Northern Superior Resources CEO Simon Marcotte On Gold Mining M&A And The Catalyst That Could Ignite Junior Mining Stocks

A wide ranging conversation with Simon Marcotte that includes some unique insights into the gold bull market

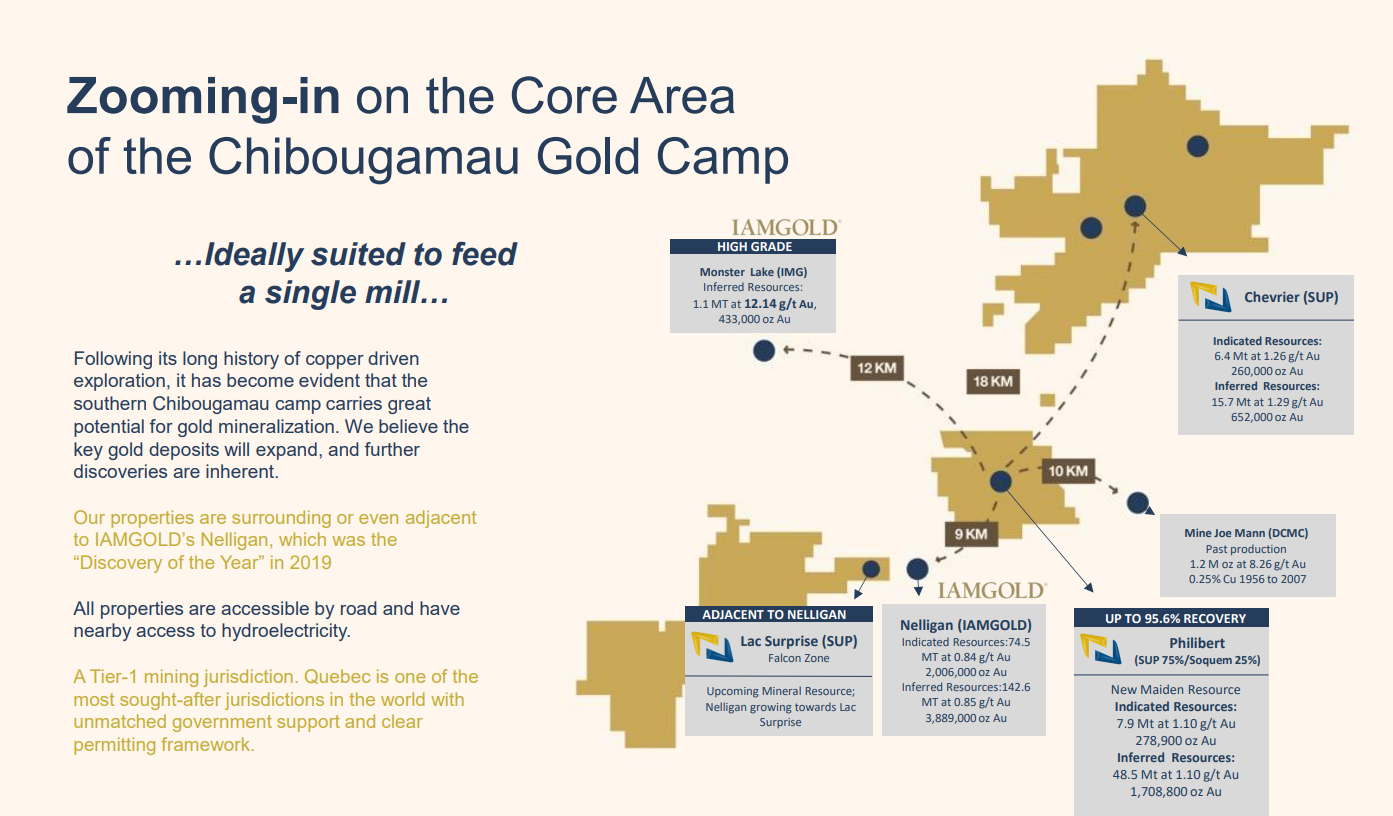

The Chibougamau Gold Camp of Quebec is an emerging Canadian gold camp that hosts multiple past producing mines, in addition to IAMGOLD’s 8.3 million ounce development-stage Nelligan Project. Northern Superior Resources has consolidated a large portion of the Chibougamau Gold Camp, underpinned by its 2+ million ounce Philibert Project that boasts a higher average grade of gold mineralization than Nelligan. Additionally, Northern Superior’s Lac Surprise is interpreted to be the western extension of Nelligan.

In this conversation with Northern Superior CEO Simon Marcotte, Robert and Simon traverse a wide range of topics including gold mining M&A, where we are in the gold bull market, generalists beginning to pay attention to gold miners, and of course Northern Superior and Chibougamau.

Goldfinger

Good afternoon, I'm with Simon Marcotte of Northern Superior Resources. SUP is the symbol on the TSX Venture. Simon, how are you this afternoon?

Simon Marcotte

I'm pretty spectacular, Robert. How are you?

