West Red Lake Gold On Track For Production Ramp-Up At Madsen

West Red Lake Gold is entering a critical production ramp-up period at its high-grade Madsen Gold Mine in Red Lake, Ontario

With gold trading above $2,900/oz, 18 months of hard work is about to be put to the test at West Red Lake Gold Mines (TSX-V:WRLG, OTC: WRLGF). WRLG is entering a critical production ramp-up phase at its Madsen Gold in the Red Lake Region of Ontario. I had the opportunity to speak with West Red Lake VP of communications Gwen Preston about the company’s recently completed C$20 million financing and key milestones investors can expect from West Red Lake over the coming months.

Goldfinger

Gwen, it’s great to speak with you again. We are seeing record free cash flow generation from the senior gold producers and a wave of consolidation is certainly still in progress across the sector, as we saw on Monday with the Caliber/Equinox deal. But let's talk about West Red Lake because this is a near-term production story that is set to get a lot more attention as mining ramps up at the Madsen mine in Red Lake over the next several months.

West Red Lake was able to close a C$20 million financing recently. Tell us about the financing and the rationale for the financing at this time.

Gwen Preston

Absolutely. We closed a C$20 million financing that was originally announced at C$12 million. We had 3 ½ times interest against that original C$12 million book. So as an aside, I think that really speaks to the market interest in a company like ours, which is not common right now. There aren’t many single asset companies putting a gold mine into production in 2025.

You and I have had this conversation before, the leverage that production offers in a gold bull market, that's an attractive thing. The oversubscribed book I think speaks to that. The financing itself, this is about financial strength.

I want to underline that the site plan remains exactly on track. The schedule that we've been talking about for the last 6-8 months remains on track. The bulk sample is about half on surface by now.

We're also building stockpiles on the surface. As we build up those bulk sample piles, we're set to turn on the mill in the next two weeks, maybe even less. I'm not sure of the exact date at this point.

And then we will start processing that bulk sample. We'll put out the results at the beginning of April. And then we will roll from there.

Once the stockpiles are at the right level, then we will roll into putting mineralized material through the mill so that we can ramp this gold mine up in the second half of 2025. Things on site are doing what they're supposed to be doing.

Was the market surprised at the financing? Obviously, you can see that in our share price.

WRLG.V (Daily)

It's all just about financial strength. Financial strength gives you options if you want to do more at a mine site.

It gives you the ability to respond if something goes wrong. A big part of managing a mining company is being prepared for the “what ifs?”. Things are going on plan, on track at the mine site right now.

But what if something happens, whether it's COVID or an earthquake or something going on at the mine, and then you have to raise money to manage that after? That means that you didn't manage risk is our position here. So we put ourselves in a position of increased financial strength so that we're better prepared for what might happen.

And also so that we can be a better situated company in what you just referenced, a strengthening M&A market. Whether that's not looking vulnerable to potential suitors, because we don't want to be taken out in some sort of opportunistic way, that's not serving our investors' best interest. Or if it's looking at things that we might be interested in acquiring.

I'm not saying that a C$20 million CDE financing is going to go to do that, but being in a position of financial strength just lets you consider these things. And so it's all just about financial strength. It's all about options and managing the potential complexities that are involved in something as complicated as starting up a mine.

So that's what the financing was about. And because we really are on track at the mine site, you know, our whole goal now is to just really get back out there now that the deal is closed and we can talk again, hence being on a call with you right now. Just get out there and really reinforce the message that we're on track and that we're so close.

And I am going to push as hard as I can to convince everyone of that so we can get the share price back to where it was as quickly as we can.

Goldfinger

Let’s talk about the financial strength of the company, you have C$31 million cash on hand. Currently, you have the US$20 million available to tap into if you choose to at some point in the future. You've tapped into US$10 million of the debt facility but there's US$20 million still available. The C$31 million in cash and the US$20 million available in debt. Is that enough to get West Red Lake through to the production ramp up process in 2025?

Gwen Preston

If you look at our pre-feasibility study, you can see that once we're putting in, you can run the numbers yourself and see that once we're putting something like 400 tonnes per day through the mill, we don't need any more money, right? Those are the way that the numbers crunch if you look at the pre-feasibility study and work through the costs and the throughput and the ounces and all that. And the goal is to be doing that.

We're going to do the bulk sample processing in March. We're probably going to pause in April while we just make sure that everything is lined up and the stockpiles are where they're going to be. And then as soon as we can after that, we're going to roll into putting mineralized material through the mill.

And our goal is to start at 400 tonnes per day. So it's a short timeframe.

And just to be very clear, we have C$31 million in the bank right now and the US$20 million. So if you want to talk about it in Canadian dollars, we basically have access to C$60 million right now.

That's what we need to get this thing into producing cash flow. And first of all, off the cuff, just sustaining. And then fairly very soon afterwards, as we ramp up in the second half of the year, doing more than sustaining.

Goldfinger

So let's talk a little bit about this bulk sample, which is expected in April, because I've talked to quite a few investors in the industry. Some of them are shareholders and they're very focused on this bulk sample.

