This Has Never Happened In History: Rare & Powerful Breakout Confirmations Across Gold Producers

August has started off with a bang across the gold mining sector with an unusual bullish breadth thrust

After a minor correction for gold & the gold mining sector at the end of July, the month of August has started off with a bang; gold has rallied ~$100/oz from its Friday morning low on August 1st, and we have witnessed a powerful bullish breadth thrust across larger gold producers.

Agnico Eagle Mines (Daily)

Barrick Mining (Daily)

Newmont (Daily)

It is exceptionally rare to see the big 3 gold producers, Newmont/Agnico/Barrick, all either at all-time highs or multi-year highs simultaneously. In fact, we have never before witnessed Kinross/Newmont/Agnico/Barrick achieve multi-year highs at the same time.

This sector-wide breakout is indicative of an industry that finds itself in a sweet spot, with improving operational execution amid a strong gold price environment.

Kinross Gold (Daily)

On Monday August 4th, UBS upgraded Kinross Gold (NYSE: KGC) to a Buy rating, launching coverage with a $20 per share price target.

UBS believes that Kinross offers an attractive valuation compared to senior gold producers (e.g., Agnico, Newmont, Barrick). The company has undergone successful re-rating after exiting higher-risk operations in Russia and focusing on North American growth. Kinross’s debt reduction, tighter cost controls, consistent guidance execution, and rising free cash flow yield (about 10% projected in 2025) reinforced UBS's confidence in its operational discipline and shareholder return capabilities.

Additionally, UBS expects gold prices to remain elevated—targeting about $3,500/oz in 2026—which supports stronger revenues and margins for Kinross.

The UBS upgrade of Kinross appears to hinge on a combination of strong gold market fundamentals, Kinross Gold’s financial and operational momentum, relative valuation appeal, and improving capital returns.

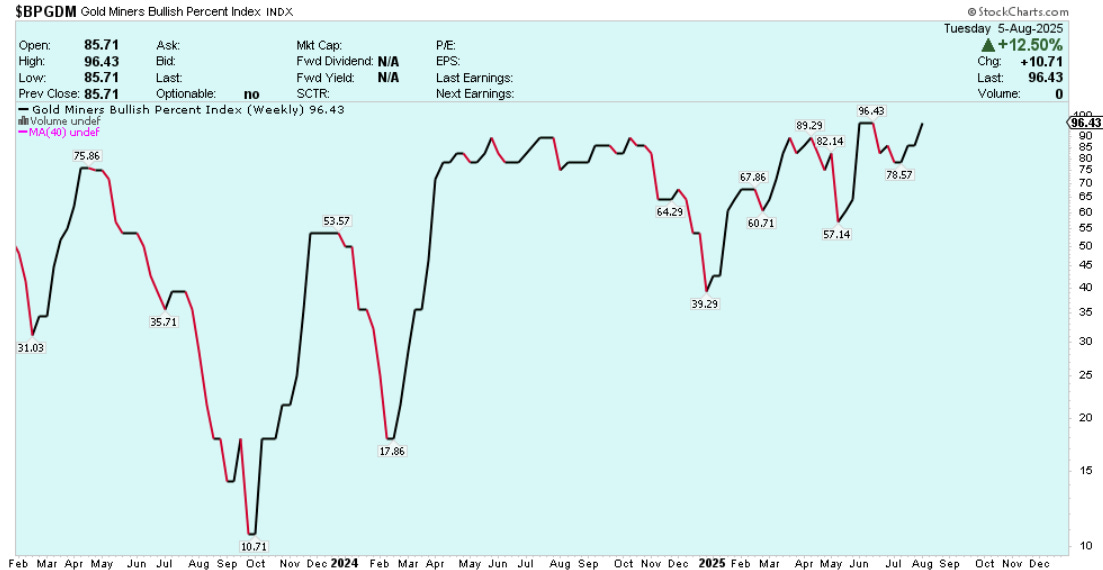

Meanwhile, armchair technicians will point to the extreme overbought reading in the Gold Miners Bullish Percent Index as offering a contrarian bearish signal (the BPGDM is a technical statistic that indicates the number of gold mining stocks on point & figure buy signals):

BPGDM (Daily)

However, it is important to emphasize that during strong bull market uptrends the BPGDM often oscillates between readings in the mid-70s and mid-90s. If share prices move slightly lower, or sideways, the BPGDM will often reset to the 60s or 70s. When viewed in the context of other technical indicators, and profitability metrics across the sector, a 96 BPGDM reading is not a bearish omen.

As the seniors continue to make fresh bull market highs, we are increasingly likely to see fund flows move down the food chain to the mid-tier producers, developers, and eventually the juniors.

Mid-tier producer Eldorado Gold (NYSE:ELD, TSX:ELD) caught an upgrade from National Bank with a price target increase to C$41 per share:

Eldorado Gold (Daily)

During Tuesday’s trading session, TSX-listed Eldorado Gold (ELD) shares rose 9.24%—the company’s largest single-day gain since April. Eldorado expects to produce between 460,000 and 500,000 ounces of gold in fiscal year 2025.

The gold mining sector experienced a whiff of nirvana in 2020 when gold prices surged by approximately 50%, while input costs remained relatively stable. However, the good times didn’t last. From 2021 to 2023, soaring energy and labor costs significantly compressed margins and forced the industry to implement widespread cost containment measures and operational streamlining. After many lean years, one could argue that the gold mining sector is now more disciplined than ever.

Meanwhile, even higher-cost tier-2 and tier-3 gold producers are generating record profits at gold prices above $3,300 per ounce. In this environment, it makes more sense than ever for mid-tier and junior producers to consider mergers of equals in order to achieve greater production scale and realize general and administrative (G&A) cost synergies. I believe we will see a busy M&A season during the final four months of 2025, beginning with the Beaver Creek Precious Metals Summit in early September.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDARplus.ca for important risk disclosures. It’s your money and your responsibility.