Red Lake Gold Revival

The C$2 billion acquisition of Great Bear by Kinross, followed by WRLG's acquisition of multiple Red Lake gold assets has opened a new chapter of gold mining in one of Canada's storied gold camps

All great mining districts experience decades of resurgence and production growth, and decades of decline and relative dormancy. After experiencing a boom period throughout the 2000s (largely thanks to Goldcorp’s discovery of the High Grade Zone at the Red Lake Mine), Red Lake went into a decade of declining production in the 2010s. Thanks to the Great Bear discovery (circa 2018/2019), and a big bet by billionaire mining entrepreneur Frank Giustra, Red Lake is back on the upswing as one of hottest Canadian gold regions.

Let’s review the history of the Red Lake gold mining region.

The Red Lake gold mining region in Ontario, Canada, is one of the world’s richest and most historic gold-producing areas. Located about 500 kilometers northwest of Thunder Bay, Red Lake has produced millions of ounces of gold since the early 20th century. Here's an overview of the region's history:

1. Early Exploration (Pre-1925)

Before gold was discovered, the Red Lake region was inhabited by Indigenous peoples, primarily the Anishinaabe (Ojibwe), who used the area's lakes and rivers for fishing and transportation.

European exploration in the area began in the late 1800s, mainly for fur trading. Gold prospecting was limited at this stage, as the remote location and harsh environment deterred mining companies.

2. The Gold Rush (1925–1930s)

The first significant gold discovery occurred in 1925, sparking a gold rush.

Thousands of prospectors, carrying supplies on foot or by canoe, arrived after the discovery of gold at Howey Bay near Red Lake.

In 1926, Howey Gold Mine and Red Lake Gold Shore Mines were established, though mining infrastructure was still in its infancy.

The area’s remoteness made transportation difficult, so floatplanes became a crucial mode of access. The development of the Hudson-Red Lake Winter Road also facilitated movement.

3. Boom Period (1930s–1940s)

By the early 1930s, high-grade gold deposits were confirmed, leading to a mining boom.

Goldcorp’s Campbell Mine and the Dickenson Mine (which later became part of Goldcorp) opened during this time.

World War II slowed production temporarily, but mining resumed quickly after the war ended.

4. Technological Developments and Expansion (1950s–1990s)

Throughout the post-war period, advanced mining and refining technologies enabled deeper and more efficient gold extraction.

Mines like Campbell became known for producing high-grade ore (often exceeding 2 ounces per ton).

In 1995, Goldcorp Inc. acquired the Dickenson Mine, and its flagship Red Lake Mine soon became one of the world’s richest, with ore grades among the highest anywhere (about 2 ounces of gold per ton).

5. The 21st Century: Global Recognition and Expansion

The discovery of new high-grade zones within the Red Lake Mine, especially the "High-Grade Zone" in 2000, significantly increased production and investor interest. This discovery made Goldcorp one of the largest gold producers globally.

Red Lake became a center for underground mining expertise, with deep shafts allowing miners to access gold at greater depths.

In 2019, Goldcorp merged with Newmont Corporation, forming the world’s largest gold mining company. Newmont continues to operate in the region.

6. Recent Developments (2020s)

In 2020, Newmont sold the Red Lake assets to Evolution Mining, an Australian company, signaling a shift in ownership.

Evolution came into the region with an eye to mining bigger. It didn’t work out well for the first while; larger mining techniques on the narrow veins in Red Lake lead to dilution and high costs. Over the last year Evolution has found a solid middle ground and is now operating reliably.

The Red Lake region remains an active and vital gold-mining district, producing gold and contributing to local employment. Recent exploration suggests potential for new discoveries, which could extend the life of mining in the area.

Impact and Legacy

Over its history, Red Lake has produced more than 30 million ounces of gold, making it one of Canada’s most productive gold regions.

The region's economic success helped sustain local communities, and Red Lake itself developed from a small settlement into a thriving town.

The area's mining history has also attracted geologists and mining engineers, making Red Lake a hub for mining expertise and exploration.

What separates Red Lake from many other gold mining regions of North America are its extremely high-grade gold deposits. The High-Grade Zone at the Red Lake Mine truly transformed Goldcorp from a fledgling producer in the early 2000s to the best growth story in the gold mining sector in the mid-2000s. Goldcorp was eventually acquired by gold mining giant Newmont for US$10 billion.

Red Lake’s rich gold deposits have helped to create many millionaires, and even some billionaires. The latest Red Lake gold discovery success story was Great Bear Resources and its C$1.8 billion acquisition by Kinross Gold in early 2022.

