This Is Why Treasury Yields Soared Last Week

Since April 2nd, global financial markets have resoundingly rejected Trump 2.0's tariff and tax cuts plans

What happened last week? Why did Treasury yields soar while the US dollar fell and gold rallied?

There were rumors that China was selling its U.S. Treasury holdings and using the dollar proceeds to buy more gold. While that explanation makes sense, I believe the reason for last week’s price action across asset classes is much simpler.

Sharply rising Treasury yields and a falling dollar are clear signals that the market is rejecting the economic plans of the Trump 2.0 administration. There is growing evidence that the Trump administration has managed to ruffle the feathers of nearly the entire world, prompting foreigners to sell U.S. stocks and avoid traveling to America.

The flight bookings data is borderline shocking, and likely to generate a number of earnings warnings from airlines (Delta withdrew its full year guidance last week):

The “America Alone” strategy is dangerously misguided, and the early results are showing up in a tumbling US dollar and surging gold price. Meanwhile, the administration’s communications “strategy” since April 2nd has sent macro uncertainty to its highest levels in history.

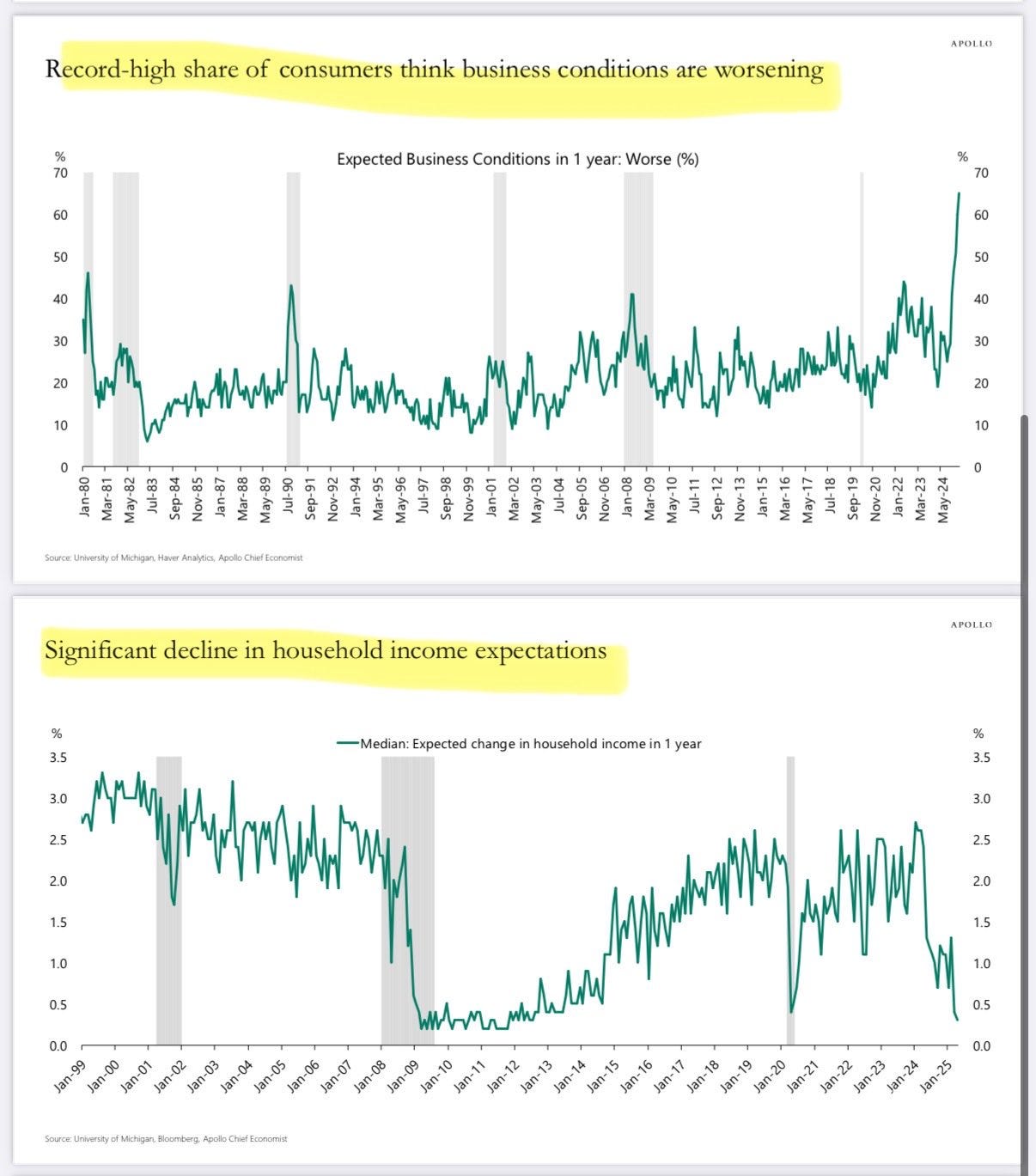

The elevated tariff uncertainty has delivered a calamitous blow to consumer sentiment and investor confidence:

It seems that the question is no longer “Are we heading for a recession?”, it is now “Did the recession start in March or in early April?” - The March PPI data was the first significant economic data point that strongly points to a recession beginning in March.

If we are in recession, why are Treasury yields rising?

That’s an important question, and one that had me puzzled at the beginning of last week. However, I took a closer look at Trump 2.0’s “big, beautiful bill” - Last week, in the middle of tariff headlines Republicans in both the House and Senate passed versions of Trump’s tax plans:

Key Components of the Proposal:

Extension of TCJA Provisions: The proposal seeks to make permanent the individual and estate tax cuts from the 2017 TCJA, which are set to expire at the end of 2025. This includes maintaining the increased standard deduction and enhanced child tax credits.

New Tax Relief Measures:

Elimination of Income Taxes on Tips: Aimed at providing relief to service industry workers, this measure would exempt tips from federal income taxation.

Exemption of Overtime Pay from Income Tax: Overtime earnings would no longer be subject to federal income tax, potentially increasing take-home pay for hourly workers.

Removal of Taxes on Social Security Benefits: Retirees would no longer pay federal income tax on Social Security income, benefiting seniors.