Goldfinger

I'm doing well. I'm very excited about what we're seeing in gold and silver, the metals themselves. Silver is looking like it's actually very close on the cusp of a breakout and gold is consolidating in quite a healthy manner near 2900.

So I'm interested in your take on the metals right now, just following up on our conversation in Florida back in September.

Simon Marcotte

Yeah, of course. I happen to be extremely bullish on gold. I think that gold and precious metals will be the next wave that we see, but we don't see waves anymore.

We only see tsunamis. Just to give some very simple examples, in the late 90s, and I think we touched on that in our last interview, nobody believed the oil price was sustainable at $12 a barrel. It went to $140.

Something like Bitcoin that people started to hear at a few hundred bucks, people thought it was absolutely crazy when it crossed $5,000 and $10,000 level and it peaked at $110,000. The same thing can be said for the Dow or the S&P 500 itself. We've been discussing for years now that we've been in the bubble of everything, right?

That's been the headline, but yet if you sold when those first headlines came across, you still missed quite a bit of it. And I think it's important to realize that there was so much liquidity pumped into the economy on the back of the 2008 crisis that we do not see waves anymore. We do not see bull markets anymore. We see absolutely unstoppable tsunamis. And if you ask me where the next thing is, I believe it is gold. We've seen this before.

It did happen before. And if the liquidity went into the bubble of everything and that turns, and there's plenty of indications that it is turning and gold is already on the move, well, gold is not just going to go up a few hundred bucks. I was at BMO conference, as you probably know, last week, the PDAC conference this week.

And yeah, people are bullish on gold, but not overly bullish, right? They're talking about where it is going to go. They're talking about the valuation of the equities that are not following through.

Gold equities are still extremely cheap. And the general sentiment is while there's a lot of unstable, destabilizing headlines in the news, that explains why gold is high. But when things settle down, gold will come back down.

It's completely normal. And it happens every time when a bull market in a commodity starts going that the stock market doesn't believe it. Back in the mid-2000s people didn't believe that oil was moving up at first, until it did.

And I think we are exactly at the same point in the gold cycle where we're really in the first inning, still in the first inning only. If you ask me, and people that are bullish on gold, well, then they're taking bets on is it going to cross $3,000, $4,000? Could we see $5,000?

I think we need to have a completely different mindset and think about is it going to cross $30,000, $40,000, $50,000/oz. And I definitely think this is in the cards in the next 5, 10, 15 years. And that really is coming our way.

And the reason why I think that is because I've never seen the economic reasons to see a huge bull market in gold being all the stars aligned on that front. And also we’re having a big geopolitical reshuffle at the moment, which typically tends to bring gold into favor. And gold always performs well when real rates are coming down.

And if the real rates ever get negative, it just ignites gold like there's no tomorrow. During COVID, we have real rates that went negative for a blink of an eye. I think it was a few weeks. I think it was a very short period in 2020, and yet the gold stocks went absolutely crazy from April to August 2020.

GDXJ (March - September 2020)

So imagine if we would enter a period where you would have the real rates negative for 5+ years. Gold could absolutely go crazy. And so the real rates are the real rate to come down and even possibly go negative, as I'm saying, you need either the rates to come down or inflation to go up or both.

And inflation is already picking back up. Inflation expectations are really creeping up. You saw those numbers.

And there's a lot of inflationary policies being put in place right now. Tariffs are the big headlines these days, but there's labor-related issues, deficit-related issues driven by potential tax cuts and our extension of tax cuts. So that is very, very inflationary.

And when you look at the rates themselves, we'll see what the Fed does, but you already hear from the current administration that their focus is not really on the overnight rate. It really comes down to the next 10 years. And what they plan to do there, in my view, is hiding in plain sight.

If you read Project 2025, Chapter 24, it says it right there what the plan is. And in Project 25, Chapter 24 is what they want to do with the Fed. And what it says there, I don't have it verbatim, but it basically says that the Fed should stop paying interest to the banks for their reserves, the bank reserves that they own, that they keep at the Fed.

Because they basically say this is a transfer of wealth from Main Street to Wall Street, which is, yeah, that's true. But there's a reason why it is like that. And the reason why it is like that, and that started after the crisis of 2008, and they had to change the law to have that system now.

It's very simple. The system changed in 2008, or shortly after. The Fed used to influence the curve by buying and selling securities.

And therefore, it would have an impact on the market, and it would have an influence on the curve, including the 10 years, which is the focus right now. But after 2008, where the Fed had to push in so much liquidity into the system, these interventions on the market no longer had an impact, because there was too much liquidity. So they changed the system, where the Fed started to pay interest to the banks for the money that the banks are keeping at the Fed.

And that's very simple, right? If the Fed pays Bank of America 5% on the money that Bank of America keeps at the Fed, well, Bank of America is not going to turn around and lend money to John Doe at 4.5%, and on top of it, take a credit risk. So that way, the Fed can really have an influence on what's happening in the economy, and hold the gates, if you want, of all of this flood of liquidity that was created in 2008.

