Observations From Vancouver & Why This Time Really Is Different For Gold

Some takeaways from Vancouver and thoughts on an impending trade deal between US/China and its implications for currencies and gold

Friday morning, at the Metals Investor Forum in Vancouver I was asked a question by an investor during the Q&A period. The question was something like this “What’s different about this gold bull market compared to previous ones? Gold has always been a disappointment, why will this time be different?”

The question immediately struck me as odd. Here we are, sitting with gold trading at US$3,350/oz, outperforming the S&P 500 over the last 20 years and we are talking about disappointment.

I asked the investor if he was referring to gold mining stocks, not gold itself. He clarified that indeed, he was referring to gold.

Well then.

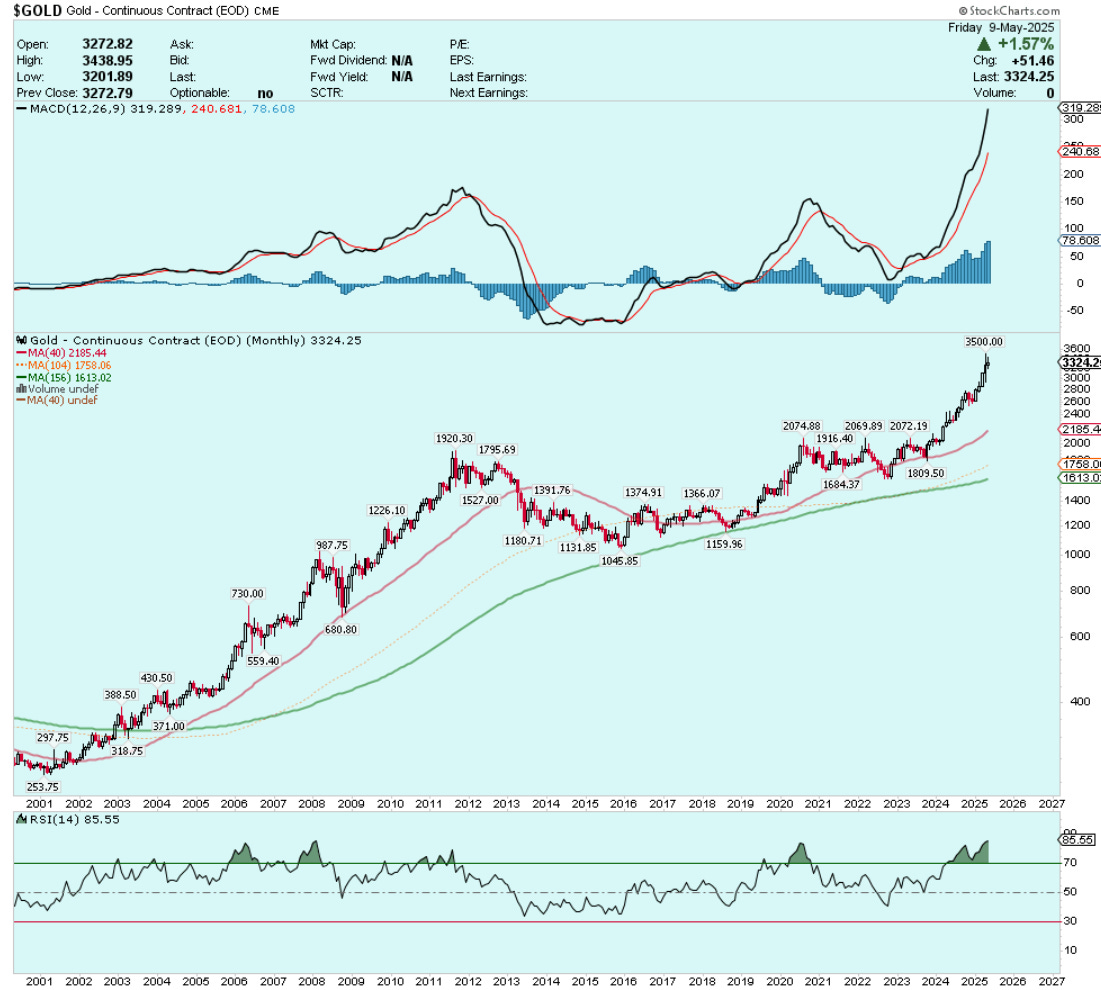

I responded that the first time I purchased gold was in 2002 for $300/oz, today it is more than 11x that price. In no realm of reality is that a disappointing performance. Even if one had purchased gold for $1800 in 2012 right before it fell $500/oz, you’d still be sitting on a nearly 100% gain today. Maybe not earth shattering, but certainly not disappointing.