Reduction of Corporate Tax Rate: The corporate tax rate would decrease from 21% to 15% for companies manufacturing products within the U.S., incentivizing domestic production.

The proposed tax cuts are estimated to reduce federal revenue by approximately $5 trillion over a decade, with spending cuts of about $2 trillion, potentially increasing the national debt by $5.7 trillion.

In 2024, the US deficit was 6.4% of GDP and is on a similar path this year. So far, DOGE is nothing more than a rounding error with lots of headlines to appease the Trump base. But DOGE is mostly “all hat, no cattle” when it comes to the bottom line. Trump’s tax cuts would ensure that the US deficit rises to 8%-9% of GDP - officially putting the US into the danger zone and likely increasing Treasury interest costs, not reducing interest costs as touted.

Biden ended his Presidency with blowout budget deficits and soaring Treasury interest expenses. So far, Trump 2.0 (on pace for a US$2.6 trillion deficit in FY 2025) is outpacing Biden:

I believe last week’s turmoil in the Treasury market was one of the clearest signs I’ve ever seen of the “bond market vigilantes” rejecting Trump 2.0’s tariff and tax proposals. The clock is ticking for the Trump administration to quickly right the ship. If the President chooses to stay the course on his tariff and tax cut plans, I fear the market consequences could be severe: the U.S. dollar could fall much further, the yield on the 10-year Treasury note could rise well beyond 5%, and a $4,000 gold price would no longer seem unreasonable.

The gold price “models” are not working because you can’t input some of the global macro variables that investors are facing today.

We’ve never been here before. There is no back-test that can tell us the probabilities of different outcomes. There is no precedent.

This is the denouement of the Fourth Turning.

Trump 2.0 is hellbent on reshaping the global trading and monetary systems, so far he lacks the graceful tact necessary to bring some of America's largest trading partners to the table.

What happens next is anyone’s guess. But if we know Trump, we know he is a man that prefers to do things his way. As long as Trump 2.0 continues to unilaterally dictate, there will be no progress on negotiations with China. That will mean that uncertainty isn’t dissipating any time soon, and recession is no longer in doubt.

Stick with gold.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDARplus.ca for important risk disclosures. It’s your money and your responsibility.

There is opposing forces between Global investors pulling capital from US markets as shown above contrasting with the easing of regulations and fast tracking of mining and energy projects on US soil. What way do you think about this, Maybe Tailwinds for ASX/TSX/LSE listed companies with operations in the US?