M&A Rekindles Animal Spirits In The Gold Sector, Junior Mining Updates (AE, BIG, EDG)

A C$2.16 Billion Deal For A Canadian Gold Miner Helped To Generate One of The Best Trading Sessions The Sector Has Seen In A Long Time

Monday morning, we learned that Osisko Mining (TSX:OSK) agreed to be acquired by Gold Fields (NYSE:GFI) for total cash consideration of C$2.16 billion. The announcement sent OSK shares soaring ~60% higher:

OSK.TO (Daily)

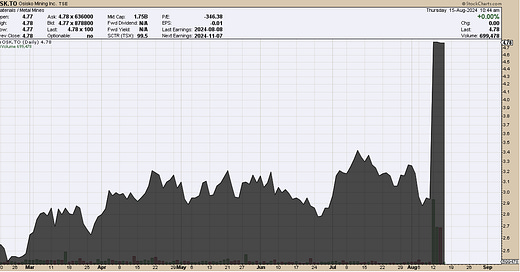

The Osisko/GFI deal comes two weeks after BHP/Lundin announced a C$4.5 billion deal for Filo Mining (TSX:FIL). Suddenly, we have a marked increase in M&A across the copper & gold mining space. The deal for Osisko served to trigger the animal spirits of investors as the market proceeded to bid-up other gold developers that investors perceived to be next in line to be acquired - these included Skeena (TSX:SKE), Bonterra (TSX-V:BTR), and producers such as IAMGOLD (NYSE:IAG):

SKE.TO (Daily)

IAG (Daily)

Keep reading with a 7-day free trial

Subscribe to Goldfinger Capital to keep reading this post and get 7 days of free access to the full post archives.