Record Profit Margins Stand To Fuel Wave Of Gold Mining Sector M&A

The gold mining sector is set to begin reporting Q4 earnings next week, many producers will report record levels of free cash flow generation

A couple weeks ago, I pointed out the unique contrast between investor sentiment and operational reality in today’s gold mining sector environment. Gold mining stocks are delivering strong free cash flow growth at a time when investors are still quite negative on the sector.

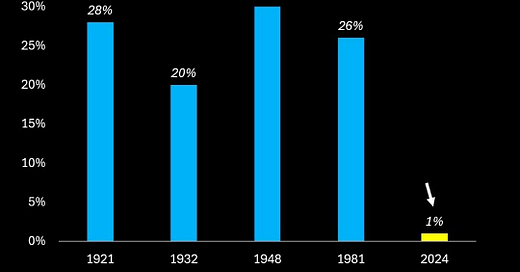

At the height of the gold bull market in the early 1980s, gold and gold mining stocks constituted roughly 1/4th of total global assets. Today, that total stands at less than 1%:

What makes these statistics all the more remarkable is that the price of gold is at all-time high levels when priced in virtually every currency on the planet.

Why is investment in the gold mining sector at an all-time low at the same time that gold is at all-time highs?

Understanding the answer to this question, and the context of how we got to where we are today, will help us to delve into the opportunity that is available to investors today.

There have been three important periods of recent history in the gold mining sector that have helped to result in the underinvestment and investor skepticism that the sector faces today:

2008-2012 M&A Phase: Gold enjoyed a meteoric rise from its 2008 GFC crash low at $695 to its peak in August 2011 at $1923/oz - this powerful gold price trajectory encouraged gold mining executives to make aggressive acquisitions. During this period, there were many disastrously spectacular acquisitions made across the sector -including:

~ Barrick Gold’s Acquisition of Equinox Minerals (2011) for $7.3 billion.

~ Newmont Mining’s Acquisition of Fronteer Gold (2011) for $2.3 billion.

~ Kinross Gold’s Acquisition of Red Back Mining (2010) for $7.1 billion.

Each one of these acquisitions proved to be major destroyers of shareholder value. The value destruction was not only due to the fact that the acquirers overpaid in each of these deals, but also because gold and copper entered bear market phases shortly after the deals were completed.

2012-2015 Bear Market: The post GFC/Eurozone Financial Crisis bear market in metals was a deep and painful one for the mining industry. Many of the big ticket price acquisitions of the bull market period were predicated upon rising metals prices, and a “get bigger at any cost” attitude. The faulty logic of this approach came home to roost during a time when metals prices sank and the sector’s profitability plummeted. Naturally, shareholders were served up with outsized losses and the sector deeply suffered.

