Talon Metals Makes New High-Grade Copper & Nickel Discovery in Michigan

The Upper Peninsula of Michigan has fascinated me for years and today we learned of a new high-grade copper/nickel discovery made by Talon Metals in the UP

The Upper Peninsula of Michigan has a long history of mining, and it is actually the location of the only operating primary nickel mine in the US. The Eagle Mine and Humboldt Mill are owned by Lundin Mining (TSX:LUN); Eagle is an underground, high-grade nickel and copper mine located in western Marquette County of Michigan’s Upper Peninsula. The mine is expected to produce 440 million pounds of nickel, 429 million pounds of copper, and trace amounts of other minerals over its estimated mine life (2014 – 2029).

Eagle has been one of LUN’s cash cow operations in recent years, largely due to the high-grade nature of its ore bodies (Eagle and Eagle East), and rising copper and nickel prices (in 2021 and 2022). Eagle generated US$250 million in profits for LUN in 2022. The problem for LUN is that Eagle is expected to deplete its ore reserves by 2029, meaning that the Humboldt Mill will either need to find a new source of feed or it will be shuttered.

Lundin’s Upper Peninsula operations employ ~500 Michiganders with high-paying jobs and benefits. Without a new discovery that has the potential to become a mine, those jobs will be gone in five years.

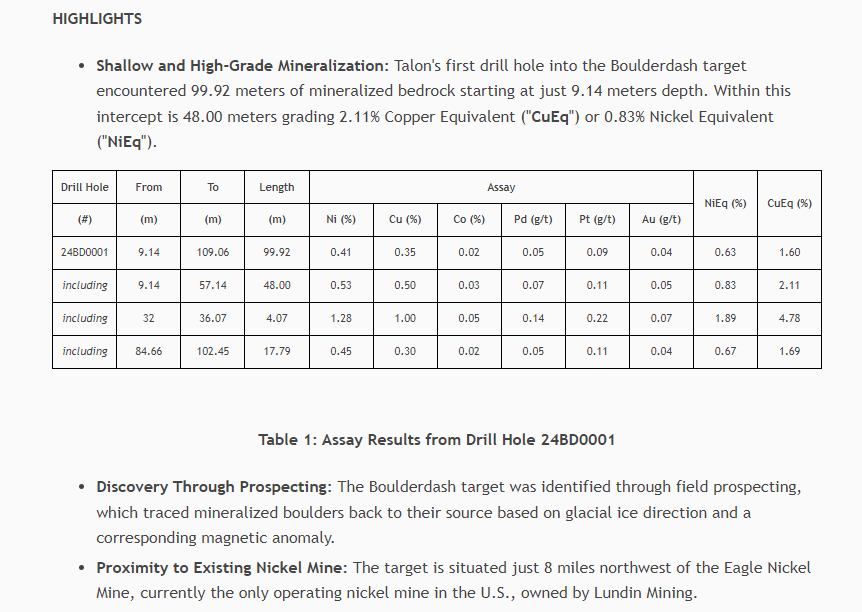

This morning, another copper/nickel mining company called Talon Metals (TSX:TLO) announced a new high-grade copper & nickel discovery only 8 miles to the northwest of the Eagle Mine:

In 2024, Talon has drilled two copper/nickel/PGM targets in the UP of Michigan (Roland and Boulderdash). Today’s discovery announcement is from Boulderdash.

In today’s news release, Talon explains how it honed in on the Boulderdash Target through field prospecting, which traced mineralized boulders back to their source based on glacial ice direction and a corresponding magnetic anomaly. In the late 2000s, Rio Tinto (Dean Rossell and team) identified the Boulderdash Area as prospective. Rio Tinto drilled a hole or two but didn’t hit, Talon used detailed geophysics to pin down the target that resulted in the discovery announced today.

A near surface hit of ~100 meters grading 1.60% copper-equivalent on the first ever hole of a maiden drill program is about as good as it gets in exploration. In fact, I don’t think I’ve ever seen something quite this good in hole #1 into a new target. Clearly, the anomaly was showing the Talon geologists what they were looking for.

Talon’s Chief Exploration Geologist Dean Rossell is credited with the discovery of the Eagle Deposit (now the Eagle Mine), he is quoted in today’s news release:

“This discovery is the result of both traditional mineral exploration practices and novel approaches to geophysics. We identified mineralized boulders at the surface while prospecting and followed the trail of boulders back to where they vanished. Then, using modern geophysical tools, we identified an anomaly, and the first drill hole hit mineralization right out of the box.

The distribution and abundance of magmatic sulfides intersected in the initial drilling at Boulderdash bear a striking resemblance to the early drill results from the Eagle deposit. In 2001, one of the first drill holes intersected a long interval of disseminated with minor net-textured sulfides which provided some of the inspiration to drill the discovery hole in 2002 which intersected 84.2m of high-grade massive sulphide mineralization.”

This is incredible news, and a remarkable piece of exploration work, finding something that was sitting 10 meters beneath the surface in a place where nobody had drilled before. Additional drilling is following up on the Boulderdash discovery, in addition to borehole electromagnetic (EM) surveys to refine the understanding of the subsurface.