So that's the reason why now you have the Fed paying those interest. So if they would find a way to enact that, where they would make it so that the Fed stops doing that, this would open the floodgate. And all of the liquidity that was created, and it's been held that way, would basically need to find a home.

And the liquidity would chase everything there is, and then the curve would fall to the ground. If that would happen at the same time as inflation goes up, then you have inflation up and rates down, and then real rates would fall dramatically for an extended period, which will not get gold to 3,000 or 4,000 or 5,000. It's going to go a lot, a lot higher than this.

There's plenty of reasons why I continue to see gold going a lot higher. In our last interview, we talked about M&A. You were saying, where do you think we are?

I said, we're just getting started. Since we last spoke, there's been a lot more M&A, right? And I don't think this is going to end anytime soon.

Goldfinger

Let's talk more about the M&A and the gold mining sector in a little bit. But first, I want to touch on a good point you made, and I haven't heard anybody else say this except for you, the real interest rates and the gold miners. So we know that real interest rates in gold have a pretty strong correlation, or at least they have normally had a pretty strong correlation, although that changed a little bit in the last couple of years.

But the gold miners seem to be particularly sensitive to rates, yields, 10-year note yield, Fed funds rate, etc., etc. And if we go back to September of last year, the GDX actually got all the way up to $44 at the October peak when gold reached $2,800 for the first time. Well, the GDX is now about $41.50 even though gold is $2,920.

So there's been a pretty sharp divergence where the gold miners have underperformed the gold price since October. And this is something that has caused a lot of consternation by investors for the last couple of years. Why aren't the gold miners performing better?

And I think that you may have just touched on it, real interest rates and the fact that the Fed has kept rates pretty high. Now, maybe that's actually about to change because the president and his treasury secretary seem to really want to lower interest rates. And they're doing a lot of policies right now that seem to be focused on pressuring the 10-year note yield lower.

Do you think if they actually manage to force yields down, is that the fuel that the gold mining sector needs to really take flight?

Simon Marcotte

Yes, absolutely. So if I go back to my analogy of the oil sector, when oil was $12 a barrel in the late 90s, and the oil stocks had never been that cheap on a cash flow multiple basis, the narrative was oil is not sustainable at $12 a barrel. The world cannot function with oil above $10 a barrel.

Therefore, why would the stock market pay for those cash flow? They're not sustainable. Stock market was wrong, but it explained the low multiple.

Now, it's a little bit of the same thing where the stock market is saying, yeah, gold's high, but it shouldn't be there because the real rates have yet to come down. So gold actually should have been coming up in the last year, two years, three years. It should have been coming up because the real rates were going up.

At the very least, they have yet to come down in any meaningful manner. So the stock market is taking the same attitude. Why would I pay up for those cash flow?

Gold is not sustainable or it doesn't deserve to be there. So the stock market is not incoherent. Gold should have been coming off or should have been stable, yet it's been going higher because central banks are buying gold and the Asian investors for different reasons are also buying gold.

But the stock market is not incoherent to me. It is just saying gold should not be where it is. Why would I pay for those cash flow?

The moment that real rates start falling meaningfully and God forbid they go negative, that will change, that will turn on a dime and it will go very, very quickly.

Goldfinger

Let’s talk about the M&A in the gold mining sector because you know I love this topic.

I really like IAMGOLD (NYSE:IAG, TSX:IMG) I think it's going to be a major target for the seniors this year, next year. I think the clock is ticking for IAG to potentially be acquired. They also put out news from the Nelligan project, which is actually nearby a couple of your projects.

IAG (Daily - One Year)

What do you see taking place with M&A in the gold mining sector?

Simon Marcotte

I can't remember exactly when we spoke, but I think it was shortly after Goldfields had acquired Osisko, if I recall correctly. Since then, we've seen, I can think of Anglo Gold acquiring Centamin. I can think of Agnico buying O3, Northern Star buying De Grey, more recently Equinox buying Calibre, that billionaire there, Nick Candy bought Condor Gold, which is a smaller name.

And even closer to us, an Australian group came in right into the Chibougamau Gold camp and acquired Lac Dore, which I find very interesting because the Australians are well known to have access to a lot more capital than Canadian companies now. And the Australian companies came into Quebec at the right time for iron ore and made an absolute killing. They came to Quebec at the right time for lithium and made an absolute killing.

So I thought that was interesting to see them get into gold and copper, and not only anywhere, but very near where we are. So M&A will keep going. I think the major producers now, you can't argue with the cash that they're making.

Their free cash flow yield is very, very appealing. It's the highest of any sector, I believe, even higher than the tech sector now. And that is starting to attract a lot of generalists, right?

We're starting to see some generalist fund managers that are hanging around the BMO conference and PDAC, not a lot, but it's starting and they tend to lead the crowd afterwards. And the gold companies went through some difficult years. So they've started to run a tighter ship, I would say.

