Hercules Silver & The Reawakening Of A Great American Mining District

After 18 months of due diligence and negotiation, a Canadian listed company called Bald Eagle Mining was able to acquire the Hercules Claims that were once held by Anglo Bomarc. 2022 was a year of capital raising and field work for Bald Eagle, by the end of the year it would change its name to Hercules Silver and plan for a maiden drilling campaign in the summer of 2023.

In the summer of 2023, Hercules Silver (TSX-V:BIG, OTC:BADEF) carried out a 6,000 meter drill program that included some “deep shot” holes designed to test a large IP chargeability they identified sitting beneath the silver bearing Jurassic rocks known as the Hercules Rhyolite. A May 2023 news release revealed the large flat-lying oval shaped chargeability target at depth:

The first of these deeper holes, Hole HER23-05, was drilled just to the west of Frogpond. The results of this hole would set off a stock market frenzy, and the most aggressive claims staking rush in the United States since the Nevada gold staking rush of the 1980s.

The Discovery

On October 10th, 2023, Hercules released the results for hole HER23-05 (185.3 meters grading .84% copper and 111 ppm molybdenum) and junior mining speculators were quick to appreciate the significance of this first deep drill result from Hercules. Within one week the stock had doubled.

Within one month of the release of hole HER23-05, BIG.V shares had risen more than 500%!

The Discovery Story

Once Hercules CEO Chris Paul proceeded through the border checkpoint, he was able to review his messages. Paul couldn’t believe he was seeing colorful copper-rich “bornite” rocks. His heart filled with elation that their gamble with drilling this deep hole was paying off.

In an interview more than a year after Hercules announced the results of hole HER23-05, Paul recounted the discovery process:

“Around 650 feet we hit a fault zone, once we went through that fault zone the rocks are extremely altered. But the first 100 feet after that fault zone the rock didn’t have copper mineralization in it, but we kept going because the veining and alteration told us that we were getting closer…. On day 12 of the deep shot (deeper hole) we got into high-grade peacock colored copper running about 2% copper grade.

Everything changed that day.”

The Hercules management team decided that they could have just uncovered a large, concealed porphyry system. They didn’t know how big it was, but they figured they had better expand their mineral claims position just in case it proved to be widespread.

As the company awaited assay results from hole 23-05 during the summer of 2023, Hercules was active in staking new ground around its core property footprint. Eventually expanding its land position from less than 10,000 acres to more than 15,000 acres.

All Out Mayhem

In a January 2024 conversation, Hercules CEO Chris Paul recounted what led to Barrick Gold’s C$23 million investment into Hercules at $1.10 per share in November 2023:

“…you’ve got three super models to choose from so who are you going to pick? Well ultimately you go with the one with the best personality, and that's not to say that the others didn't have good personalities. I just really liked the way Barrick was coming at it, the way they were negotiating. They were very honest and forthright, there was no gaming….the last thing I asked for was some of their technical expertise, so we basically as part of agreement seconded three Barrick geologists.

The deal all came together very quickly. I remember we sent the term sheet to them on a Wednesday, we basically followed up on Thursday, and then they said on the follow-up Zoom call that they basically accept these terms, but they asked for that fraction of a warrant which would allow them to get to 15%. Obviously we were very agreeable and then the next thing they asked for was if we could close on Sunday. So we had three days to close it, it was wild how quickly it came together and it shows how a major company can move so quickly when they really want something.”

The Majors

Barrick Gold (NYSE:GOLD, TSX:ABX) - Barrick Gold was the first company to move into the Idaho Porphyry Belt shortly after Hercules Silver’s announcement of hole 23-05 on October 10th, 2023. Barrick began with open market buying of BIG.V shares, and then proceeded to invest C$23.1 million in Hercules at a share price of $1.10 per share. Barrick also acquired a slug of in-the-money warrants for a total investment of roughly C$35 million to acquire 33.56 million shares of Hercules.