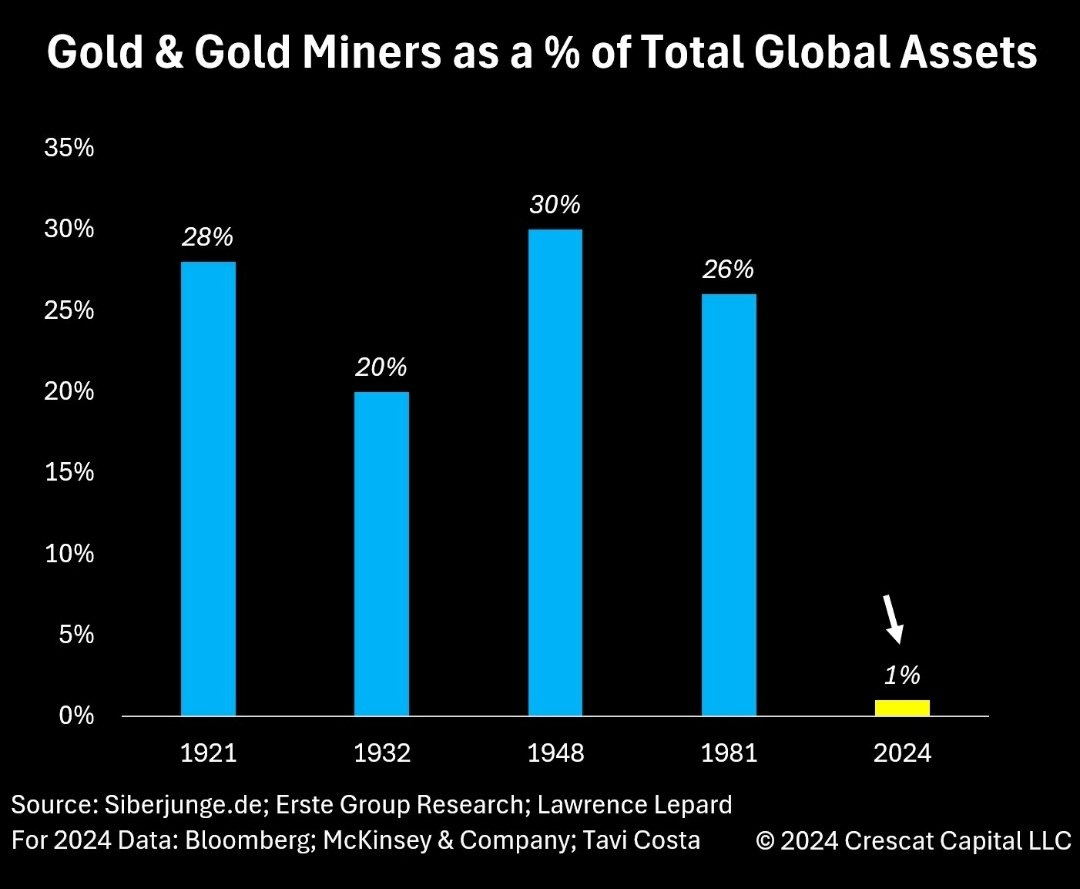

2021-2024 Cost Inflation Surge: While gold prices traded between $1625 and $2000 during this time period, cost inflation across the economy combined with supply chain pressures caused gold producer costs to soar. This was a particularly disappointing and disillusioning period for investors in gold mining stocks due to the fact that the sector drastically underperformed gold itself.

From January 2021 to June 2024 gold rose ~27% vs. a decline of 1.8% for the GDX

After years of suffering through a metals bear market environment, it was the producer cost inflation during a period with relatively strong metals prices that ultimately resulted in a wave of investor capitulations during 2023 and 2024.

The expression 'it's darkest before the dawn' is how it feels today in the gold mining sector. The investing public has given up on the sector, institutional ownership is at record lows, yet gold prices are climbing to new record high levels and producers are coming off consecutive quarters of record free cash flow generation.

If we were to simply look at the contrast of record high gold prices and bearish investor sentiment on gold mining stocks, it would create an intriguing dynamic worthy of closer inspection. However, when one drills down into the financial health of the sector, low debt levels, and rising profitability metrics it becomes one of those triple-take moments in which one wonders if this setup can actually be real.

