Trump 2.0 Executive Order On Copper Brings Renewed Focus To America's Copper State

President Trump could be on the verge of ushering an American copper mining renaissance (article sponsored by Gunnison Copper Corp.)

Earlier this week, copper hit the headlines when President Donald Trump signed an executive order initiating an investigation into the national security implications of copper imports into the United States. Copper has been growing in strategic importance globally for the past several years but few have been paying attention.

Trump’s executive order thrusts copper into the spotlight and represents a major shift in US federal government attitude towards the US hard rock mining industry.

Trump’s executive action directs the Secretary of Commerce to conduct a Section 232 investigation under the Trade Expansion Act of 1962, aiming to assess whether the current reliance on foreign copper threatens the country's security and economic stability. The investigation is expected to conclude within 270 days and may recommend measures such as tariffs or quotas to bolster domestic production.

The executive order highlights concerns over the United States' increasing dependence on imported copper, which has risen from nearly zero in 1991 to 45% of consumption in 2024. Despite having substantial domestic copper reserves, the U.S. lags in smelting and refining capacities compared to global competitors, particularly China, which controls over 50% of global smelting capacity. This concentration raises concerns about potential supply chain vulnerabilities that could impact defense applications, infrastructure, and emerging technologies reliant on copper.

Copper's strategic importance stems from its extensive use in critical sectors. In defense, copper is the second-most utilized material by the Department of Defense, essential in various military hardware and systems. Its superior electrical and thermal conductivity makes it indispensable in infrastructure projects, including power generation and transmission. Additionally, copper is vital in emerging technologies such as electric vehicles, renewable energy systems, and advanced electronics, all of which are pivotal for technological advancement and economic growth.

The administration's move to potentially impose tariffs on copper imports aims to revitalize domestic mining, smelting, and refining industries, thereby reducing reliance on foreign sources and enhancing national security. This initiative aligns with previous actions taken to protect and promote U.S. industries critical to national interests.

Fortunately, the US has substantial undeveloped copper reserves and significant copper exploration opportunities. Copper mining is a major industry in Arizona, which is the top copper-producing state in the United States. The state has a long history of copper production, with some of the world’s largest copper deposits and many active and development-stage mining projects.

Three of the four largest operating copper mines in the US are located in Arizona. The porphyry copper deposits found in Arizona are among the richest in the Americas, and Arizona accounts for nearly 70% of total U.S. copper production.

The most important copper mining operations in Arizona include:

Morenci (Freeport-McMoRan) – The largest copper mine in North America with annual production of over 900 million pounds (450,000 tons) of copper. The Morenci Mine is expected to continue production well into the 2040s.

Bagdad (Freeport-McMoRan) – A major open-pit copper mine.

Sierrita (Freeport-McMoRan) – A significant producer of copper and molybdenum.

Ray (ASARCO) – A large open-pit copper operation.

It’s not an overstatement to say that southern Arizona is the heart of American copper mining.

Important Development-Stage Copper Projects in Arizona

There are numerous copper mining projects in Arizona that are in different stages of development, from advanced exploration to permitting and construction.

Resolution Copper (Rio Tinto & BHP)

Location: Superior, Arizona

Status: Advanced permitting stage

Description: One of the largest undeveloped copper projects in North America, with an estimated resource of 1.78 billion tons at 1.5% copper. The project is facing environmental and permitting challenges due to its location on federal land.

Rosemont Copper (Hudbay Minerals)

Location: Near Tucson, Arizona

Status: Permitting challenges

Description: A proposed open-pit copper mine with estimated reserves of 5.9 billion pounds of copper. It has faced legal and environmental hurdles that have delayed its development.

Florence Copper (Taseko Mines)

Location: Florence, Arizona

Status: In-situ recovery project, nearing commercial production

Description: A low-cost, in-situ copper recovery operation expected to produce 85 million pounds of copper per year once fully operational.

Copper World Complex (Hudbay Minerals)

Location: Near Rosemont, Arizona

Status: Prefeasibility stage

Description: A newly discovered open-pit copper deposit adjacent to Rosemont, with measured and indicated resources of over 400 million tons. Hudbay is working on state-level permitting to advance the project.

Hermosa Project (South32)

Location: Patagonia Mountains, Arizona

Status: Prefeasibility stage

Description: Primarily a zinc-manganese project but with potential copper by-product production. This is one of the only large-scale U.S. battery metals projects currently in development.