So they have a good balance sheet, a lot of free cash flow, but to be focused on cash flow and preparing for this moment came at a cost, which is they invested a lot less than in previous cycles into exploration. So now they have the cash flow and they need to replenish their gold in the ground. I always say if you pull off all of the senior producers altogether, they depleted about a third of their reserves over the last decade or so.

They need to replenish that.

Yet the difference in valuation now between the majors and the explorers or developers, the companies with gold in the ground, that gap in valuation has never been this high. And if you look at what it costs to find a new deposit for a large company, obviously, once they found something, it's fine.

It gets cheaper to find ounces in the ground, but there's a lot of groundwork that leads you there. There's absolutely no doubt that it is a lot, a lot cheaper to buy companies that have already identified and formalized those ounces. And it moves the needle a lot faster as well.

So that's why size matters. You want to get as large as you can in order to move the needle for when the large company wants to buy gold in the ground. So that has been our business model at Northern Superior to consolidate the whole Chibougamau Gold camp.

Now to move to the other thing you mentioned, which is IAMGOLD came up with a new resource at Nelligan. Very interesting indeed. Nelligan now stands a total of 8.3 million ounces. They clearly stated publicly that they still see growth in that deposit. So if you look at the camp now, and we always said that this camp, all these deposits are so close to one another that they deserve to all be together, I believe, because they're so close that they can feed the same mill. And the camp would benefit from optimization work to run, to go after the higher valuable material first to lower the payback period of an eventual operation.

So we've been consolidating the camp. So if you look at only IAMGOLD and Northern Superior (TSX-V:SUP, OTC:NSUPF), nobody else, just those two companies right now, you're already at 12.4 million ounces that have been defined with plenty of room to grow. Nelligan will grow, or Philibert will grow, or other projects are going to grow, Monster Lake, IAMGOLD is going to grow.

So that camp, I think, will speed through 15 million ounces in no time. But already at about 12.5 million ounces already defined, I challenge you to find a camp of this size that is currently not owned or controlled by a major producer. I can't think of any.

And not only that, but it is in Quebec, one of the safest jurisdictions there is. And any big companies you're talking to, geopolitical risk is even more important than before. Large companies, they're trying to still move away from African jurisdiction, for example, and into safer jurisdiction.

So it positions us very, very well, Robert.

Goldfinger

One of the reasons why I like IAMGOLD as a takeover candidate, well, number one is that Cote Lake has ramped up quite nicely. That's a tier one asset for sure. But then Nelligan, they have their asset in Africa, Tasiast, which is a cash cow as well. That's the flagship asset of the company. But that's something that could be spun out in a transaction with a major if the major doesn't want more risk in Africa.

At Nelligan they published a resource of 8.3 million ounces. Most likely that's going to grow to 10 million ounces. Maybe it will get even bigger. And then as you say, in the district nearby, you have another 3-4 million ounces with Northern Superior.

And so putting this all together, I see that as a very attractive growth target, this region. The Chibougamau region is a very nice growth region of Canada for gold mining. To me, This scale in tier-1 Quebec, that makes it very attractive.

How does that affect your company in terms of if IAG were to be acquired by a senior gold mining company, how would that affect you?

Simon Marcotte

Well, we'll see who that would be. I certainly have my ideas on that. But it could force things to get together before any of that happens.

Because there's so much more value by putting the camp all together. If you want to maximize the value of it, you probably want to consolidate it sooner rather than later. But I will point this out first, though, that I do not believe that IAMGOLD is the only suitor for the Chibougamau gold camp.

And the reason I say this is there was a research note published by National Bank, who is not any analyst. National Bank is the lead underwriter for IAMGOLD, right? It was the National Bank who raised them $300 million so that they could buy back 10% from Sumitomo there.

Anyway, the analysts wrote that IAMGOLD could welcome a joint venture partner for the camp. So I think that makes an enormous amount of sense. I mean, IAMGOLD has been doing spectacular over the last couple of years, but they went through a big roller coaster before that, right?

As they were ramping up Cote and the CapEx increase that they had and the balance sheet issues that they had, they did a phenomenal job to fix all of that. But it's been a long road. So would IAMGOLD want to jump by itself right away into the next big project?

I think that's not obvious. So to joint venture the next area of growth could mitigate that, lower the risk because they need to have growth. I mean, IAMGOLD cannot say like we're not going to have growth and do anything else.

That's not an option either. So I think a joint venture would make a lot of sense. And if another large company wants to enter Canada, one of the easiest ways to do that would be to acquire Northern Superior and then do a joint venture with IAMGOLD so that the whole camp can be together.

And then you can optimize it. Because yeah, you mentioned that Nelligan is now above 8 million ounces, probably going to go above 10. So it's not just a matter of size anymore, or I would say it's no longer a matter of size. It is a matter of optimization.

When you look at these big projects, and by that I mean those big bulk tonnage projects, just exactly the same type of project that IAMGOLD built in Ontario with Cote Lake, it always comes down to the payback period. So the payback period of the project determines whether the company will secure the necessary funds for its construction or not.