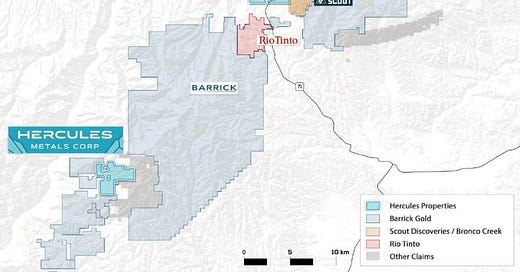

Barrick’s investment in Hercules was the first move in a larger plan by the Canadian copper and gold producer to assemble the largest land position in this new district. Over the next year, Barrick embarked on an aggressive claim staking program and managed to assemble more than 100,000 acres of mineral claims across a 60+ kilometer long belt:

In October 2024, Barrick’s North American Exploration Team hosted a town hall in Cambridge, Idaho. The presentation delivered many key insights into Barrick’s goals in Idaho, including plans to begin its first drill programs in the Belt in 2026. In 2025, Barrick is planning extensive field programs and a belt-wide ZTEM Survey. The ZTEM geophysical survey will help Barrick to identify deeper targets that would otherwise remain concealed.

Rio Tinto (NYSE:RIO) - Kennecott, Rio Tinto’s USA subsidiary, was active in the area shortly after Hercules’ October 2023 announcement. Kennecott staked a large chunk of ground (Rush Creek) a few kilometers south of the southern limit of Hercules’ ground. The area that was staked by Kennecott had also been explored by Bear Creek in the 1960s, including some limited, shallow drilling. It is unclear the extent of work carried out to date by Kennecott.

Teck Resources (NYSE:TECK) - Teck Resources is the newest entrant into the Idaho Porphyry Belt with a US$2.5 million investment in Scout Discoveries to take a 6.8% stake in the privately held company. Considering that Teck’s largest income source by metal is copper, there is little doubt that the $22 billion market cap Canadian miner invested in Scout due to its interest in the Idaho Porphyry Belt.

The Explorers

To reflect the widening metals focus from silver only to silver, copper and molybdenum, Hercules Silver became Hercules Metals in early 2024. Hercules Metals is a Canadian listed company that is solely focused on the Idaho Porphyry Belt via the Hercules and Mineral Projects. The 100% owned Hercules Project located northwest of Cambridge, Idaho hosts the newly discovered Leviathan porphyry copper system, one of the most important discoveries in the region to date.

Drill programs in 2023 and 2024 have delineated an extensive hypogene copper enrichment blanket with drilling defined dimensions of 1,100 meters x 1,600 meters. Multiple drill intercepts into the enrichment blanket have delivered wide intervals of 1%+ copper, including:

Hole 23-05: .84% copper 111 ppm molybdenum 2.6 g/t silver over 185.3 meters, including 45.3 meters grading 1.94% 104 ppm molybdenum 8.2 g/t silver.

Hole 24-01: .44% copper 64 ppm molybdenum 10.87 g/t silver over 155 meters, including 30 meters grading 1.11% copper 32 ppm molybdenum 48.5 g/t silver.

Hole 24-08: .47% copper 82 ppm molybdenum .67 g/t silver over 479.5 meters, including 54.5 meters grading 1.47% copper 39 ppm molybdenum 1 g/t silver.

Hole 24-20: .55% copper 182 ppm molybdenum 4 g/t silver over 300.2 meters, including 137.6 meters grading .85% copper 172 ppm molybdenum 5 g/t silver.

20,000 meters of drilling in 2023/2024 have made it abundantly clear that Leviathan is a very large porphyry system. The drilling to date has predominantly intersected phyllic and propylitic alteration. However, the potassic core of the Leviathan Porphyry System remains elusive.