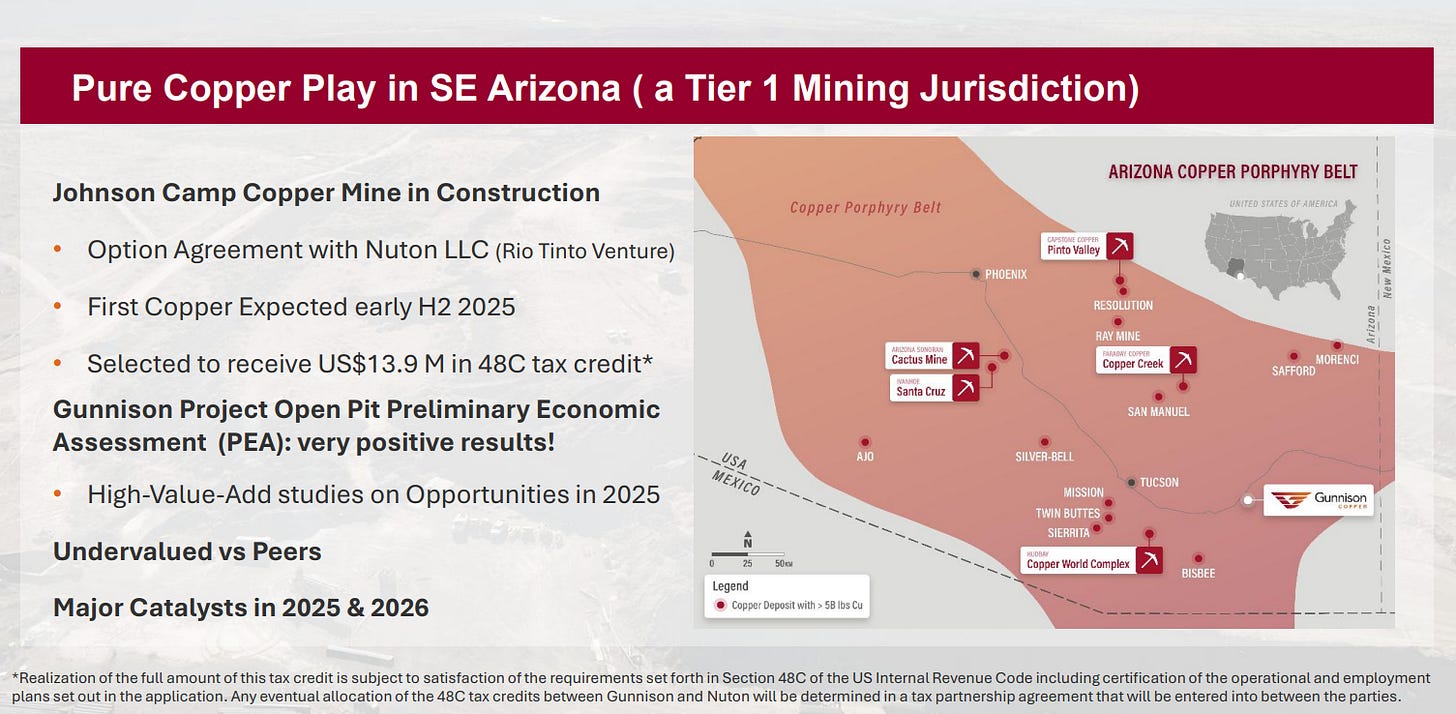

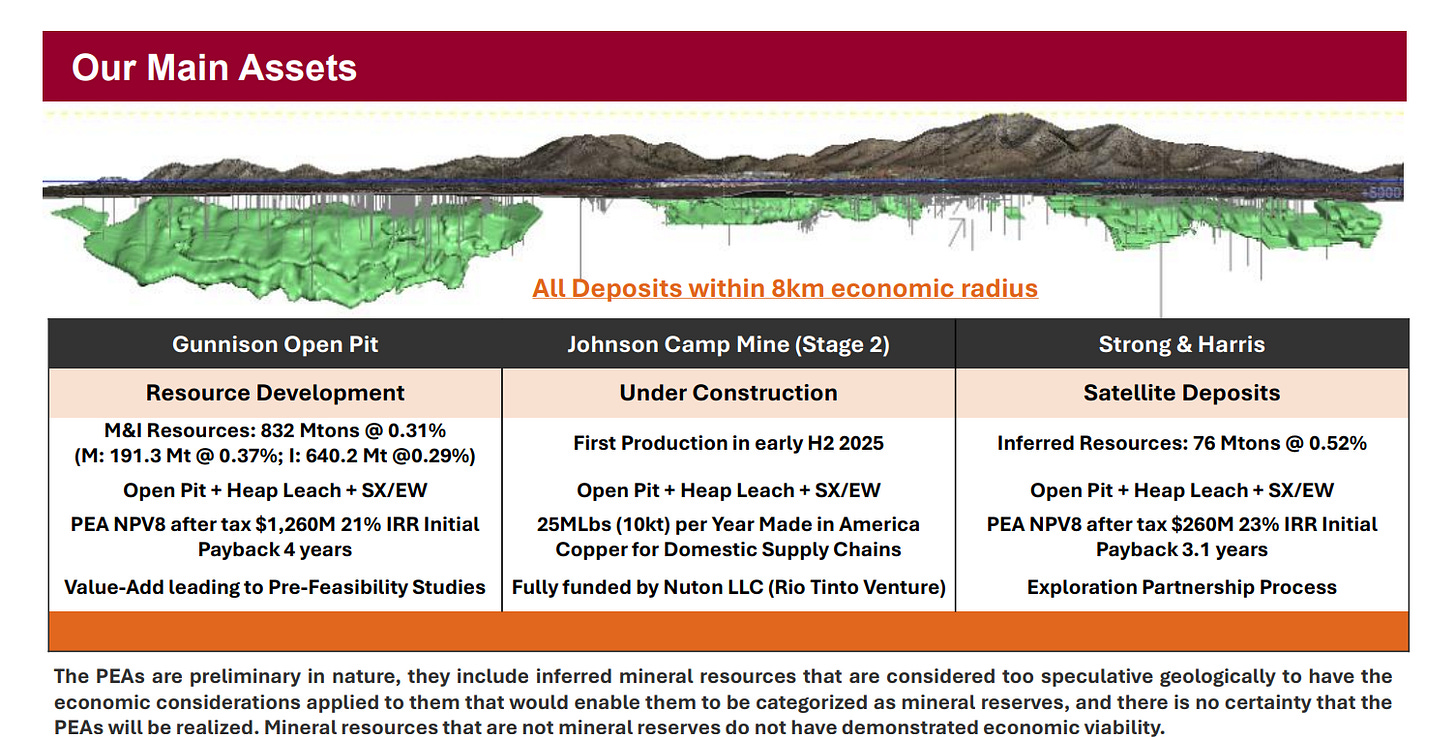

Gunnison Copper Project: Open-pit, preliminary economic-stage copper project with measured and indicated (M&I) resources containing over 831 million tons at 0.31% Cu; NPV of US$1.3Billion, an IRR of 20.9%, at a modest $4.10 Cu price, which is one of the most substantial open-pit copper projects in the United States.