And when you look, when you calculate those paybacks, the cash flow of year one to five is everything. It's absolutely paramount. So if you're able to mine higher grade first, that helps a lot.

If you're also able to mine material that has a better recovery, that helps enormously. So it is in that sense that I think that to look at the camp as one project, which has always been our approach, makes an enormous amount of sense, right? Because if you look at our resource, and I'll talk about the most recent press releases, but the basic resource that we have, we have a grade of 1.1 grams a tonne, which is already meaningfully higher than the Nelligan grade, but it can be optimized by itself.

If you increase the cut-off grade just a tiny bit from 0.35 to 0.5 at our Philibert Project, the grade goes from to 1.33, which means that you would be getting like about, I need to do the math exactly, but about 25% more gold per tonne that you get from the Nelligan average grade. Plus our metallurgy has proven to be very simple, and we get to 25% plus recovery. So if you process that material, again, you increase the amount of gold that you get for every tonne that you mine and you process.

That makes an enormous difference. So it is not a situation of, oh, well, they'll need to buy more ounces when they'll be done mining. This is not the right thinking, the right approach. The project needs to be as good as it gets before we make an investment or we put the money in order to build it.

So I continue to believe that Chibougamau is one of the best jurisdictions there is. It's a mining town, and we got the size in the right country, and it's the right time because Chibougamau always had this big potential.

But obviously, IAMGOLD was laser focused on Cote Lake. Now Cote Lake is doing great. Maybe it's not on absolute cruise control yet, but it's doing extremely well.

I can tell you from what we hear in Chibougamau that IAMGOLD is spending a lot more money and a lot more attention. And from the top, they are saying “tell me what you need to advance this”.

My understanding is that now IAMGOLD will be drilling somewhere around 30,000 meters in the months ahead.

And I don't even think that's constrained by budget. I just think that that's all it needs as far as drilling. I don't think that they would have the use to do more meters.

So they're going to be drilling again at Nelligan and Monster Lake, but also IAMGOLD has been making further acquisitions. Obviously they bought Vanstar, which was the joint venture partner for Nelligan, but they acquired three other projects in the area that I can think of that kind of flew under the radar. But they keep on moving there.

So the fact is, I always say what's good for IAMGOLD is definitely good for us because then the focus comes to Chibougamau. We're not the only ones who are very active anymore.

Goldfinger

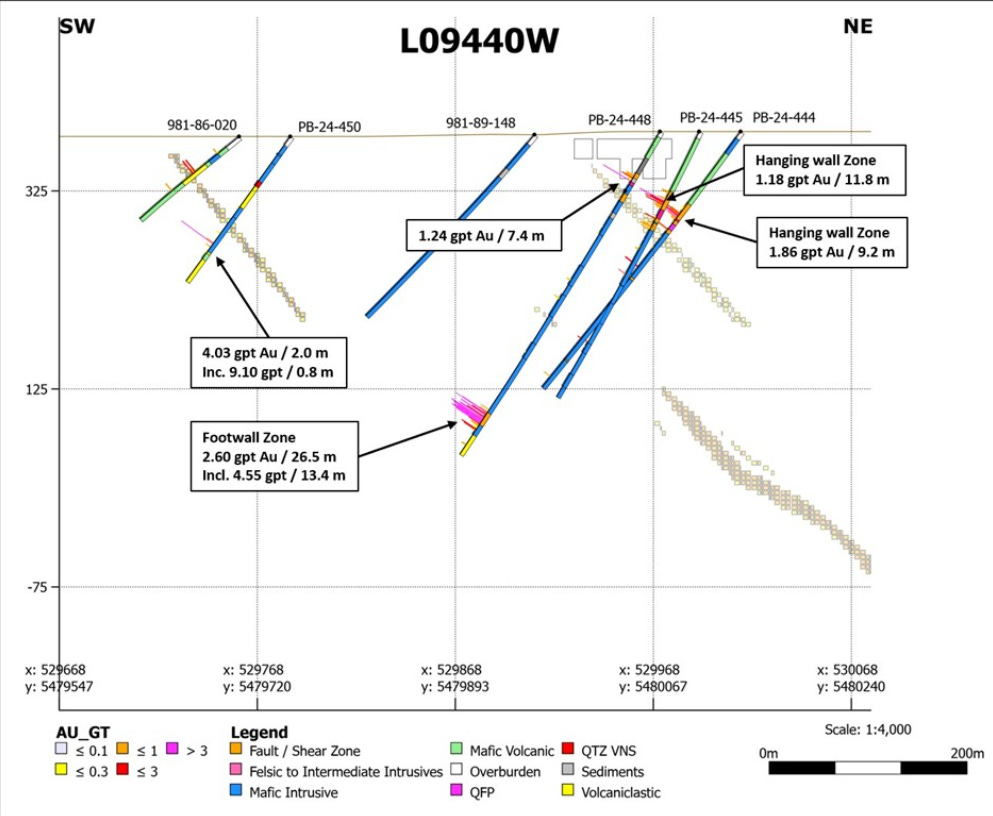

At the Philibert property, you have about 2 million ounces in resource right now at 1.1 grams per tonne average grade. The Philibert project checks a lot of boxes, including the fact it can be an open pit. It's fairly near the surface, great infrastructure, good net testing results so far.