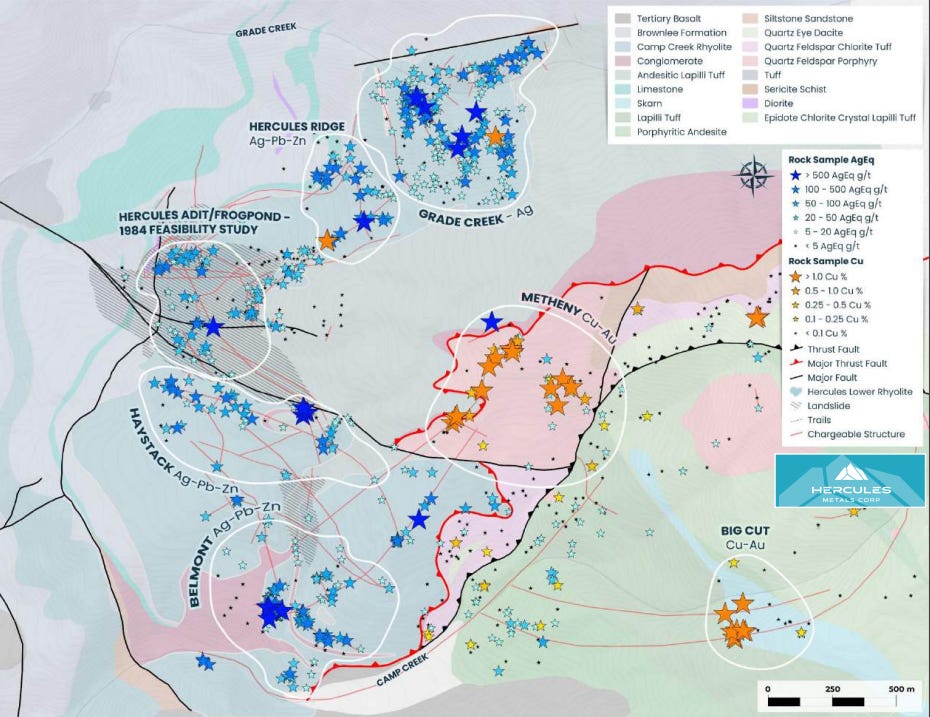

Hercules Priority Target Zones

Grade Creek - At the end of the 2024 drilling program, the Grade Creek target area has quickly moved up to being arguably the highest priority target area at Leviathan. The area extending up from Frogpond/Hercules Adit/Hercules Ridge up towards Grade Creek was well known for strong silver mineralization. In fact, it was the focus area of much of the shallow drilling throughout the 70s and early 80s.

Soil sampling and rock sampling programs carried out by Hercules Silver in 2022 also identified strong geochemical surface anomalies at Grade Creek.

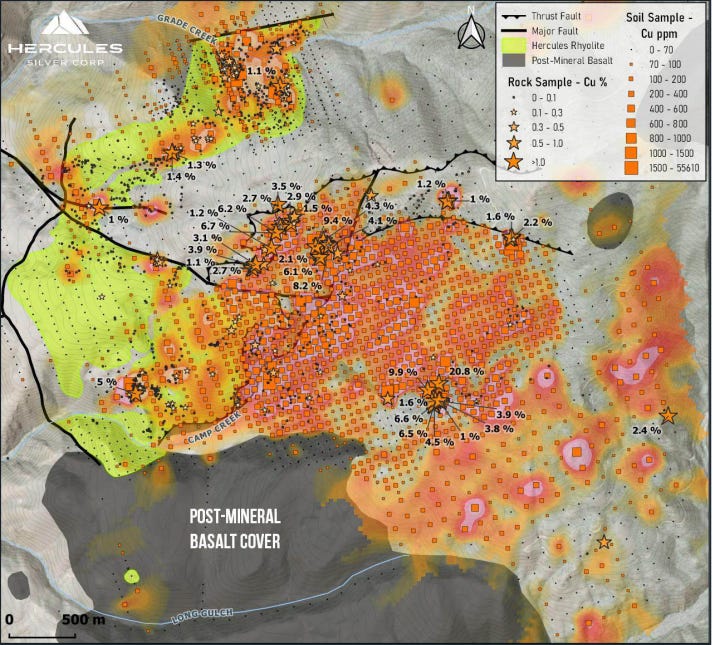

Grade Creek definitely exhibits the strongest surface silver anomalies:

And copper lights up in the soils around Grade Creek…

However, the combination of modern geophysical tools and new revelations from 2024 diamond drilling have made Grade Creek a super compelling drill target for the 2025 program:

On January 22nd, 2025 Hercules CEO Chris Paul stated:

“I would say that (Grade Creek) is the highest probability for where at least one of these potassic centers is lurking….. you can see quite a bit of chargeability still going all the way to the northern edge of the IP survey. There’s a part of the system up there which clearly has a lot of sulfide and doesn’t have a drill hole in it.”

Gap Zone (Between Belmont and Metheny) - A 600 meter x 800 meter zone that extends from Belmont to Metheny was left untouched until three of the final holes of the 2024 drill program honed in on this highly prospective area. Hole 23-14 was the easternmost hole drilled in 2023, it was drilled to the east and it encountered distal mineralization (inner propylitic) with relatively low copper grades. Hole 23-21 is the deepest hole drilled to date at Leviathan, but it was drilled to the west and encountered a broad zone of ~.2% Cu mineralization. Much of the drilling early in the 2024 program was focused on the western trend that exhibits elevated hypogene enrichment blanket mineralization (holes 23-05, 24-01, 24-08, 24-11, and 24-12).

