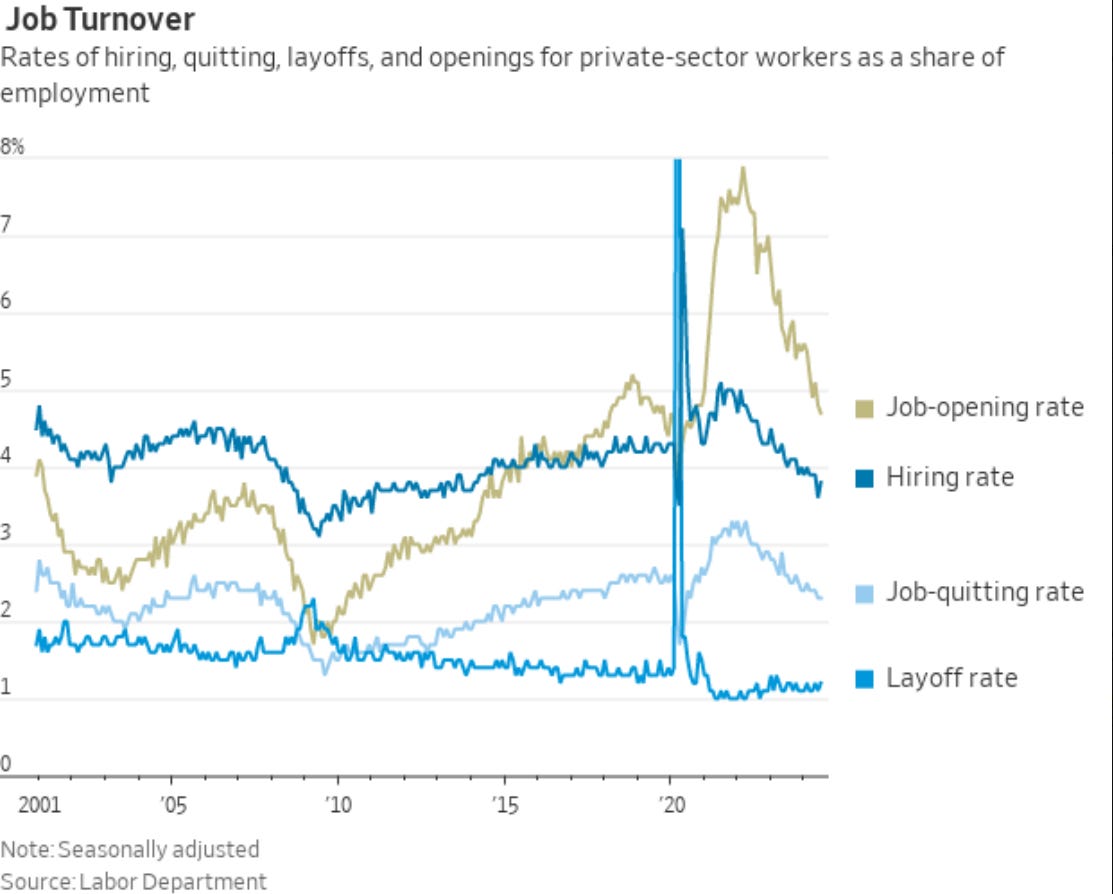

This morning’s July JOLTs report from the Bureau of Labor Statistics (BLS) showed a continued deterioration in the US labor market. June job openings were revised down from 8.184 million to 7.91 million (a decline of more than 270,000 job openings), and the July number registered 7.673 million vs. a consensus estimate of 8.1 million. The July JOLTs print is the lowest since January 2021, a point in time that marked the middle of the covid pandemic.

The steepness of the descent in the job-opening rate should raise some eyebrows and cause concern among FOMC members. This is a labor market that is in the process of rapidly transitioning from being too tight to too loose.

This morning’s JOLTs data also confirms what Fed Chair Powell stated in his recent speech at the Jackson Hole Symposium:

“The hiring and quits rates are now below the levels that prevailed in 2018 and 2019. Nominal wage gains have moderated. All told, labor market conditions are now less tight than just before the pandemic in 2019—a year when inflation ran below 2 percent.”

Inflation is no longer the Fed’s primary focus. Powell clearly stated he does not welcome any further labor market weakening, and that is exactly what the recent data is suggesting.

On the heels of the July JOLTs data, Citi Research was quick to pull the trigger calling for a 50bps rate cut from the Fed in two weeks:

"The labor market is looser than it was pre-pandemic and continues to loosen further, according to the July JOLTS report. Job openings fell from 8184k in June (now revised down) to a below-consensus 7673k in July. The ratio of openings to unemployed individuals is down to 1.1-to-1, below the 1.2-to-1 ratio that prevailed just prior to the pandemic. The hiring rate increased to a still-subdued 3.5% from 3.3% with government hiring falling. The layoff rate remains low at 1.2%, but the labor market increasingly looks to be at an inflection point with an even sharper weakening likely coming. A 50bp rate cut in September is likely."

I view a 50bps rate cut as being a 60/40 proposition at this point, with the recent trends in economic data moving in favor of 50bps over a more modest 25bps cut. I believe the fact that there is no October FOMC meeting puts the odds in favor of Fed choosing to move 50bps. The statement and press conference will also likely make it clear that they are in the process of getting the Fed Funds Rate down to a more neutral level near 4.00% by Q1 of next year.

Friday’s NFP report could seal the deal for a 50bps cut on September 18th - the consensus estimate is for +160,000 payrolls and 4.2% on the unemployment rate. A significant downside surprise (130k or less) could lock in a larger rate cut from the Fed and send gold soaring to new highs above $2,570/oz.

Gold (Daily)

I welcome the recent consolidation and cooling off of investor sentiment in gold. A couple more days of sideways action might present a very nice setup heading into Friday’s NFP data. We must also remember that the month of September has historically been a treacherous one for the yellow metal.

Support sits near $2,500 followed by $2,450 in the most liquid December futures contract. The all-time high stands at $2,570.40.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This video is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.