So you're getting good recoveries at Philibert. You put out news on March 3rd. I want to talk about what you learned from the drilling there last year and how much expansion potential do you see right now?

Simon Marcotte

So you mentioned the resource that we have of approximately 2,000,000 ounces. This resource is in a pit, it's kind of an oval and it's about three kilometers long. It's about the same size as Nelligan by the way.

It's about 3 kilometers long. And a few months ago we announced that we had found some higher grade mineralization, it was 26.5 meters at 2.6 grams/tonne, that was 200 meters from the pit. So obviously that indicates the mineralization continues, and obviously we can keep growing the ounces.

Then you mentioned the one announced just recently on March 3rd. Well, then we announced that we are still finding some high-grade 750-800 meters from the pit. Now obviously you shouldn't jump to conclusion and do a rule of three and go 3 kilometers for 2 million ounces, you add another kilometer, it’s not as easy as that.

But it's definitely extremely encouraging, and we can definitely keep growing the resource at Philibert. We also are finding some very good material under the pit. And so what we've been doing at Philibert is making it wider.

We extended the mineralization to the north a little bit, so it makes the oval a bit wider, which then allows us to have a deeper pit to go after the higher grade that is at depth. And all of that continues to pan out. Philibert can extend on its width, on its length, and a depth as well.

So we keep moving on, and there's further results to come. There was a bit of a delay because we're in the middle of a 20,000 meter drilling campaign. We just recently brought in a second rig on site.

But there's been a bit of a delay to the results. We explained the reason for the delay in the last press release is that when we acquired the project, we inherited a lot of historical core that were on the shelf that were never looked at by the previous owner. So we are using that core and sending that to the lab.

And we came out, and we explained those results, and there's some good results that came out of that, including something like close to 30 meters at 1.1 grams a tonne. But now that this batch has been sent to the lab and received, now they're processing the new drill core that we sent. So as we mentioned in the press release, further results should be expected in short order.

