It was July 2023 and Hercules Silver CEO Chris Paul couldn’t believe what he was seeing. Paul was driving from his home in Kelowna, B.C. to Cambridge, Idaho where his flagship Hercules Silver Project was located and his geologists were sending him pictures of fresh drill core from a risky drill hole that was still in progress. His life had just changed, but he wouldn’t know it until he passed through the border checkpoint and had more time to see the images he had been sent. Before we learn how the story played out, we must first set the stage and understand the context of the discovery.

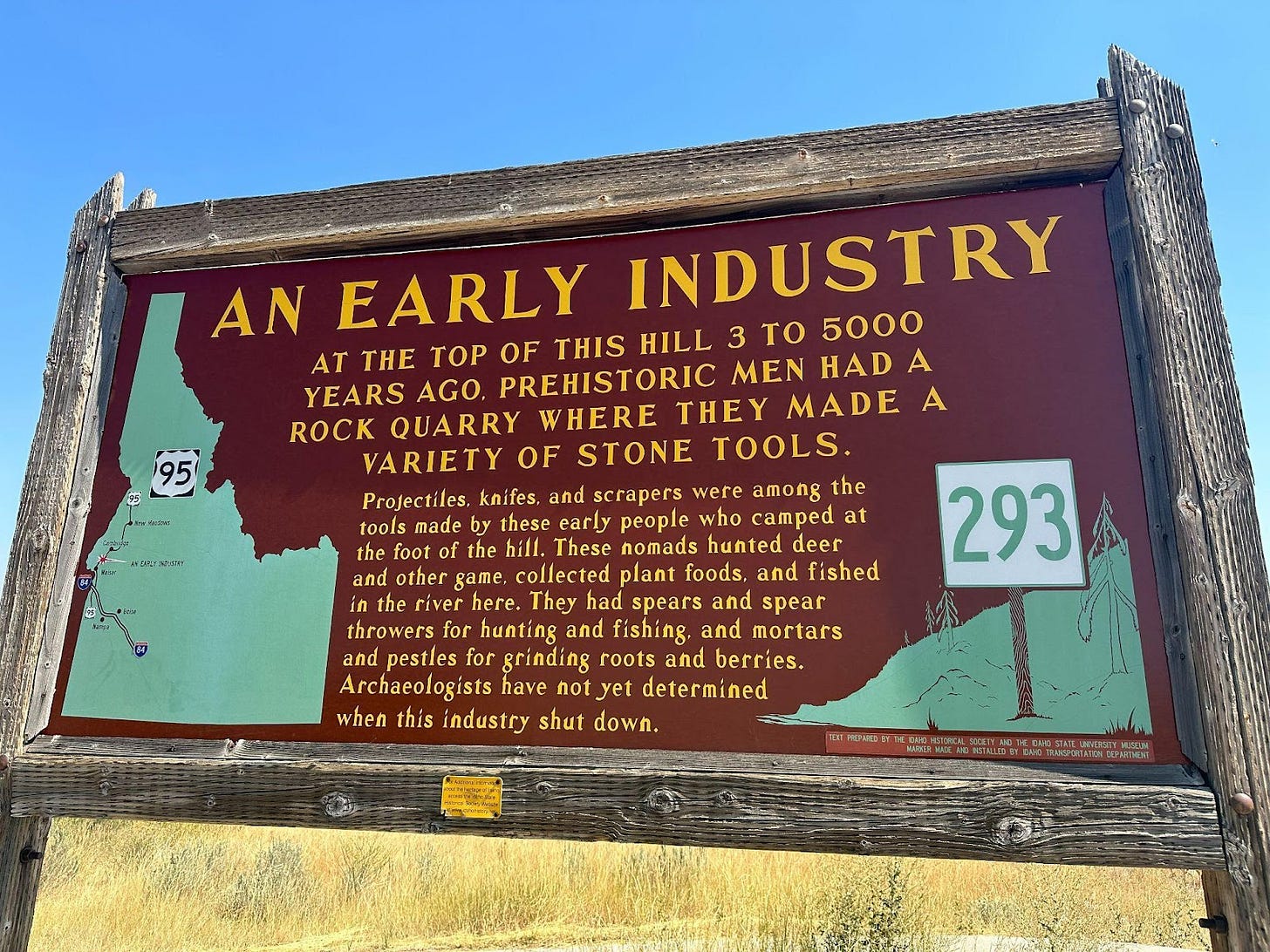

The state of Idaho has a rich mining history dating back thousands of years. In fact, on the drive north from Boise to Cambridge, one comes across a rest stop that memorializes the earliest Native American miners who created tools and weapons from metals they were able to dig up with their hands.

However, in modern history the story begins in the 1860s. Like much of the American West, the discovery of gold in the Clearwater River in the early 1860s set off a gold rush in modern day Idaho. The Idaho gold rush began in 1860, and miners poured into areas across the state, leading to discoveries in places like the Boise Basin, Silver City, the Silver Valley, and other regions across Idaho.

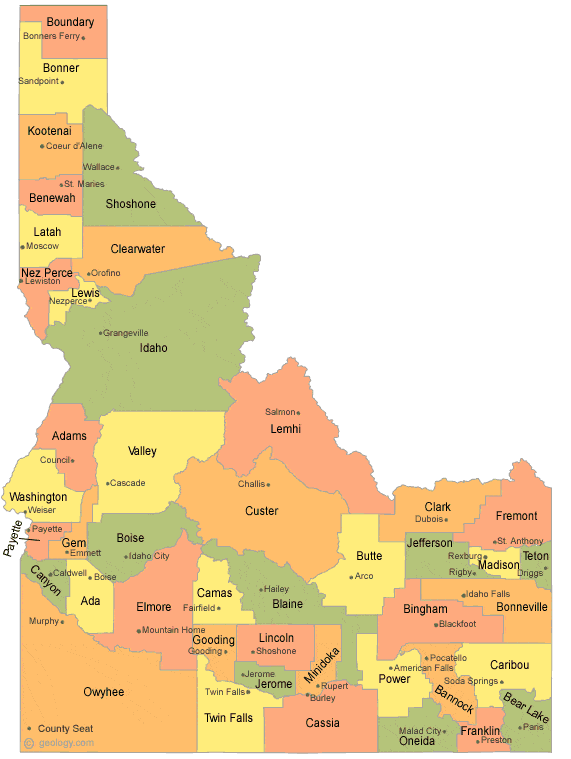

A particular focus for early prospectors in the 1860s and 1870s was an area of western Idaho that runs along the Snake River where the modern day Idaho-Washington state border resides. Gold discoveries in this area spread from the south in Silver City, north to Florence and Warren. This is a unique area of the United States, and early prospectors were able to clue in on the abundance of mineral riches that this region hosts.

A portion of this same area, extending from Payette to Adams County, is geologically distinct. It is called the Olds Ferry Arc Terrane, an area of the Blue Mountains region of the western United States, specifically in Oregon and Idaho, representing a piece of an ancient volcanic arc that collided and accreted onto the North American continent during the Late Triassic to Early Jurassic period. It is characterized by a sequence of volcanic and sedimentary rocks called the Huntington Formation and is considered "fringing arc" terrane due to it being situated close to the edge of the continental margin at the time of its formation. One can imagine a modern day volcanic arc such as Indonesia or the Philippines being accreted onto (or smashed onto) the western side of the continent – this is what occurred hundreds of millions of years ago with the Olds Ferry Terrane.

From an academic paper published by Boise State University:

“The Olds Ferry terrane of the Blue Mountains province is one of the numerous accreted terranes that comprise the western North American Cordillera. The Blue Mountains province is located in central and eastern Oregon, western Idaho, and extreme southeastern Washington, and is a crucial link in reconstructions of the North American Cordillera due to its position in an area with few visible terranes between the more extensively exposed terranes to the south in California and Nevada and to the north in Canada and Alaska.