A news release dated November 4th, 2024 stated that mineralized early biotite alteration was intersected in 3 holes to the southeast (24-19, 24-20, and 24-21), with mineralization potentially plunging below the drill trace of hole 23-14.

This area remains open to the southeast towards Camp Creek.

Metheny (eastern fault block) - The widespread copper in soil anomaly on the eastern side of the unconformity is still yet to be drill tested by Hercules. The source of the soil anomaly is not a secret; east of the unconformity the Triassic rocks daylight at surface and distal porphyry mineralization can be seen in outcrop. The soils exhibit an abundance of copper due to weathering of the porphyritic Triassic rocks just below the surface.

I believe Hercules will test Metheny with multiple drill holes in 2025 in an effort to understand the full extent of the Leviathan Porphyry System and discover what may be lurking in the depths in the eastern fault block.

Western Deeps - The Western Deeps is a completely new target that exhibits the strongest geophysical anomaly seen anywhere on the property.

The most fascinating part of the Western Deeps area is that it hasn’t seen much historical drilling. The old timers called this area the “Camp Creek Rhyolite” and didn’t find it interesting enough to divert their focus from the silver rich Hercules Rhyolite.

Hercules intends to properly test this area with a fence of deep drill holes in 2025.

Scout Discoveries

Scout Discoveries, a private US-based mineral explorer based in Coeur d’Alene, Idaho, holds the eastern half of the known Cuddy Mountain porphyry district adjacent to Hercules. The Scout team was the first modern entrant into the Cuddy Mountains area specifically targeting porphyry copper mineralization by staking the Cuddy Mountain property in 2020, historically referred to as IXL. Scout pulled together the regional story that the Cuddy Mountains were the extension of the BC porphyry belt to the south, but were unable to attract a major partner to advance the project due to the perception that porphyry copper deposits of significance did not exist in Idaho.

Thus, the project remained dormant until late 2023 when Hercules clearly demonstrated this perception to be incorrect with their discovery hole and reignited interest in the district. Scout completed aggressive surface exploration work in 2024 outlining three separate porphyry centers on the property, and they are now planning the maiden 10,000 meter drill program at Cuddy Mountain beginning in late-Q2 2025, which will be the first drilling since the 1970s.

Scout Priority Target Zones

Climax Target - Climax is Scout’s highest priority target area; this area exhibits a strong magnetic anomaly and classic IP chargeability zonation with moderate/high chargeability center encompassed by low/mod charge halo. A magnetite (iron) mine operated at Climax during the 1950s and the area hosts strong, widespread copper and molybdenum soil anomalies.

A multi-kilometer circular chargeability high at Climax correlates with mapped porphyry veining and strong magnetic highs:

In its maiden drill program at Cuddy Mountain, Scout is planning 5,000 meters of diamond drilling at Climax.

IXL Zone - The IXL Zone hosts a known porphyry center with a preserved potassic core and stockwork veining. At IXL, Triassic-age rocks outcrop and the zone hosts the largest/strongest known copper in soil anomaly in the entire Cuddy Mountain area.

Railroad Zone - Scout believes that a third porphyry center on its ground could be present at the Railroad Zone. Railroad hosts copper-gold skarn mineralization at surface, and the skarns have produced the highest surface rock sample grades seen at Cuddy Mountain:

Scout has just closed a US $9.6 million financing at $1.00 per share. Scout is a private company and the latest financing round values the company at approximately US $36 million.

This is an impressive valuation for a privately held exploration company. However, the company’s shareholder registry is even more impressive.

Scout Major Shareholders:

The Electrum Group - 30.2%

EMX Royalty Corp - 12.4%

Commodity Discovery Fund - 6.8%

Teck Resources - 6.8%

Hercules Metals Corp. - 3%

Sprott Global – 1%

The CEOs

Over the next several years, there will surely be more companies and CEOs that play integral roles in the development of the Idaho Porphyry Belt. However, for the purposes of this article I have decided to focus on two men. Hercules Metals CEO Chris Paul and Scout Discoveries CEO Curtis Johnson.

Both men are young, especially by mining industry standards. Both CEOs are under 40; Johnson is 34 and Paul is 39. Beyond the youthful appearances exists a savvy and geological aptitude that is well beyond their years.