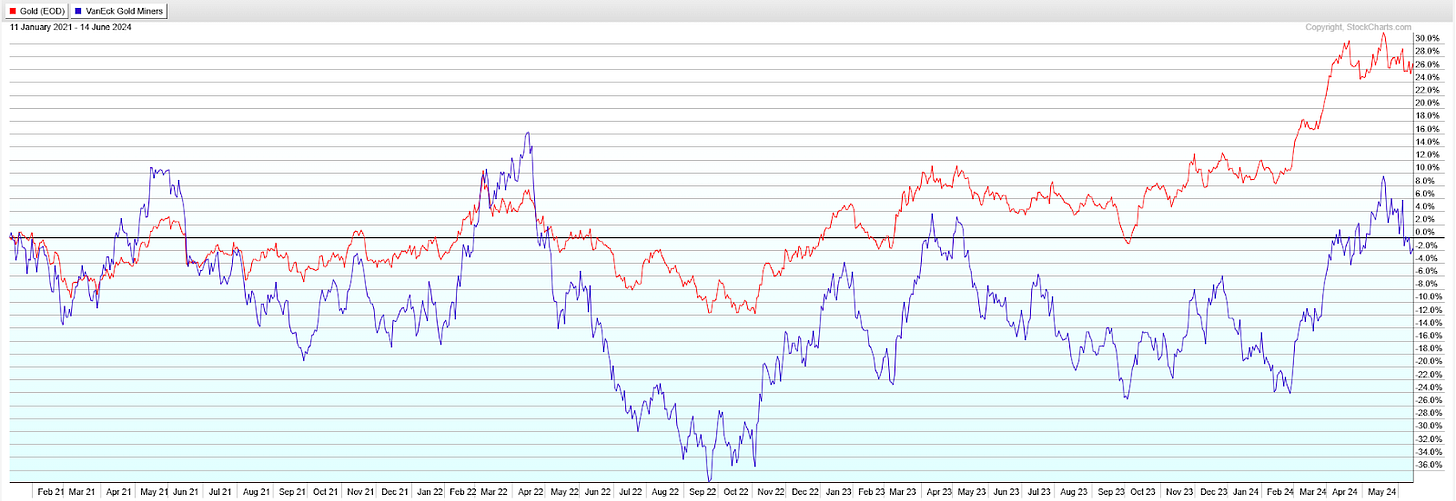

Let’s look at gold miner profitability:

After years of trimming the fat and focusing on profitability over production volume, the gold mining industry has never been more profitable. In fact, it is now a shining beacon of profitability that stands above other sectors such as energy and financials.

Some profit metrics from larger producers (above US$1 billion market cap):

Agnico Eagle

Gross margin 38%

Operating margin 34.4%

Kinross Gold

Gross margin 27.7%

Operating margin 24.5%

IAMGOLD

Gross margin 30.4%

Operating margin 29.5%

In Q4, the gold price averaged roughly $2,650/oz and Agnico sees all-in sustaining costs coming in at roughly $1,250/oz. It’s not a stretch to consider that Agnico is about to produce a record AISC margin quarter, in excess of 50% margin. In addition, its operating margins (including corporate overhead) should also come in north of 40%.

Operating margins are considered to be a measure of short-term efficiency, while AISC margins are a better measure of long-term profitability. Free cash flow generation and all-in sustaining cost profit margins are probably the two best ways we can measure gold miner profitability. The trends in both metrics are decidedly positive, and many gold producers are generating record levels of each.

Here is a graphic showing the trend in Agnico Eagle’s free cash flow:

Gold miner free-cash flow margins are approaching their 2020 peak levels, and likely to reach new all-time high margins in 2025:

50% FCF margins (h/t Garrett Goggin) are absolutely unheard of in the gold mining industry. In fact, such fat margins are rare in any industry.

Record levels of profitability and strong metal prices mean that the sector is facing an unusual problem: Too much cash on its hands. What will the gold mining industry do with all this cash?

There are four main answers to this question:

Return it to shareholders through dividends and share buybacks

Pay down debt (at already historically low levels)

Invest in organic growth through exploration and development of internal project portfolios

Acquire other companies (producing assets, development stage assets, and exploration projects)

The first two choices aren’t sexy and the industry has pretty much followed this playbook for the last several years. The third option is something that companies are always doing, but it does not generate rapid growth. It is the fourth option that is the most intriguing, and the choice that can generate the most accretive growth and investor returns across the sector.

A wave of gold producer earnings beats being reported over the next month, in conjunction with two of the biggest mining conferences of the year (BMO Metals & Mining in Florida at the end of February, and PDAC in Toronto in early March) could set off the next wave of M&A in the gold mining sector.

Making new gold discoveries is hard, and the odds of finding an economic ore body in a stable jurisdiction are daunting. It makes much more sense for cashed up producers to acquire assets that have already been discovered and de-risked to the point that they become valuable additions to a large producer’s pipeline of opportunities.