Great Bear’s discovery of the LP Fault Zone in 2019, with similarities to the Hemlo Gold Discovery (also in Ontario), propelled Great Bear to being one of the most successful Canadian-listed gold exploration companies of the last decade. Kinross recently published a maiden PEA for the Great Bear Project (formerly Dixie) that included an updated resource estimate (inferred resource totaling 3.884 million ounces at 4.74 g/t gold, which is in addition to the existing M&I resource estimate of 2.738 million ounces at 2.81 g/t gold). The economics outlined in the PEA were compelling and included annual production of more than 500,000 ounces per year at an all-in sustaining cost of approximately $800 per ounce during the first 8 years through a conventional, modest capital 10,000 tonne per day mill.

Kinross’s Great Bear project is still at least five years away from being constructed, fully permitted, and in operation. However, in mid-2025 West Red Lake Gold (TSX-V:WRLG, OTC: WRLGF) will bring the Madsen Gold Mine back into production.

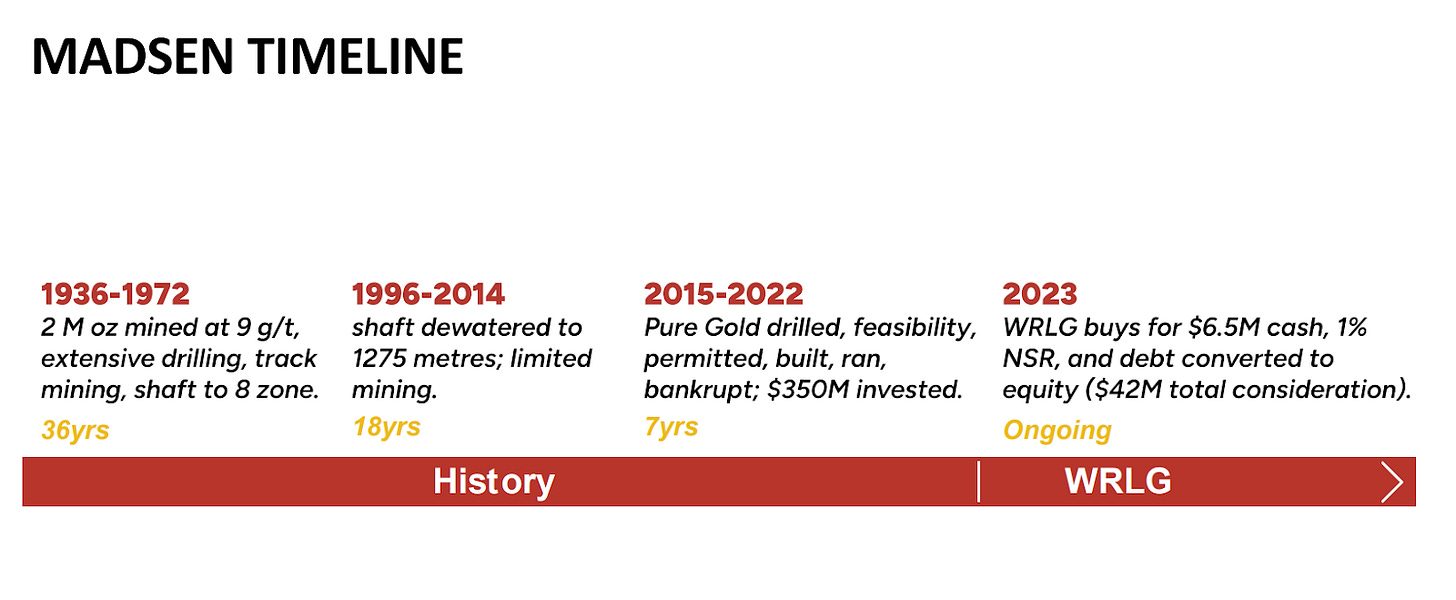

in early 2023, during a challenging capital markets environment for the gold mining sector, West Red Lake Gold was able to acquire the Madsen Mine and ~$350 million worth of infrastructure for pennies on the dollar. Leading the financial backers of WRLG was billionaire mining entrepreneur Frank Giustra. Giustra and his group had a vision of consolidating high-grade gold assets in the Red Lake region, and eventually creating a formidable mid-tier producer. Not a much different strategy than what Goldcorp was able to do in the late-1990s and 2000s.

West Red Lake has moved rapidly and with last week’s announcement of a funding package, WRLG has a clear path to entering commercial production at Madsen in the 2nd half of 2025.