Some people may view youth to be a weakness, but in the mining business in 2025 I believe it is a great strength. In fact, one of the major challenges that the mining industry faces today is a shortage of young talent. This shortage is especially acute in the West, countries in which the mining industry has been demonized for the last several decades.

In addition to energy, drive, and hunger, youth tend to try new things and test theories that old gray beards might dismiss.

The junior mining sector desperately needs a surge of young talent. Perhaps the success of Hercules and Scout will inspire other young people to pursue an education in geology or engineering.

Curtis Johnson holds a Ph.D. in Economic Geology from the University of Nevada, Reno, a M.S. in Geology from Oregon State University, and a B.S. in Geology from the University of Idaho.

He led the generation, advancement, and marketing of gold and silver projects in the western USA for EMX Royalty Corp. from 2018 to 2022. His efforts were instrumental in developing the current Scout portfolio in Idaho.

Prior to his tenure at EMX, Curtis held production and exploration roles with Newmont, the largest gold mining company in the world. At Newmont he worked at the Leeville and Phoenix Mines in Nevada.

Hercules Metals CEO Chris Paul is 39 years old. He is a professional geologist with over 15 years of discovery and capital markets experience in numerous senior exploration management roles. Principal and Founder at Ridgeline Exploration; acquired by Goldspot Discoveries in 2021. Fundamental in significant copper and gold discoveries for Golden Ridge Resources and Damara Gold Corp, Paul holds a B.Sc. In Geology from Simon Fraser University, Diploma in Mining from the British Columbia Institute of Technology.

Johnson and Paul are two of the rising stars in the North American mining industry. The Idaho Porphyry Belt is lucky to have them leading the charge with a commitment to advancing America’s newest copper belt, making a difference in the world and supporting Idaho’s economy.

Community Dialogue & Support

In 2024, I made two trips out to Idaho. On both trips I fell in love with the state and I actually plan to move there later this year. There is something about the nature, the people, and the energy of the state. Maybe it’s also the metals in the ground, and the adventure of being close to discovery.

Boise is the state capital, a modern city with multiple major universities and a strong technology industry. It’s also the small towns that one encounters on the drive north that offer an authentic slice of Americana; humble people who live off the land, attend church on Sundays, salute the flag, and raise their families in peace.

Since Hercules was the first mover in the district, and the first company to drill in the district in the modern era, it has been Hercules who has engaged with the community. Hercules has already hosted three town halls and supported Barrick with hosting its first town hall in Cambridge.

In addition, Hercules has actively harnessed community resources by hiring many local residents to support both drill programs and working with local businesses to the maximum extent possible.

A portion of the local businesses, community organizations, and public services that Hercules has supported:

Windy Acres Design Shop

Washington County Fairgrounds

OH Honey Bee-stro

Country Coffee Cabin

Blake's Sinclair

Gateway Pizza

Office Bar

Loveland's General Store

Gateway Realty Advisors

Midvale Fire Protection District

Midvale FFA Alumni Chapter

Clay Buster Bonanza Fundraiser

Washington County Fair & 2024 Livestock Sale

Tri-Valley Titans Little League Baseball

2024 Hells Canyon Jam

Adams County Fair

Washington County Fairgrounds

Titans Athletics Sponsorship

Midvale 4th of July Celebration

Barrick, Hercules, and Scout have all shown they are committed to respectful engagement and dialogue with the community.

With three major mining companies involved in advancing this emerging US copper district, cutting edge modern technology (AI, deep-penetrating geophysical surveys, and 3D modeling of historical exploration data across the district), and some of the brightest young talent in the North American exploration industry committed to making new discoveries the future is bright for the Idaho Porphyry Belt. I believe the 2021-2024 era will be viewed in retrospect as a first chapter in a new era. 2025 is poised to be the first part of chapter two, a year of major breakthroughs and new discoveries in the Idaho Porphyry Belt.

The author would like to acknowledge Hercules Metals and Scout Discoveries for providing source materials and feedback that supported the creation of this article. The author and his family own shares of both Hercules Metals and Scout Discoveries at the time of publishing, as such some information could be biased.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Hercules Metals Corp. is a high-risk venture stock and not suitable for most investors. Consult Hercules Metals Corp SEDAR profiles for important risk disclosures.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.sedarplus.ca for important risk disclosures. It’s your money and your responsibility.

Fantastic article Robert! Interesting that the staking is still going on. Almost the whole western side of Washington and Adams county is currently staked. We will be happy to have you in Idaho. God bless