New field evidence and U-Pb zircon geochronology for volcanics within the sedimentary onlap assemblages overlying the Wallowa and Olds Ferry volcanic arc terranes provide evidence for an earlier connection between the terranes than has previously been recognized. The boundary between the Izee and Olds Ferry strata is an angular unconformity based on geochronological data, the consistent angular discordance between the Olds Ferry and Izee strata, and the presence of locally derived volcanic and plutonic clasts of the Olds Ferry arc in the basal Weatherby conglomerate of the Izee terrane.”

The mineral potential of the Olds Ferry Terrane had been demonstrated by early prospectors, however modern exploration in the 1960-80s failed to demonstrate economic, large-scale mineralization. This is despite the fact that British Columbia to the north and Nevada to the south host many porphyry copper deposits – the sought after large copper deposit style of the major copper producers – of the same age as the Olds Ferry Terrane. Previous exploration efforts in the Cuddy Mountain area in the 1960s offered strong evidence that this was fertile terrain for porphyry deposit formation, however, conventional geological wisdom had it that Idaho did not host economic copper porphyry deposits. Subsequently, the Hercules Property saw limited work for copper but significant drilling efforts for silver in the 1980s. However, the property went dormant thereafter and didn’t see much exploration for 40 years. Similarly, the modern Cuddy Mountain project area saw its last real exploration program carried out in the 1970s.

Based on modern age dating, we now know the Olds Ferry Terrane contains rocks that are the same age as the major Copper Mountain and Highland Valley porphyry systems currently in production in British Columbia. The age of the porphyry rocks being late-Triassic at Leviathan supports the theory that the Idaho Porphyry Belt is the southern extension of the B.C. porphyry trend:

Perhaps most importantly for porphyry copper potential, the Olds Ferry terrane was volcanically active from the late-Triassic (roughly 210 million years ago) through to the early Jurassic (175-185 million years ago):

This is important because the relatively long duration of magmatic activity is critical for the formation of economic porphyry deposits; most of the well-endowed porphyries across the globe experienced 5+ million years of magmatic activity.

An Idaho placer miner pictured at the turn of the century

Now back to how we got to today… as prospectors pushed west they found gold in streams and rivers across Idaho. When it became more difficult to find gold in the streams and rivers, clever explorers proceeded to move up into the mountains looking for the hard rock sources of the alluvial gold.

Most of the early prospectors were looking for gold, but they quickly found copper. Some early explorers found a colorful, copper-rich mineral called bornite (often called ‘peacock ore’) in large quantities in the Seven Devils Region in what is now Idaho and Adams Counties, Idaho:

A 1970 article in a local Idaho paper reciting the story of the discovery of rich copper ore (bornite) at what is now known as the Blue Jacket Mine

There are multiple long dormant copper mines in the Seven Devils, including the Blue Jacket (located south of Helena, Idaho and discovered in 1887) and Red Ledge Mines. What makes the Seven Devils and Cuddy Mountain Districts geologically distinct is the stratigraphy of mineralization; the age of the ore deposits in the Seven Devils are Cretaceous era, while the Cuddy Mountain District are Jurassic and Triassic eras.

The Cuddy Mountain Mining District, which occurs to the south of the Seven Devils region in similar rocks within Washington and Adams counties, saw a large uptick in mining activity in the 1880s and 1890s including the construction of a mill near the Belmont Mine at the Hercules Property. A significant number of outcrop occurrences in the area near Cuddy Mountain became the foundation for an active mining camp; with a great deal of claim staking activity, and numerous adits being driven into hills, including several adits on Cuddy Mountain itself.