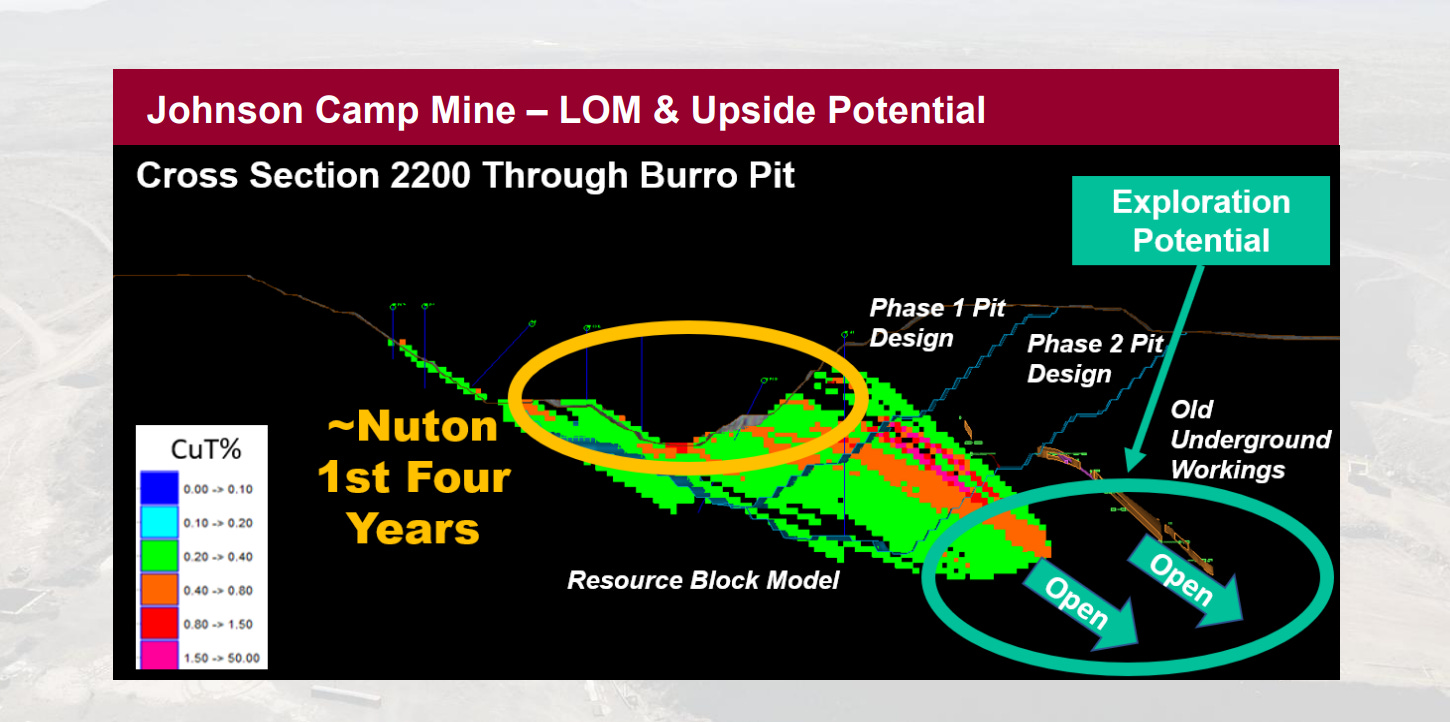

Johnson Camp Mine Project (~2 km north of Gunnison Project): Open-pit, construction-stage copper project with first Cu production slated for the second half of 2025; with mine restart in coordination with Nuton LLC, a Rio Tinto venture.

Arizona’s copper industry remains critical to the global copper supply chain, with both existing mines expanding and new projects advancing to meet growing demand for copper in electric vehicles, renewable energy, and infrastructure. However, permitting challenges, environmental concerns, and water availability continue to be major hurdles for new developments.

With the Trump Administration’s freshly amplified focus on copper and reenergizing the American copper industry, some of these hurdles that have hampered the US mining industry stand to be alleviated.

Near term production and development copper opportunities in the US stand to potentially receive government support and reduced permitting timelines. One American copper deposit poised to move into production in 2025 is a project that I had the opportunity to visit a few years ago.

The Johnson Camp Mine is slated to be moved into production faster than any of the other Arizona copper projects, with first production expected later this year at the Johnson Camp Mine. On January 16th, 2025 Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) and Rio Tinto venture Nuton LLC announced that they have been selected to receive US$13.9 million in tax credits under the Qualifying Advanced Energy Project Credit Program (48C program) to expand production of Made in America copper, which is designated a Critical Material for Energy, from its Johnson Camp Mine in Southern Arizona.

Gunnison is situated at the southeastern end of the Arizona Copper Porphyry Belt, approximately a one hour drive from Tucson:

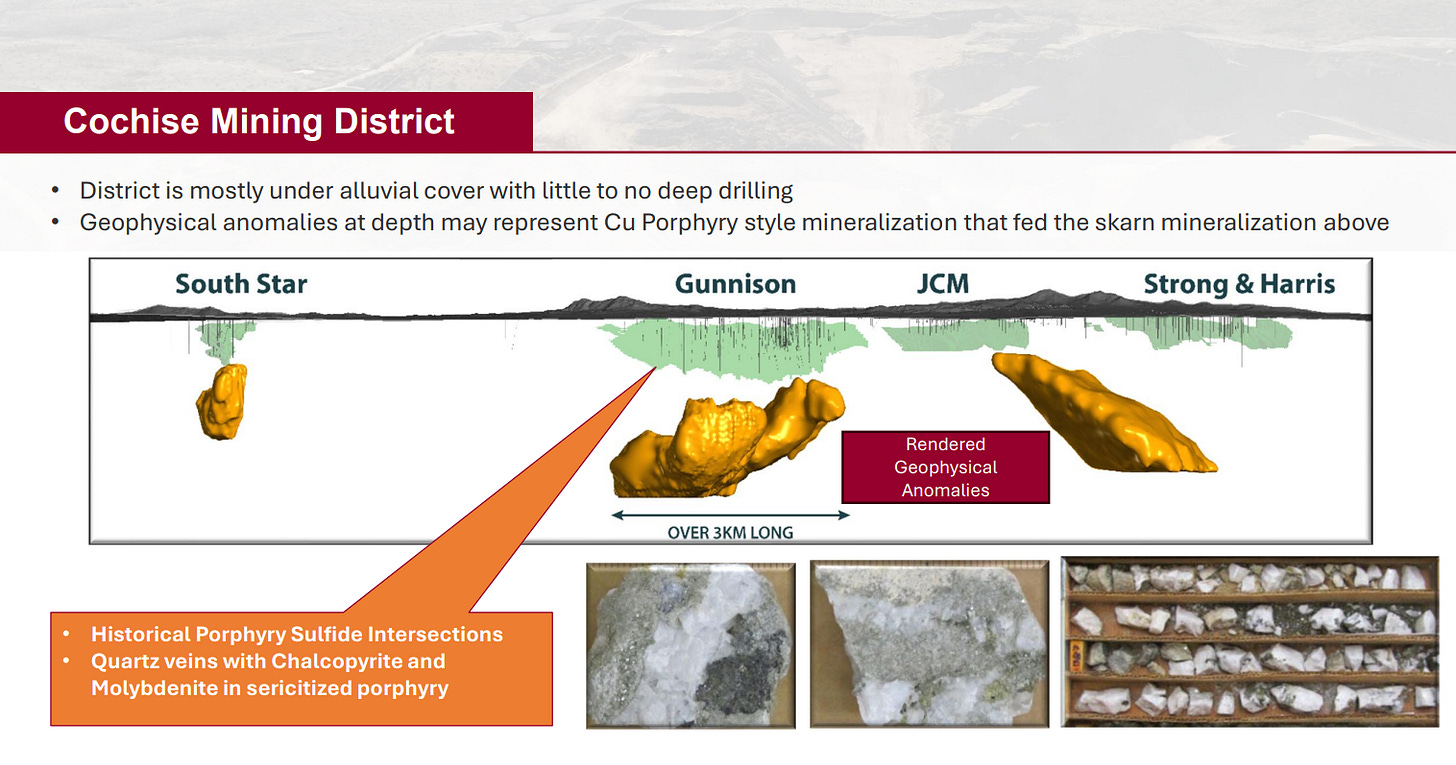

The Johnson Camp Deposit is one of three deposits along an 8 kilometer radius with total resources of nearly one billion tonnes (in all categories) grading above .3% copper:

Additionally, the Johnson Camp Deposit has only seen fairly shallow drilling to date. The deposit remains open along plunge at depth that aligns with copper mineralization in the resource block model:

Johnson Camp is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million pounds of finished copper cathode annually. That American copper cathode produced in southern Arizona will help to meet strong domestic demand in the US. Gunnison's Johnson Camp Asset also received the federal 48C tax credit, another sign of government support and a positive shift in attitude towards the US mining industry.

Next to Johnson Camp is Gunnison’s flagship asset, the Gunnison Copper Project, which has a measured and indicated mineral resource containing over 831 million tons with a total copper grade of 0.31%. Using a conservative $4.10/lb copper price, the economics at Gunnison yields a net present value of US$1.3Billion, an IRR of 20.9%, and payback period of 4.1 years. The Gunnison Copper Project is being developed as a 175 million lbs per annum heap leach, and SX/EW refinery to produce finished copper cathode on-site with direct rail link to the US copper industry.

There are very few mining project locations that I would deem to be virtually ideal, but Gunnison is one of them. Project advantages:

Located in the Arizona Copper Belt in THE copper state of Arizona

Has existing permits, that only need amendments to start mining

Rural location with low population density

No cultural sites, tribal land or nearby tribes; No threatened/endangered species or habitat

Main industries in the area are ranching/mining, no National/State Forest land

Gunnison Copper has US$12 million in cash as per latest financials, and barely a US$40 million market cap. With construction nearing completion at Johnson Camp, first production in six months, plus the large adjacent Gunnison open pit project being developed next to it, GCU (OTC:GCUMF) shares represent one of the few publicly traded near-term American copper production stories out there.

GCU.TO (Daily)

Disclosure: Author owns shares of Gunnison Copper and may choose to buy or sell at any time without notice. Gunnison Copper is a sponsor of Goldfinger Capital so some information presented should be considered biased. It is crucial that readers conduct their own research prior to investing. This includes reading the companies' SEDAR and SEC filings, press releases, and risk disclosures. The information contained in this article is based on data provided by the companies, extracted from SEDAR and SEC filings, company websites, and other publicly available sources.

DISCLAIMER: The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Gunnison Copper Corp. is a high-risk venture stock and not suitable for most investors. Consult company’s SEDAR profiles for important risk disclosures. Goldfinger Capital is not a registered investment advisor and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions. This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDARplus.ca for important risk disclosures. It’s your money and your responsibility.