Cost of capital is a big challenge for smaller producers and developers. The WACC (weighted average cost of capital) for juniors is typically above 15%, whereas, for larger producers like Barrick or Newmont it is closer to 8%.

Size matters in mining. Rolling up quality assets into one entity can reduce overall corporate overhead, while reducing the overall cost of capital across the asset portfolio.

More compelling reasons for increased M&A in the gold mining sector:

Economies of scale: Larger mining operations can benefit from economies of scale, which means they can produce more output at a lower cost per unit. This is because they can spread their fixed costs such as exploration, development, and infrastructure, over a larger volume of production.

Access to capital: Larger mining companies typically have better access to capital markets, allowing them to finance large-scale projects that would be too expensive for smaller companies.

Technological expertise: Larger mining companies are more likely to have the resources to invest in the latest technologies, and attract the best talent, improving efficiency and productivity.

Market power: Larger mining companies have more bargaining power with suppliers and customers, helping them to negotiate better prices.

I am highlighting two companies that I believe could perform very well during the anticipated acceleration of gold mining sector M&A. The first one is a producer that is just completing ramp-up to full throughput commercial production at one of the largest operating gold mines in Canada. The second is a fledgling gold producer that is on the brink of bringing a high-grade past producing gold mine back into production. The market caps of the two companies are very different, as is the investment risk/reward profile.

IAMGOLD (NYSE:IAG) was my top gold mining stock pick in 2024 and it did not disappoint with shares rising more than 100%, far outperforming its mid-tier gold producer peer group. In Q4 2023, the gold sector was deeply out of favor and IAG was a distressed company. However, IAG has regained its luster in the eyes of investors after strong operational performance, a successful production ramp-up at its flagship Côté Gold Mine, and a more than 200% share price appreciation since October 2023.

IAG (Weekly)

The most important thing to understand about IAG is that it’s a gold production growth story that includes a pipeline of high quality development stage assets in Quebec (tier one jurisdiction):

Essakane (West Africa) has been IAG’s standout performer for the last several years, but it will pass the torch to Côté over the next couple of years. Côté is expected to reach nearly 400,000 ounces of production in 2025 with an estimated life of mine of 18 years. Once it achieves steady-state production, Côté is expected to be one of the three largest long-lived gold mines in Canada:

Its performance metrics are impressive, including a nearly 50% AISC margin at today’s gold prices:

IAG’s high-grade Westwood Complex in Quebec is an underrated cash generator and the company just updated the mine plan, extending the Westwood mine life to 2032. Additionally, the company’s development-stage Nelligan and Monster Lake assets in Chibougamau (Quebec) give the company an attractive future production pipeline. Nelligan shares some important similarities to Côté in that they are both large ore bodies that have mineralization that starts close to surface. Nelligan’s location in an established mining camp with excellent infrastructure make it a priority asset for future growth.

National Bank rates IAMGOLD as a top pick in the gold sector with a C$12.50 price target (US$8.75), the Canadian bank goes on to state:

“IAMGOLD remains our Top Pick in the Intermediates due to the incremental de-risking of the Côté gold mine ramp-up and strong operational performance over the last several quarters. In our view, IAMGOLD is a potential acquisition target given its discounted valuation and high quality asset base that supports a robust FCF generation outlook, with the bulk of its NAV tied to low-risk jurisdictions.”

I view IAG to be a moderate risk gold producer due to its more mature operating mines and strong balance sheet. However, it also carries with it a US$3.7 billion market cap, a double isn’t as easy to come by once a company reaches a multi-billion dollar market cap valuation.

With more risk comes more potential reward.

The second gold producer idea carries significantly higher risk than IAMGOLD, but it could also produce multi-bagger returns.

The well known Lassonde Curve is an essential tool for any junior mining speculator as a guide post for where a mining project might reside along the mining life cycle. The discovery phase is the most exciting part of a project’s life cycle because it’s the stage when the speculation can be the greatest and new investors are joining the party on a daily basis.