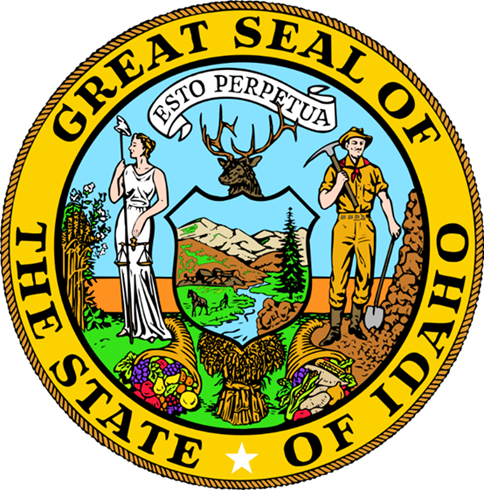

The most well-known deposit in the early history of the Cuddy Mountain region became the Belmont mine, which produced silver, lead, zinc and copper. The mill at Belmont is featured in the inset of the Idaho state logo that was created in 1891:

In a reference to the state of Idaho’s natural resource wealth, the Latin words Esto Perpetua means “let it go on forever”.

Today, the only remnant left from the Belmont Mill is this rubble wall along Camp Creek Road:

There were multiple financial panics in the United States around the turn of the century (1893, 1896, 1901 etc.), which hindered mining activities in Idaho and resulted in a decline in activity around Cuddy Mountain. During the 1920s, there were several groups that attempted to rehabilitate old adits that had gone dormant twenty years earlier. There was even a failed stock promotion of the Red Ledge Mine in the Seven Devils region in the late 1920s. The blow-up of the failed promotion cast a dark shadow over the region and foreshadowed the Great Crash of 1929. By the onset of the Great Depression in 1929 the Seven Devils/Washington County Mining Districts had gone completely dormant, which lasted well into the 1950s.

Before delving deeper into the reawakening of the Idaho Porphyry Belt, let’s first understand why it matters.

Why Does Copper Matter?

Mineral discoveries are exciting treasure hunts that require detailed analysis with modern exploration tools and a bit of good old luck, but without finding a mineral that is in high demand the discovery might not prove to be viable economically.

Copper is already in high demand globally, and that demand is set to rise substantially over the next few decades. As the world electrifies and consumes more energy than ever before, humanity finds itself facing an immense challenge: where will all the copper come from?

It’s not an exaggeration to state that copper touches every aspect of our lives on Earth. Copper is a vital material for modern infrastructure, technology, and renewable energy systems due to its unique properties including excellent electrical and thermal conductivity, corrosion resistance, and ductility.

Here are the primary drivers of copper’s surging global demand:

Electrification and Renewable Energy:

Copper is essential in renewable energy systems like wind turbines, solar panels, and hydroelectric plants.

Electric vehicles (EVs) and their charging stations require significantly more copper than traditional internal combustion engine vehicles.

Expanding power grids and energy storage solutions depend heavily on copper for efficient transmission and distribution.

Infrastructure Development:

Emerging economies are rapidly urbanizing, requiring copper for construction, plumbing, wiring, and telecommunications.

Modern buildings incorporate advanced electrical systems, further increasing copper demand.

Electronics and Technology:

Copper is a core component in consumer electronics, semiconductors, and telecommunications equipment.

The rollout of 5G and advancements in data centers and cloud computing rely on high-grade copper.

Sustainability Goals:

Nations aiming to reduce carbon emissions and transition to green technologies depend on copper-intensive solutions.

Circular economies and recycling efforts emphasize the need for high-quality copper materials.

The International Energy Agency (IEA) and other studies estimate that global copper demand could double by 2050 to around 50 million metric tons per year due to the electrification of transportation and energy systems.

A study by S&P Global suggests cumulative copper demand could reach 1.6 billion metric tons between 2022 and 2050.

Meeting this demand will require significant investment in mining, exploration, and recycling infrastructure. Meanwhile, the mining industry faces challenges such as declining ore grades, environmental regulations, and geopolitical factors affecting copper production.