So why is the bulk sample important and what kind of results are we looking for?

Gwen Preston

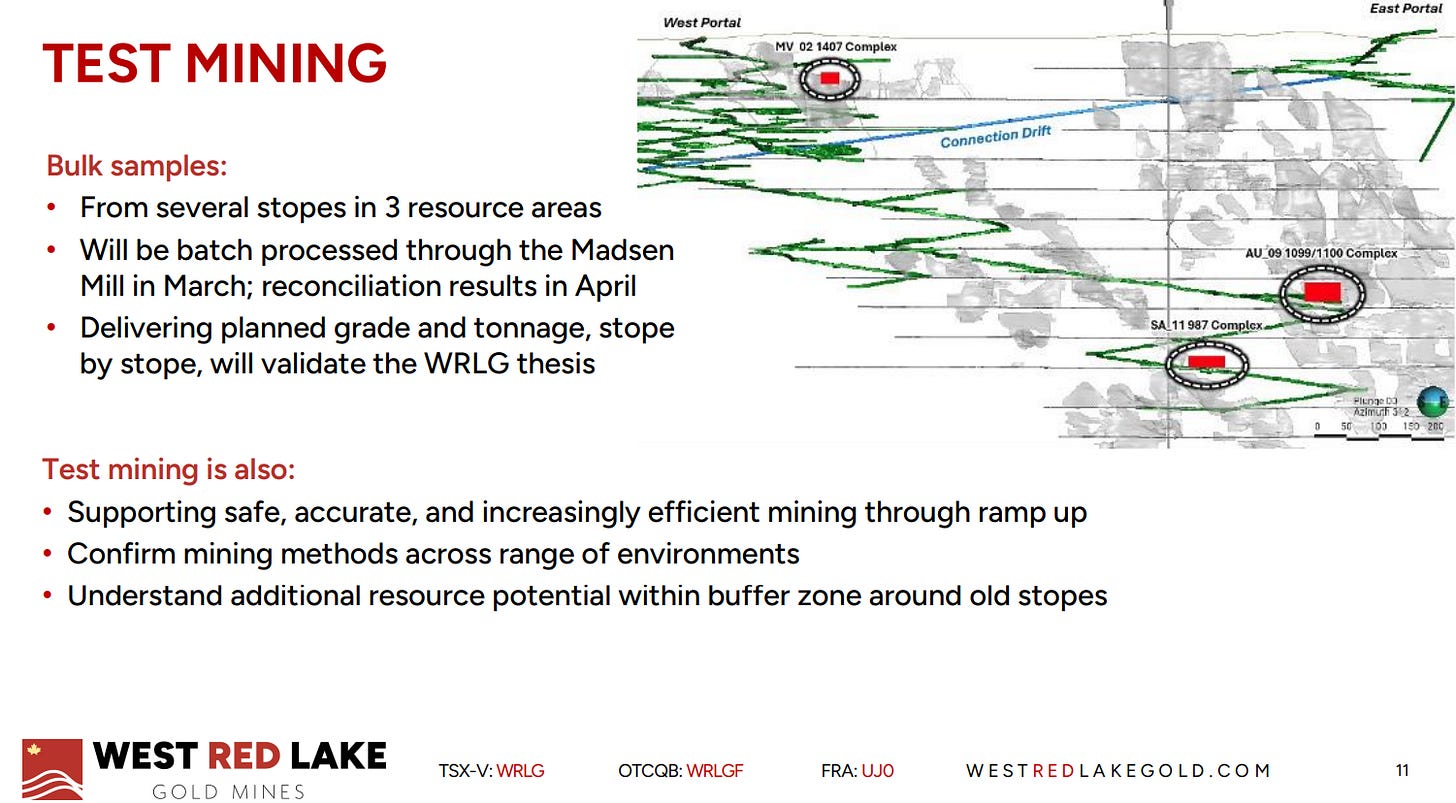

I’m really glad we're talking about this because the bulk sample is so important. The entire premise, the entire investment thesis for West Red Lake Gold is that we can make Madsen a success. Clearly that is in the context of the prior operator having failed at the asset.

Our approach is that by doing a level of definition drilling that is appropriate for the kind of mineralization that we're doing, the rule of thumb of seven meters spacing is what it is for the Red Lake District. It's not what the prior operator did. So we're doing the kind of definition drilling that we believe is just necessary for this kind of system.

We're doing the mining methods that we think are appropriate for this kind of system. And that all leads into the thesis that we're going to be able to deliver the expected tonnes and grade to the mill. We say that this stope has this many tonnes at this grade and this stope has this many tonnes at this grade, and that we're going to be able to do that, because that's really what the prior operator was unable to do.

They said they were going to average 9 g/t gold and they averaged 3.5 g/t. That's obviously a big, big problem. Their costs were also higher, but the first part of the problem was that they weren't able to do the most important thing.

So this bulk sample is our first opportunity to demonstrate that we can do that first most important thing. So there's going to be four to six stopes. We'll see how it plays out, at least four for sure.