However, it is the pre-production sweet spot that is often the most profitable. When production is only months away, junior mining companies often begin to experience an upward rerating as institutional investors begin to anticipate commercial production and cash flow generation.

Furthermore, as a mining company transitions to being a producer it becomes eligible for inclusion into a swathe of ETFs and mutual funds that it would have previously not met the qualification. It is the hand-off from retail investors to institutional ownership that can greatly affect a junior miner’s valuation and consequently lower its cost of capital.

There is a fledgling Canadian gold producer that is entering the pre-production sweet spot.

West Red Lake Gold Mines (TSX-V:WRLG, OTC:WRLGF) is restarting the Madsen Mine in Red Lake, Ontario. Madsen will be a high-grade underground gold mining operation that is expected to begin ramping up to commercial production in mid-2025. WRLG recently announced a maiden prefeasibility study for Madsen and it demonstrates favorable economics for the Madsen Mine restart.

The PFS numbers are based on a conservative gold reserve of 458,000 ounces at 8.16 g/t gold average grade, driving a 7.2 year, 800 tonne per day operation producing an average of 67,600 ounces of gold annually. The PFS envisions an all-in sustaining cost of gold production of US$1,681/oz. The PFS significantly de-risks the Madsen Mine restart which remains on-track for mid-2025.

Of course, there is considerable room for WRLG to expand reserves at Madsen, which could increase annual production in future years, as well as potentially reducing AISC to below US$1,600/oz. The important thing to understand about Madsen is that the prior operator (Pure Gold) spent C$350 million rebuilding the mine and mill, and since acquiring it in 2023 West Red Lake has invested another C$100 million in preparation for a successful restart.

By tightening the drill spacing from 20 meters to 7 meters West Red Lake has greatly increased confidence in the continuing of the ore body, and anticipated head grades. Additionally, detailed mine engineering including keeping a running 15-month stope book helps to ensure the mill continues to be fed at planned throughput. Stopes are underground rooms where ore is extracted. It’s critical for stopes to be prepared well in advance for efficient future ore extraction.

One of the next big catalysts for West Red Lake will be the results of bulk sampling from several stopes in two resource areas in April. The successful processing of bulk samples will be followed by test-mining, and then the mine ramp-up will begin by June/July.

The successful restart of Madsen will set the stage for WRLG to begin to benefit from cash flow generation. This will enable the company to further outline growth targets, including:

Fork deposit: newly recognized high-grade core measuring 400 x 250 x 200 meters

Upper 8: newly discovered near surface ore shoot within 500 meters of existing workings

Rowan deposit: 12.8 g/t near surface inferred resource. Permitting progress suggests mineability in 2027.

Cantor Fitzgerald analyst Matthew O’Keefe rates West Red Lake at a BUY rating with a C$1.50 price target - he writes:

“With the de-risking PFS we have updated our valuation methodology to reflect an equally weighted 1.0x NAV / 5.5x 2026e CFPS from a 0.8x P/NAV basis previously. As a result, our price target increases to $1.50 per share from $1.40 per share previously. Our Buy rating is unchanged. With the PFS providing a solid basis for the mine restart, we remain confident that the restart of the Madsen mine will be successful. The high-grade nature of the mine with its significant upside potential should ultimately drive a premium valuation. We note that our $1.50/shr price target remains conservative based on a long-term gold price estimate of US$2,200/oz.”

WRLG.V (Daily)

I am long both IAG and WRLG.V at the time of publishing this article and I look forward to updating readers following IAG’s Q4 2024 earnings report in two weeks.

Disclosure: West Red Lake Gold is a sponsor of Goldfinger Capital so some information could be considered biased.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. West Red Lake Gold Mines Ltd. is a high-risk venture stock and not suitable for most investors. Consult West Red Lake Gold Mines Ltd’s SEDAR profiles for important risk disclosures.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.sedarplus.ca for important risk disclosures. It’s your money and your responsibility.