According to today’s news release, Talon continues to advance exploration efforts at the Roland Target, which was drilled earlier this year. Four drill holes were completed, and an off-hole electromagnetic (EM) anomaly was identified, indicating the potential for nickel and copper mineralization. Talon plans to resume exploration at the Roland Target in the 2025 drill season to follow up on the anomaly and further evaluate the target’s early potential.

The Boulderdash discovery is certainly quite significant for Talon, however, the company’s current valuation is largely tied to its Tamarack Deposit in Minnesota (60% Talon, 40% Rio Tinto). Talon has also had a large fund selling its shares in recent months that has weighed heavily on its share price:

TLO.TO (Daily)

I own Talon shares with a cost basis of around $.10, however, I believe the bigger opportunity could actually exist in a company that has a land position that borders Talon’s Roland Project, roughly ~200 meters to the west, in the same belt of rocks as both Boulderdash and Roland (Baraga Basin).

Source: Rossell and Strandlie, 2024, Potential links between the Midcontinent Rift (MCR) related Baraga-Marquette dyke swarm and early MCR related magmatic Ni-Cu sulfide deposits in Michigan, USA.

Bitterroot Resources (TSX-V:BTT, OTC: BITTF) conducted drill programs at its neighboring LM Property in 2020/2021/2022 before the nickel market entered a brutal bear market - BTT has been unable to muster the resources necessary to conduct a phase IV drill program at LM.

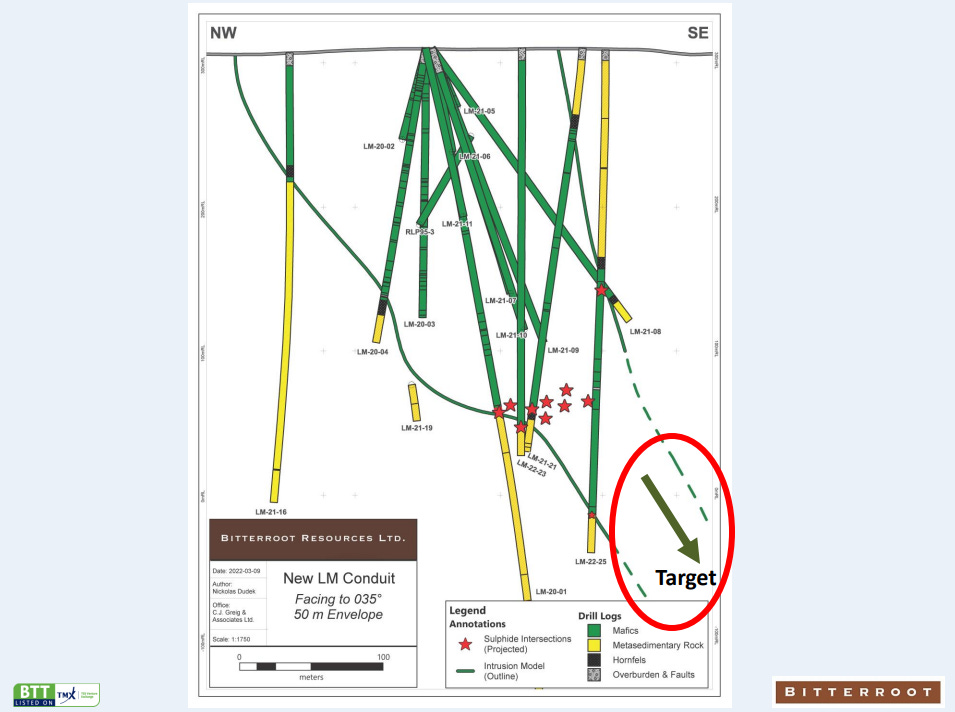

The evidence from 26 holes drilled at LM between 2020 and 2022 supported the potential for a large high-grade Nickel-Copper-PGM sulphide body at depth that has fed much of mineralized intervals that BTT generated in diamond drilling:

In 2021/2022 drilling, BTT never drilled a hole that screamed “Aha! We’ve found it!” - they kept getting sniffs of semi-massive sulphide rip-up clasts that had been driven up closer to surface through a powerful magmatic event. The copper/nickel/PGMs that BTT intersected at depths of 200-300 meters were not the heart of the potential ore body, they were more like the fingernail of a much larger body.

When 2022 drilling concluded, BTT developed an interpretation that the ‘LM Conduit’ is plunging to the southeast and the real target area may be at about 500-600 meters depth, the deepest BTT ever drilled was ~300 meters:

BTT’s furthest east hole stopped just ~150 meters from the property boundary with Talon at Roland. With a new high-grade discovery at Boulderdash, an off-hole electromagnetic anomaly identified at Roland, indicating the potential for nickel and copper mineralization, and ongoing drilling by Talon. Suddenly, the Upper Peninsula of Michigan’s Baraga Basin becomes an area of increased focus for copper/nickel/PGM exploration in the United States.

I am a shareholder of both Bitterroot Resources (most of my shares purchased at much higher than $.045 per share) and Talon Metals at the time of publishing this post. I believe in the discovery potential and the economic benefits of mining in Michigan. I also believe in American copper and nickel.

Disclosure: Author owns shares of BTT.V and TLO.TO at the time of publishing and may choose to buy or sell at any time without notice.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The stocks discussed in this article are high-risk venture stocks and not suitable for most investors. Consult Company SEDAR profiles for important risk disclosures. This interview contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information.