Global Demand For Pristine Collateral With No Counterparty Risk Is Creating A Short Squeeze Like We've Never Seen Before

After the latest batch of Trump tweets, gold futures are making new all-time highs in Asian trading

Since briefly dipping back below $3,300/oz on Thursday morning, gold has risen another $100/oz to a new all-time high:

Gold (30-Minute)

The latest batch of Trump 2.0 tweets offer a cryptic comment on gold, in addition to a list of ‘non-tariff cheating’ that makes a raft of trade deals look increasingly unlikely:

“He who has the gold makes the rules.”

This is the so-called Golden Rule - those with money and resources hold the power, and thus are able to dictate the terms of agreements.

Donald, who has the gold? What happens when more than one party has the gold?

I believe the President is referring to the fact that the United States is the wealthiest country in the world as measured by total GDP, and also in terms of total national wealth (total assets - total liabilities). Additionally, the United States has the largest gold reserves by a wide margin (~5,000 tonnes more than #2 Germany).

However, the United States also has enormous sovereign debt and even greater mind-boggling levels of unfunded government liabilities (social security, Medicare, etc.). Much of the US government’s ability to fund itself at relatively low interest rates depends upon the willingness of foreign investors to hold US Treasury securities. Moreover, the US Dollar holds the throne as the global reserve currency because the United States not only has the largest economy, but it is also viewed as a safe and predictable nation with rule of law (laws are enforced fairly, transparent and predictable), and the deepest & most liquid capital markets.

During ‘Pax Americana’ (the post-1945 global order), the United States has been viewed as a benevolent world leader; certainly not without its flaws, but a country that has done more good than evil overall. While the United States is not perfect by any means, investors largely viewed US equity and debt markets as much more attractive than the rest.

Trump 2.0’s trade and tariff agenda, combined with a major shift in the U.S. posture toward the rest of the world, is putting Pax Americana—and the U.S. dollar’s status as the global reserve currency—at risk.

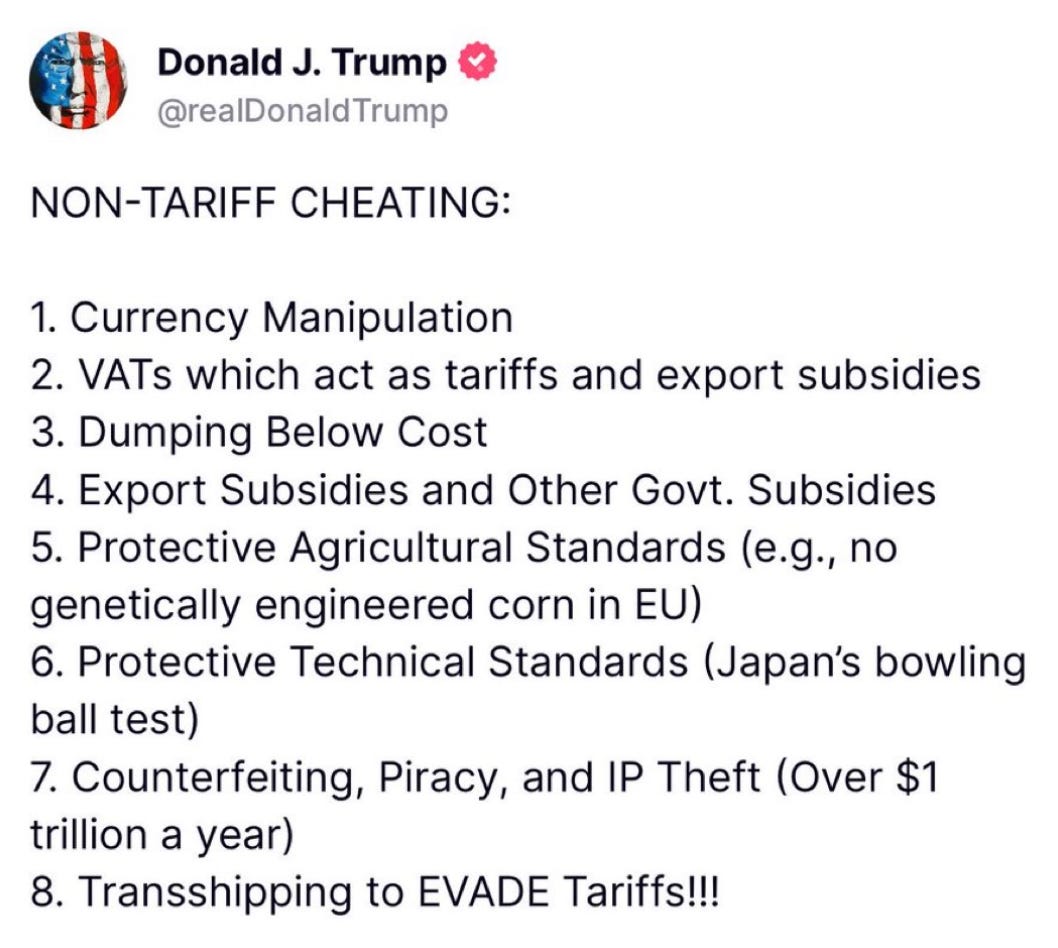

Trump’s next tweet helps to emphasize this last point:

When the President of the United States suddenly labels virtually every major U.S. trading partner a “cheater,” it signals a cataclysmic disruption in the global order. Although these eight points are clearly targeted at China, they also complicate the prospects for meaningful trade agreements with the EU, Canada, or Mexico in the near future.

As of this evening, the U.S. dollar continues to decline, while gold surges to new highs, one after another.

EUR/USD (Daily)

With economic uncertainty rising to new heights and de-dollarization flows accelerating, gold’s role as pristine collateral-free from counterparty risk-has never been more significant. The "no counterparty risk" aspect is becoming increasingly important as investors seek to take physical possession of their gold. This trend is evident both at the individual level, with investors favoring physical coins and bars over ETFs, and at the sovereign level, with countries like Germany considering repatriating gold reserves from New York to Frankfurt.

It is this flight to pristine, physical collateral that is fueling a short squeeze unlike anything we’ve seen before.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SedarPlus.ca for important risk disclosures. It’s your money and your responsibility.