The Charts Of The Week: Copper, Onyx Gold, Platinum, Hercules Metals, Emerita & More

Copper and platinum grabbed the baton from gold last week, meanwhile, a number of gold and copper explorers delivered positive news from ongoing drill programs.

Last week, we witnessed the passing of the metals bull market baton from gold to copper and platinum; copper rose more than 5%, platinum traded above $1,400/oz for the first time in more than a decade, and gold fell nearly 3%.

Goldman Sachs issued a bullish report on copper:

There is a significant gap between COMEX (US) and LME (UK) copper futures prices, with the market currently pricing US copper at a ~14% premium to UK copper. This spread implies a 14% US tariff on copper imports, however, Goldman Sachs sees the potential for a 25%, or even 50% tariff on US copper imports.

Goldman sees LME copper rising to $10,050/tonne in August, using the current 14% spread this equates to a US copper price of $5.20/lb. Last week, copper rose more than 5%, leaving it within spitting distance of Goldman’s $5.20/lb target with one trading day left in June:

Copper (Monthly)

Zooming out to a 25-year quarterly chart of copper it’s evident that the current rally to above $5/lb could be the beginning of a much larger move:

Copper (Quarterly)

Copper is an integral element of human progress, critical for building out energy infrastructure. Copper has the second-highest electrical conductivity of all metals (after silver), making it the most cost-effective material for transmitting electricity with minimal energy loss.

In addition, renewables like wind, solar, and hydro require significantly more copper than fossil-fuel-based generation because of the distributed and wiring-intensive nature of these systems.

As the US attempts to catch up to China’s blistering pace of electricity generation growth, other populous countries such as India and Nigeria have ambitious plans to expand and modernize their respective energy grids. Copper demand stands to be borderline insatiable over the next decade.

While copper had a strong week, platinum was the standout performer among metals:

Platinum (Weekly)

Last week, platinum rose more than 25%. This is its largest weekly gain since 2008, and it’s also the highest weekly close in more than a decade.

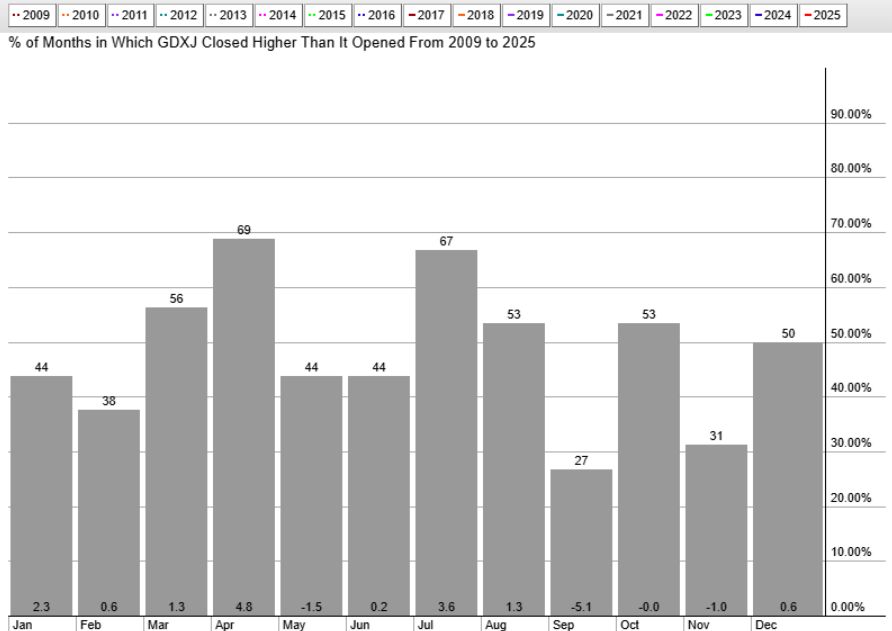

Turning to gold miners, after trading reasonably well early in the week the gold miners were hit hard on Friday. June has historically been a lackluster month for the gold mining sector, this June was no different. Seasonality turns decidedly more favorable in July, particularly for the slightly smaller GDXJ components:

The world’s largest gold producer, Newmont (NYSE:NEM), made a new 52-week high on Monday but then proceeded to get caught in Friday’s strong downdraft, shedding 4.11% to close the week.

NEM (Daily)

At the end of July, the gold mining sector will begin reporting Q2 2025 earnings results. The results from the producers in Q2 should be jaw-dropping, including average realized gold selling prices north of US$3,250/oz generating record free cash flow.