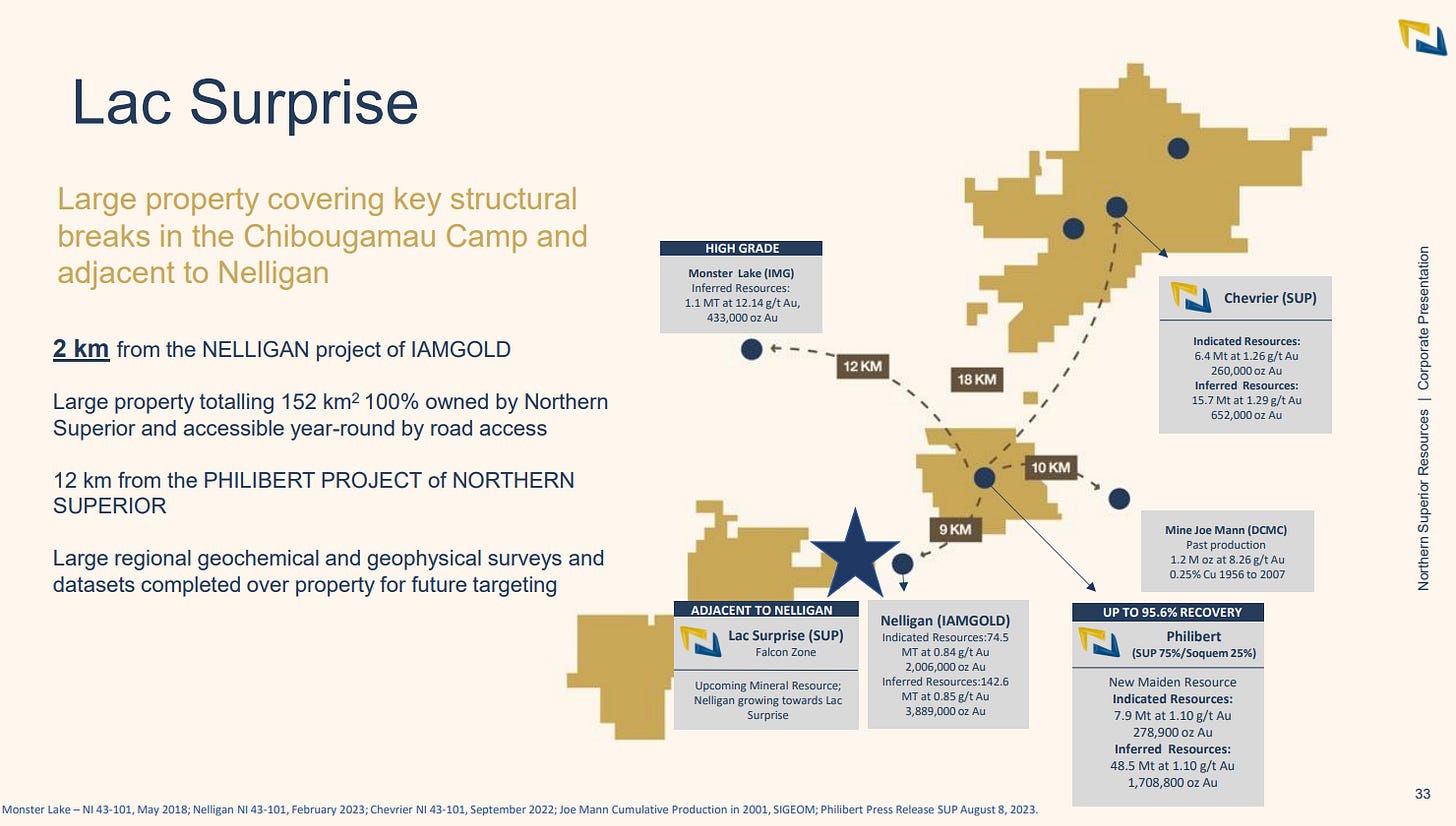

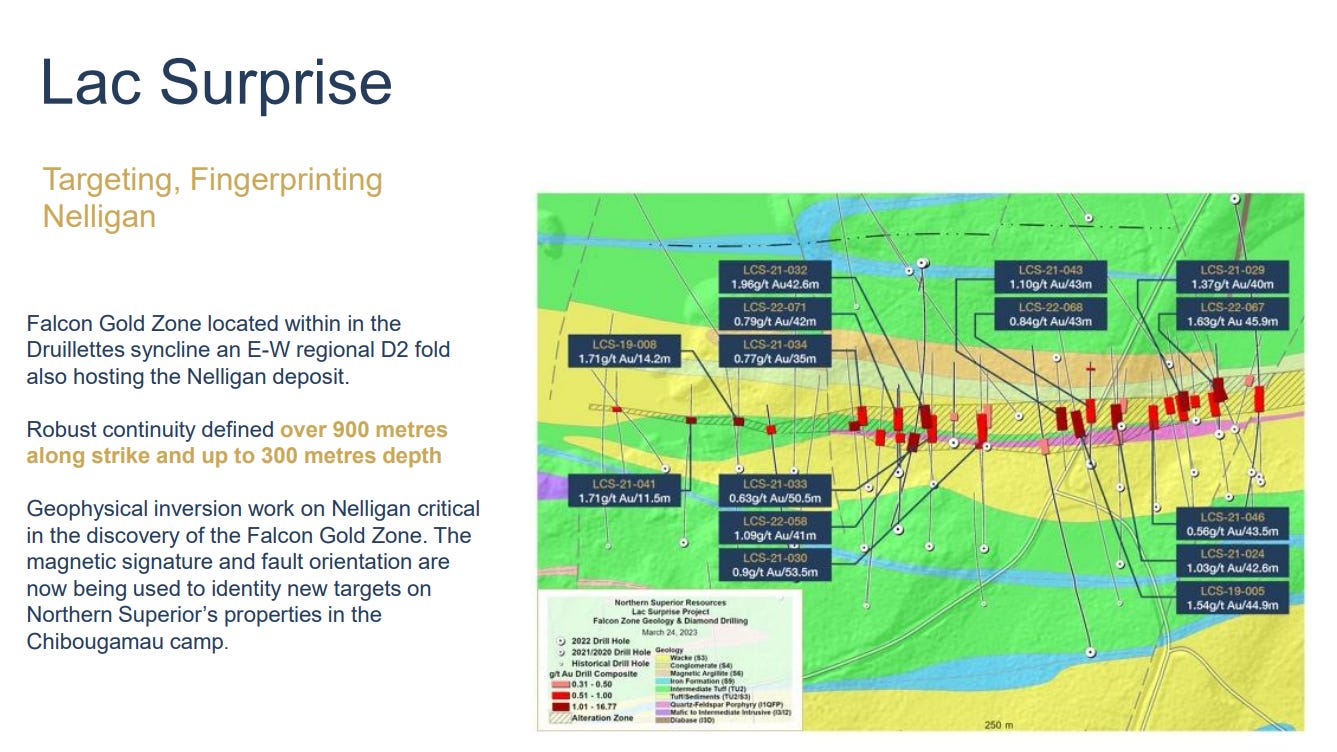

And then after that, obviously, once we're done with the drilling campaign and compiling and releasing all these results, then we'll move to the next stage of most likely upgrading the resource calculation at Philibert. I'll also mention that our Lac Surprise is quite interesting. As you know, we have yet to formalize ounces at the Lac Surprise.

The Lac Surprise to us is very clear that it appears to be the western extension of Nelligan itself. And Nelligan is growing towards our Lac Surprise. So as Nelligan is growing towards Lac Surprise, it's creating value for us.