Gold (Monthly - 25 Year)

The investor question caught me by surprise so much that I’ve been thinking about it ever since. How could someone view gold’s performance as disappointing?

It could be that this investor’s expectations were extremely high. It could also be that he bought gold just before it entered one of its cyclical bear markets. The psychological trauma of buying at exactly the wrong time can imprint itself upon an investor’s psyche, and then permanently alter his/her view of a particular stock or asset class.

Is it different this time?

The world is different today than it has ever been before, so yes, it’s different this time.

Does that mean that gold will defy the laws of physics and never enter a bear market again? Absolutely not.

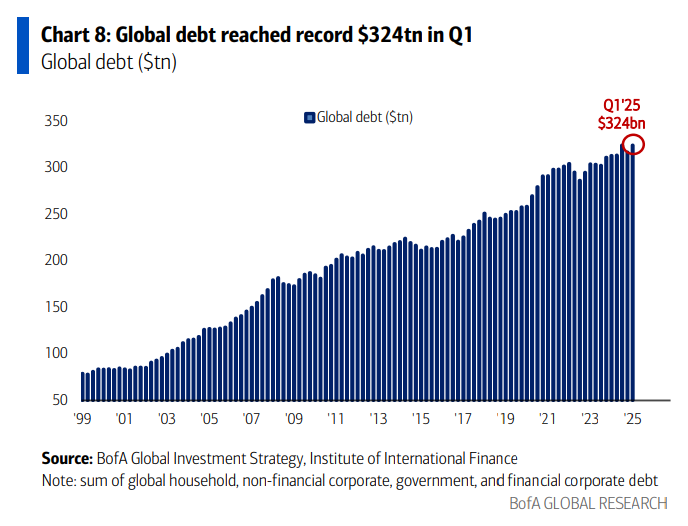

It’s also different this time because global debt has never been greater:

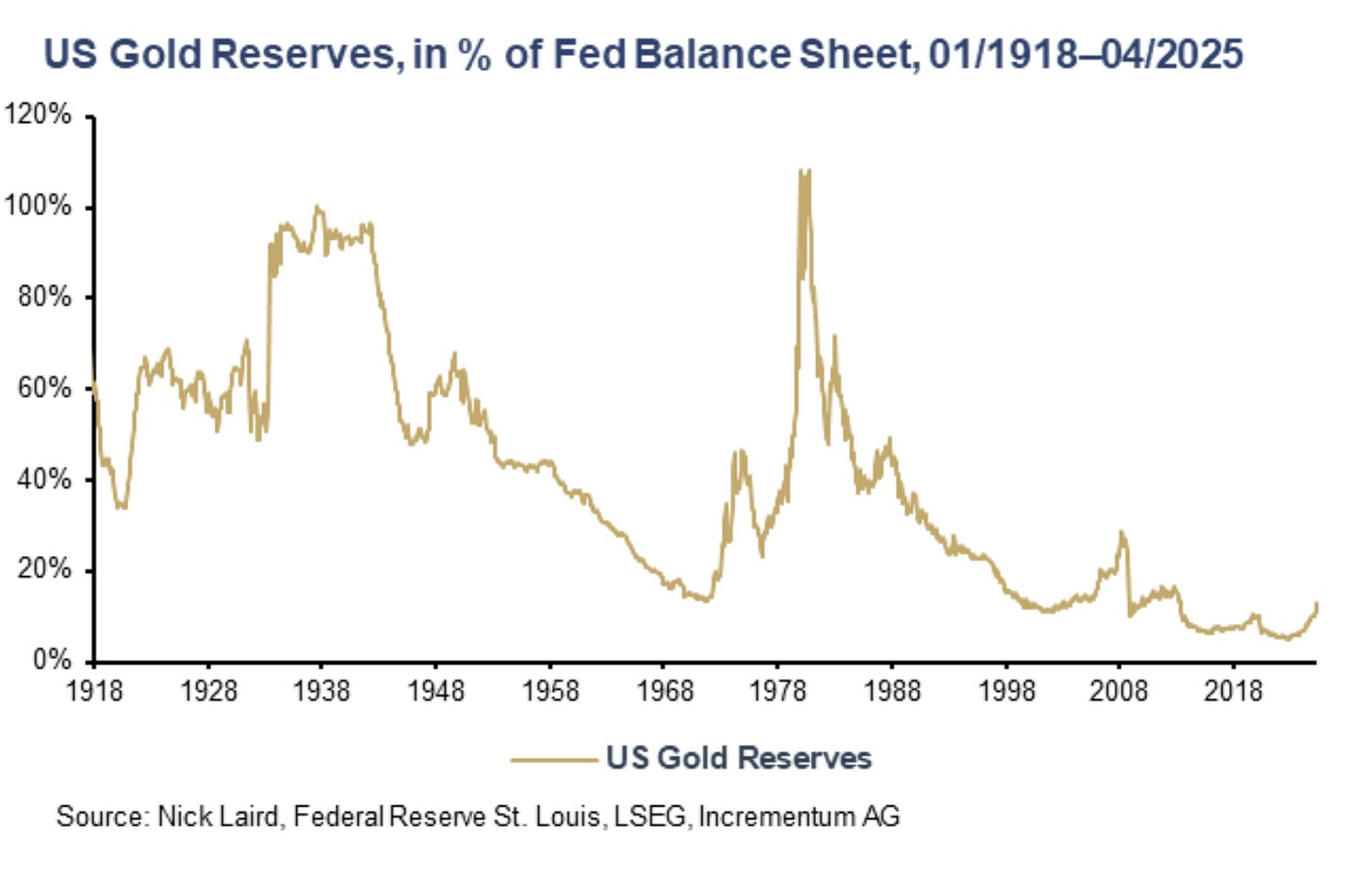

And gold reserves as a percentage of the Federal Reserve balance sheet has virtually never been lower:

It’s different. But that doesn’t mean that the laws of market and economic cycles are different.

While attendance at MIF was quite good, sentiment didn’t feel anything close to euphoric. If anything, sentiment was rather subdued, despite the TSX Venture Composite breaking out to three-year highs in recent weeks.

TSX-Venture Composite (Weekly)

In other news, the US and China are sitting down for trade talks in Geneva this weekend. The timing of these talks is definitely not an accident; the pain is being felt in China, and if the trade embargo continues much longer US consumers will be feeling the effects in a big way this summer.

I am standing by my prediction laid out in January that an upward revaluation of the Chinese yuan (CNY) against the US dollar is on the table in 2025. A stronger yuan (weaker USD/CNY) will help to rebalance global trade by making Chinese exports more expensive in foreign currency terms, likely reducing the volume of exports. Meanwhile, imports become cheaper for Chinese consumers and firms, encouraging more imports. This narrows China’s trade surplus and helps address global imbalances.

In addition, I expect that gold will play an integral role in the reshaping of the global trading and monetary system. Gold could serve as an anchor, bridge currency, or settlement mechanism in a system transitioning away from full dollar hegemony.

Gold will serve as a neutral settlement asset due to the fact that it is universally accepted and has no counterparty risk. It can be used to settle bilateral or multilateral trade imbalances without relying on politically sensitive fiat currencies. For example, countries running trade surpluses could accept partial payment in gold, reducing exposure to debased currencies or sanctions risks.

I am less sure about a gold revaluation. I actually think that the US and China may simply allow market forces to do the revaluing higher. As gold becomes more sought after as a neutral settlement asset, then it should continue to appreciate.

Simply put, gold provides a trustworthy and apolitical basis for settlement in a multipolar trade environment.

I believe we are about to find out a lot more about the voracious gold buying and US imports of gold during the first four months of the year.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SedarPlus.ca for important risk disclosures. It’s your money and your responsibility.