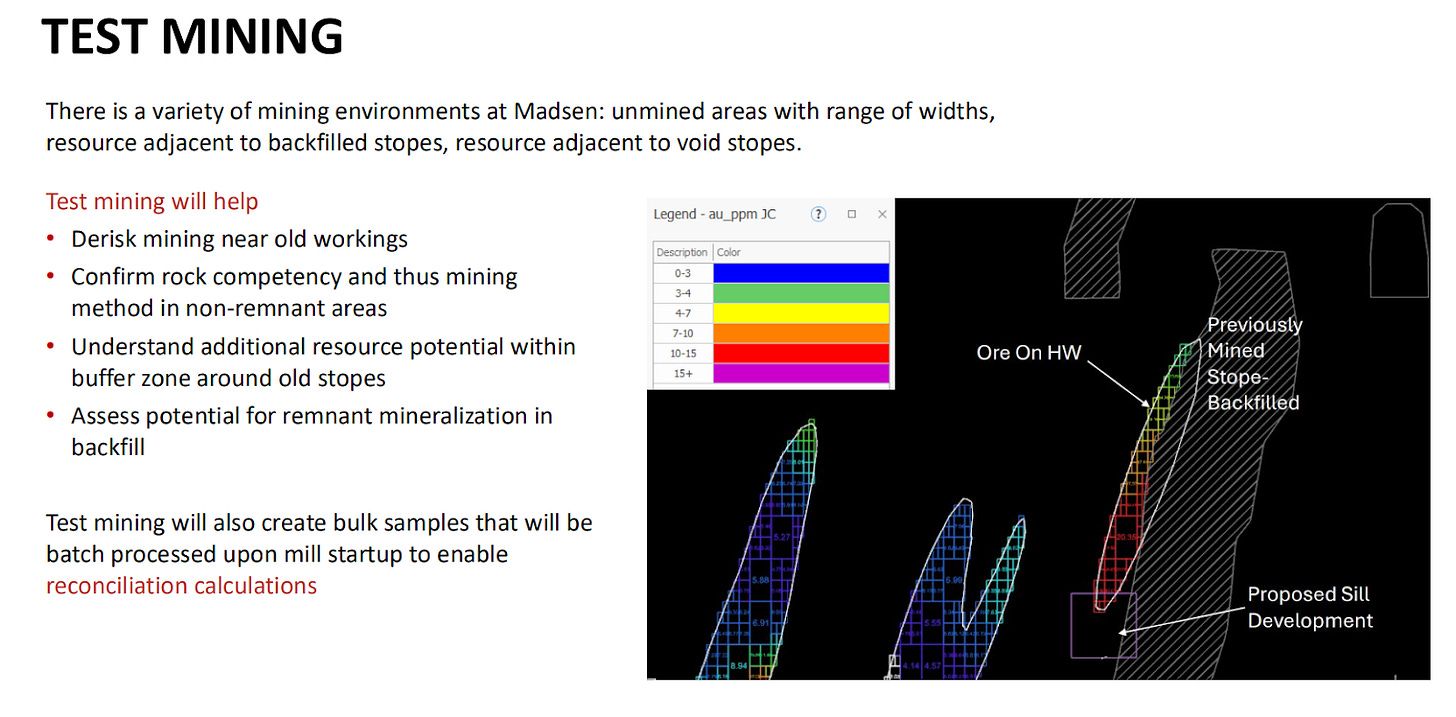

The Madsen mine has a 43-101 resource of 2.1 million ounces. This year the company has completed a 40,000-meter definition drill program with two drills and is in the midst of drilling an additional 10,000 meters (combination of definition and exploration drilling). Last month, WRLG began test mining at Madsen, adding a key derisking component before formally restarting production at Madsen next year.

The test mining program is expected to run for four months. Bulk samples will be batch stockpiled on site. WRLG expects to process these bulk sample stockpiles soon after restarting the mill.

The test mining and bulk sample program is designed around three goals.

To understand, prior to restart, the best methods to mine safely and efficiently in the various underground environments at Madsen.

To inform mineability decisions for mineralization near old stopes. Historic stopes are currently wrapped in 2-meter, null-resource buffers that could potentially be reduced or removed if trial mining demonstrates these buffer areas are mineable. This represents potential upside to the overall mineable inventory.

To create bulk samples that WRLG can batch process on mill startup to complete reconciliation calculations between expected and actual tonnes, grade, and ounces of mined material.

During the next nine months, WRLG will execute a precise multi-faceted plan necessary to launch a successful mine restart at Madsen in 2H 2025:

Red Lake remains one of the most iconic gold-mining regions in the world, the tag line “Canada’s Fort Knox” is apropos. Kinross Gold and West Red Lake Gold are at the forefront of the Red Lake gold mining renaissance and there are strong indications that Red Lake’s best days are still to come.

Disclosure: Author owns shares of WRLG.V and may choose to buy or sell at any time without notice. West Red Lake Gold is a sponsor of Goldfinger Capital.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This video is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.