But not only that, if you look at the Nelligan in the press release of IAMGOLD, I invite you to take a look at the cross section that is in that press release. And you'll see that they have a big high-grade lens that is developing towards the west. So that higher-grade zone of Nelligan is actually developing towards Lac Surprise.

So we're definitely in the right area. So we have yet to formalize ounces on Lac Surprise. But to me, it could very well end up being part of the same geology of Nelligan.

Goldfinger

At Philibert, you own 75% of that project. Do you think if you owned 100%, the market would give you a higher valuation per ounce in the ground?

Simon Marcotte

Yeah, it's not a bad question. It's a bit of an odd joint venture that we have with SOQUEM, right? And again, to take a step back to explain the relationship there.

So Philibert was discovered by SOQUEM, which is a government entity. It's part of Resource Quebec. It's a spectacular entity, in fact, that has been helping the mining industry in Quebec for quite some time.

And they have a good group. And they've made this discovery. But when they made the discovery of Philibert, that was before the discovery of Nelligan.

They were actually looking for something similar to Monster Lake. So they were really only interested in high-grade at depth. Because the thinking back then was, well, that material will need to be trucked for a very long distance.

So only high-grade will work. Now that this camp has completely changed with Nelligan and other discoveries, this is now a bulk tonnage area. So it is to that effect that they had drilled basically right through an open pit and kept those cores on the shelf.

And it's always that material that we send to the lab, and we get a lot of ounces that way. Now, they started it. And then we ended up with a project that was through an earn-in.

And we earned the option in full. And now we are at 75%. And they are at 25%.

Usually, in a joint venture like this, we would pay for 75% of the exploration cost. And they would pay for 25% of the exploration cost. It's not the case in this joint venture because it wouldn't make sense for them to contribute the 25% for the very simple reason that we have an option to acquire the whole thing.

So we have an option to acquire the remaining 25% for a cash payment, which will bring them to zero. So it wouldn't make sense for them to be contributing 25% and then end up with zero, right? But if we decide, that will be in 2026.

If we decide not to exercise this option, then the joint venture will revert to a traditional joint venture where they will either contribute their 25% or get diluted. So when we get there, we'll need to do the math on what makes the most sense.

Goldfinger

Sounds to me like you're going to be 100% owner in 2026. Simon, what can investors expect from you in 2025? What is there to be excited about?

I'm going to give you the last word, Simon.

Simon Marcotte

So for Chibougamau, obviously, more results to come and some very good-looking rocks that we're looking at. I've learned not to get excited by the look of it.

In the gold business, you wait for the results, but the rock certainly looks very good. So more results, and then resource updates, and then more action in the camp, more strategic discussions for sure. I believe that this whole camp, we'll see a lot of M&A action in 2025.

But we have yet to even talk about what we're doing in Ontario, right? So we also own 62% of a company called OnGold (TSX-V:ONAU). OnGold has the TPK project, which used to be the heart of Northern Superior.

It's the largest gold and silver anomaly in North America, potentially the world. It's a huge, huge discovery in the making. Although the price is too big to do it wrong, we want to do it.

We have the permits to drill, but we also want to have an agreement with the local communities and the First Nation before we do anything. They recently had an election. Usually that opens a window to have more constructive discussions.

So we'll see what happens at TPK. But if we are to ever drill this, I think it's going to bring a lot of interest, big discovery in the making. And in the meantime, OnGold acquired Monument Bay.

So now Agnico Eagle (NYSE:AEM) is a 15% shareholder of OnGold. I don't know if you remember Mega Precious. So Mega Precious had Monument Bay.

You're looking at about 3 million ounces at about 1.1 g/t Au. So Mega Precious had Monument Bay. Yamana acquires Mega Precious for Monument Bay. Then Agnico acquired the Canadian assets of Yamana, you recall.

So this asset was on the back burner. Agnico did not deserve to be on the back burner. And Agnico saw us as the right custodian for the asset because of the team that we put together.

And you'll see that just a few days ago, we announced a framework agreement with the local communities to move forward. And there's a lot of work that's been happening geologically speaking. And they do see a lot of potential targets for expansion or new discoveries in the area.

So OnGold is doing pretty well, and we still own 62% of OnGold. So whatever is good for OnGold is good for us. And whatever is good for gold is good for us. So stars are getting aligned here, I think.

SUP.V (Daily)

Goldfinger

The TPK asset could be a company maker by itself. That's a very exciting story. I invite readers and viewers to dig into that one and learn a little more.

Because when that gets drilled, it is definitely going to bring a lot more eyeballs to Northern Superior and OnGold. And obviously, you own 62% of OnGold. Simon, thank you so much for your time this afternoon.

Simon Marcotte

I appreciate it. Thanks for having me on, Robert. Cheers.

Disclosure: Goldfinger Capital has been compensated for production, editing, and dissemination of this interview.

Disclaimer The video is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Viewers are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The stocks discussed in this video are high-risk venture stocks and not suitable for most investors. Consult Company SEDAR profiles for important risk disclosures. This interview contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDARplus.ca for important risk disclosures. It’s your money and your responsibility.