Simply stated, the gold mining sector has never been in a stronger position financially than it is today; profitability metrics are off the charts and balance sheets are getting stronger by the day.

Meanwhile, the ETF proxy for the sector continues to see outflows and shares outstanding reaching fresh 52-week lows:

There are many conclusions we could draw from this trend, but the simplest observation is that despite a strong performance over the last couple years, the gold mining sector remains out of favor with North American investors.

Turning to junior mining, the standout chart of the week was Onyx Gold (TSX-V:ONYX, OTC: ONXGF) - ONYX rose more than 100% over the span of 3 trading sessions to end the week at a new all-time high:

ONYX.V (Daily)

Onyx traded so well last week that “Great Bear” comparisons are already being tossed around.

We can dream.

Onyx delivered two news releases last week:

June 24th - Onyx Gold Continues to Consolidate Key Ground at Munro-Croesus with Strategic Acquisitions

Expanding the land position at Munro-Croesus to more than 100 square kilometers, and then delivering two impressive step-out intercepts at the Argus North Zone was enough to generate considerable investor enthusiasm.

Drill results to date demonstrate both grade and continuity, with three of four holes drilled so far at the Argus Zone intersecting high-grade mineralization over wide intervals.

In limited drilling to date, Argus North has produced multiple potentially economic gold intercepts at depths that could be inside of a future open-pit mining scenario. I will be most interested to see if Onyx will be able to expand the Argus North Zone to the west (along the Pipestone Fault) and north.

Another company that delivered positive news last week was Hercules Metals (TSX-V:BIG, OTC:BADEF). Hercules management is encouraged enough by what they are seeing in the initial drill holes of the 2025 program that they decided to accelerate the drill program. A total of five drill rigs are now active—four core rigs and one reverse circulation (RC) rig.

BIG.V (Daily)

So far, more than 3,000 meters have been drilled in 2025 with two holes completed, and five more currently in progress. The key takeaways from Monday’s news release were:

The initial holes of 2025 drilling at Leviathan are confirming the new 3D geological model.

A trend of increasing grade along porphyry contacts.

The 2025 drill program is being accelerated and expanded in order to better delineate the true thickness of the known 1,300 meters of strike extent, AND extend the system along trend to the north and south.

I delved into the Hercules drilling update, and explained last Friday’s high-volume sell-off in more detail here.

Sticking with copper porphyry explorers, Hannan Metals (TSX-V:HAN, OTC: HANNF) has commenced its maiden drill program at the Valiente Project in Peru. Drilling at the Belen Target is now underway, with 5,000 meters planned over 18 diamond drill holes targeting three priority areas at Previsto. Hannan’s first drill hole at the Vista Alegre Target was completed to a depth of 184.6 meters, testing a 600 m by 500 m high chargeability zone that coincides with strong gold-in-soil anomalies and surface mineralization grading up to 2.7 g/t Au and 44 g/t Ag. Hannan plans to systematically drill-test across a 2.4 kilometer long geophysical anomaly.

HAN.V (Daily)

While the inaugural drill program is underway at Belen, the HAN.V chart has formed a textbook head & shoulders pattern. Since forming the right shoulder in early June, the recent downtrend has moved the share price below $1.00, on the verge of testing critical support near $.85.

It’s important to remind ourselves that a H&S top pattern is not completed until the neckline support level is decisively broken. In fact, I expect that a test of the $.85 support level next week will find eager buyers. The more concerning scenario for Hannan bulls will be if the support near $.85 gets tested repeatedly; the more times a level is tested, the more likely it is to break.

Valiente is located in a Miocene-aged linked porphyry-epithermal mineral belt in central-eastern Peru. Early surface prospecting identified two outcropping copper-gold porphyry targets and one epithermal target at Belen. Hannan geologists quickly discovered multiple porphyry target areas at Serrano Norte, Serrano and Pucacunga. The focus more recently has been on Previsto. At Previsto and Belen, a district-scale porphyry cluster within an area of 25 km by 10 km, with eight porphyry and/or epithermal targets now identified in more detail with up to 10 earlier stage targets awaiting further work.

It’s not a stretch to state that Hannan is currently exploring one of the most interesting, high-potential grassroots epithermal-porphyry projects in the world today. I wish them success with their 2025 exploration programs in Peru.

Vizsla Silver (TSX-V:VZLA, OTC:VZLA) had a remarkable run from April through June that saw VZLA shares more than double. One of the company’s great strengths has been the ability to raise money on favorable terms, while always maintaining a strong treasury position. Last Friday after the market close, Vizsla announced a US$100 million bought deal priced at US$3.00 per share led by Canaccord as sole bookrunner and lead underwriter. One week later the financing was closed in record time.