An additional complicating factor to the strong copper demand growth over the next few decades is increasing resource nationalism. Meanwhile, trade tensions between China and the United States have been escalating due to a range of interconnected economic, political, and security concerns. In particular, critical minerals have come into focus since the invasion of Ukraine by Russia in February 2022. Tensions between the United States and China over critical minerals are escalating due to the strategic importance of these materials in modern industries and geopolitics. Critical minerals such as rare earth elements (REEs), lithium, cobalt, and nickel are essential for advanced technologies, including electric vehicles (EVs), renewable energy systems, defense equipment, and electronics.

NATO recently outlined a list of critical raw materials that are integral for military uses. Copper was featured prominently on the list as high-risk for a number of military applications including the production of fighter aircraft, battle tanks, missiles, ammunition and artillery.

The United States does not produce enough copper to meet its domestic needs. While the U.S. is a significant producer of copper, particularly from states like Arizona and Utah, domestic production only accounts for about 50-60% of the country's copper consumption. The remainder is imported primarily from countries such Chile and Canada.

The U.S. uses copper extensively in industries like construction, electronics, energy, and transportation. Copper is critical for wiring, motors, plumbing, renewable energy technologies, and electric vehicles, which are driving increased demand.

The looming copper supply shortage combined with copper’s strategic nature has motivated three of the world’s largest mining companies to establish a presence in the Idaho Porphyry Belt.

1960s-1980s Exploration Activity at Hercules/Cuddy Mountain

In the 1960s, the new understanding of the porphyry copper exploration model took the United States by storm, with dozens of exploration groups scouring the mountains of the west searching for stockwork vein zones containing copper. This led to the recognition that the Cuddy Mountain district contained porphyry style mineralization and several small drill programs were carried out at both Cuddy Mountain (IXL, Railroad) and the Hercules Adit/Ridge areas. Several good copper intercepts were delivered by drilling into the Triassic rocks outcropping at IXL. Drilling at the “Point Six Claims” (Herc Adit/Ridge) generated some very nice silver intercepts into the upper plate Jurassic rocks, and some sporadic sniffs of copper.

One of the groups that conducted multiple exploration programs in the area during the 1960s was Bear Creek Mining (later became Kennecott, now the US subsidiary of global mining giant Rio Tinto). During the 1960s and early 70s, Bear Creek conducted several drill programs in Washington County, including atop Cuddy Mountain at the IXL Zone. Bear Creek drilled 177 meters grading 0.34% copper including 40 meters @ 0.78% copper. In addition, underground drilling from the IXL adit delivered an intercept of 35 meters grading 1.23% copper and 1.5 meters grading 5.04% copper in sulfide.

By today’s standards, these shallow intercepts are compelling enough to warrant a much larger drilling program in order to better understand the dimensions of the mineralized zones atop Cuddy Mountain. However, in the 1960s Bear Creek was looking for broad zones of very high-grade copper mineralization (think massive sulfides or near surface skarn deposits with grades above 1.5% copper). When copper was trading at $0.45/lb in the mid-60s, even 35 meters of 1.23% copper wasn’t interesting enough to Bear Creek to warrant follow-up drill programs.

Geologists in the late 1960s noted the potential for copper at depth, but drilling 1,000+ feet holes was a truly Herculean effort in the 1960s. The topic of the copper potential at depth was left as economically questionable and something to be explored at a later date.

That later date did not occur for more than fifty years. Cuddy Mountain officially went dormant after a small soil sampling program in 1980 and would not reawaken until more than 50 years later.

Stayed Tuned For Part II “Hercules Silver & The Reawakening Of A Great American Mining District” Next Week

The author would like to acknowledge Hercules Metals and Scout Discoveries for providing source materials and feedback that supported the creation of this article. The author and his family own shares of both Hercules Metals and Scout Discoveries at the time of publishing, as such some information could be biased.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Hercules Metals Corp. is a high-risk venture stock and not suitable for most investors. Consult Hercules Metals Corp SEDAR profiles for important risk disclosures.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.sedarplus.ca for important risk disclosures. It’s your money and your responsibility.