VZLA (Daily)

Unfortunately, the combination of the large bought deal financing and Friday’s gold/silver smackdown has left VZLA’s chart looking a bit worse for wear. However, the good news is that the recent ~20% correction has simply returned the VZLA share price to its rising 40-day simple moving average. There is important support in the $2.75-$2.80 area with much bigger support at ~$2.50.

The good news is that with this latest financing VZLA has nearly US$200 million in cash. The enviable cash position will serve VZLA well in delivering a Feasibility Study for the Panuco Project later this year, and then moving towards a construction decision early next year. Panuco will be an underground high-grade gold & silver mining operation and the project is located in a brownfield setting (historical mining operations and mill on site) - that means that the project should be looked upon much more favorably by Mexican authorities.

Finally, Emerita Resources (TSX-V:EMO, OTC:EMOTF) filed an appeal of the resolution dated May 30, 2025 made by the Delegación Territorial en Sevilla de la Consejería de Economía, Hacienda y Fondos Europeos - Consejería de Industria Energía granting the exploitation permit for the Aznalcóllar project to Minera Los Frailes S.L. (Spanish subsidiary of Grupo Mexico).

To be clear, this appeal is distinct from the ongoing criminal trial that is scheduled to conclude in July. Emerita has requested that the permit and the resolution awarding the permit to MLF be deemed null and void.

These are the grounds for Emerita’s appeal and request to nullify the awarding of Aznalcollar to Minera Los Frailes (MLF):

MLF did not participate in the public tender for the Aznalcóllar project and should not have been awarded the rights to the Project nor should it have the legal right to apply for, or be awarded, an exploitation permit.

There is no formal authorization from the Administration granting MLF the rights to the Project as required by Spanish law;

Emerita has asked the Administration to clarify which party participated in the tender as it remains unclear whether the mining project/plan was presented by Minorbis S.L. or a consortium composed of Grupo Mexico with Minorbis. The project/plan submitted in the public tender, including the proposed discharge of water into the Guadalquivir river, is completely different than the mining project/plan presented by MLF to obtain the exploitation permit; and

Various breaches of administrative and mining laws and regulations.

It is abundantly clear that there were serious issues and misrepresentations involved in the awarding of the Aznalcóllar project (AZN) tender in 2015. Emerita is asking authorities to clarify whether the official bidder was Minorbis S.L. or a consortium involving Grupo México. The actual technical and environmental plan approved for MLF apparently differs substantially from what was submitted in the public tender.

In addition, it is clear that there were various legal and regulatory breaches in how the tender was adjudicated—both in terms of administrative violations and misapplication of mining laws. In summary, it is becoming increasingly difficult to envision how the administrative court can continue to uphold the awarding of the tender to MLF.

According to Spanish law, if a crime is committed in the awarding of a public tender, the bid must be disqualified, and the project awarded to the next highest bidder. Emerita contends that it was the only qualified bidder in the Aznalcóllar tender process and should be duly awarded the project tender.

The EMO share price continues to gyrate in a messy range largely contained between $1.00 and $1.50:

EMO.V (Daily)

Despite a brief dip below $1.00 in May, the H&S pattern was never completed. I would consider the pattern decisively invalidated on a daily close above the key $1.50 resistance level. Additionally, I will view a breakout above $1.50 as strong market validation that Emerita has a good chance of being ultimately awarded the AZN tender.

Before I leave you to enjoy your weekend, I’d like to point out a half dozen impactful drill programs that are now in progress across North America: Ridgeline/S32 kicked off drilling at Selena, drilling is underway at Kingfisher Metals’ HWY 37 Project in the Golden Triangle, Talon Metals has two rigs turning at Boulderdash in Michigan and a drill rig will resume drilling at the new MSU discovery zone at Tamarack next month, American Eagle Gold is one month into drilling at its NAK copper-gold porphyry project near Smithers, BC and a bevy of Yukon explorers are well underway with their summer drill programs (Banyan Gold, Sitka Gold, Yukon Metals, Snowline Gold, Forge Resources etc.).

Despite last week’s summer doldrums price action across the junior mining sector, this is an exciting time across the sector with some of the most promising drill programs I’ve ever witnessed in progress.

Disclosure: Author owns shares of some stocks mentioned in this article including ONYX.V BIG.V and may choose to buy or sell at any time without notice.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SedarPlus.ca for important risk disclosures. It’s your money and your responsibility.