And we are going to say how many tonnes and what grade our mine plan said was going to be in each of those. And we're having this audited by third parties, so it's not like we can make the numbers work. We are going to have them audit the numbers that we said came from our mine plan.

We're going to publish those and then we're going to reconcile those against what actually came out of the mine and came out of the mill. So we'll be able to demonstrate our ability to do this. And so it goes without saying that that is then, I mean, the most important piece of news that's going to have come out of West Red Lake for a very long time, arguably since the inception of our entire effort there is this test case of everything that we've been saying we're going to be able to do.

Those results will come out in the first half of April. And yeah, I know that there's lots of people who are watching this closely, there's other examples of bulk samples where people were watching really closely.

The one that I like to point to is Osisko. The Windfall Deposit wasn't a failed mine, but it's a complicated ore body and there was concern about whether the approach to mining was going to be able to deliver the tonnes and grade. They did a bulk sample and they were able to deliver the tonnes and grade. They were able to manage the inconsistency of the deposit, the lack of continuity of the deposit.

They were able to deliver and the market responded in spades. So that's the rationale for doing it. And that's why it's just so important.

Goldfinger

In fact, I spoke to one investor at Mines and Money in Miami last week and he literally told me, “I'm waiting for the bulk sample results before I buy.” I found that to be an interesting comment. It helps to emphasize how important these results will be from a de-risking standpoint.

Gwen Preston

Oh, I love to hear that.

Goldfinger

He's not a small investor either. That's why I made a point to talk about that. So let's discuss the South Austin results because you close the financing and then boom, you hit us with 114 grams per tonne of gold over 10.6 meters, and then 77.9 grams per tonne over three meters. Additionally, there were a few other intercepts averaging above 20 g/t gold. And I see that the South Austin zone has a resource in the indicated category of 474,600 ounces at 8.7 grams per tonne.

When I reviewed the recent results from South Austin, I noted that almost all of those intercepts are above the average grade of that zone. Does that mean that South Austin could actually be higher grade than 8.7 grams per tonne average resource grade?

Gwen Preston

The beautiful thing about Red Lake is the richness of these gold systems. When you look at the mineralization in Red Lake, you can complain about the fact that you have to do 7-meter spacing on the drilling, but when you do 7-meter spacing on the drilling and really define those zones, like actually know exactly where the mineralization is going in those zones, then you're able to tap into the richness of these systems, right? You’ve got to mine in the right places.

And so that's what the definition drilling program is all about is making sure we know exactly where the South Austin zone is in all of its different parts. And when you do that, then you start getting into some of the goods, right? This is why they've mined 30,000,000 ounces of gold in Red Lake, because the more you get into the system, the more likely you are to be able to hit into the kind of goodness that exists there.

So is South Austin going to be higher grade than the resource? I can't say here or there. I will say that these results are phenomenal.

I love seeing 114 grams per tonne over 10 meters. That's a really wonderful exit number, because when you're looking at mining widths and grades, I mean, man, that kind of area can make a big impact on the value of a particular stope. And it just reinforces why we're doing what we're doing.

Yes, there's lots of reason that Madsen is not an easy mine. It's been mined before, so we have to work around old workings. It requires a lot of drilling.

I get it. It's not an easy mine. But there's a reason that we're there, and it's because it's got mineralization like this.

And so we're so excited. That set of drill results when they came in was just such a strong reminder for us at the team of this is why we're doing what we're doing.

Goldfinger

Followed by a period of test mining, and then if all goes well, at some point in June, the ramp-up process will begin. And you mentioned the 400 tonne per day mark. So once the operation at Madsen does achieve that 400 tonne per day throughput, is that when we can officially say the ramp-up has started?

Gwen Preston

Yeah, I'd say that that's a good capture for sure. We don't want to say, we are starting production on and then give a date. We want to process the bulk sample.

So test mining and bulk sample, those are basically synonymous. We are test mining to produce the bulk sample. We are also at the same time mining to start building up stockpiles, because you want to have stockpiles.

As the test mining for the bulk sample finishes, and we have those stopes that we identified for the bulk sample in their piles on the surface, then all effort will just go into mining and building up those stockpiles. And once the stockpiles are the size that we are comfortable with, then we will start feeding material into the mill. That's the process.

And we'll just be able to start putting out news releases that say, now we're feeding mineralized material into the mill. Then we will issue monthly updates outlining how much mineralized material we've fed through the mill.

That's our approach to ramp-up. That’s what investors can expect and we're on track for that schedule.

Goldfinger

The company is about to make a really important transition from building up and getting ready to actually fully operate a mining operation and produce gold that will in turn generate cash flow. And this is all going to happen pretty quickly here over the next several months. What is the transition like from a feasibility stage company to an actual mining company?

I know the financial reporting is a little different. I've seen some companies report financials on a monthly basis at the start of the ramp-up process. What will happen with West Red Lake?

Gwen Preston

Yeah, good questions. So I think the summary is that in 2025, at some point we will officially say that we are a producing company instead of a developing company. And like you say, that changes how we do financial reporting.

So that will happen. I'm not sure exactly when that is. It may be very soon.

And then in terms of how we are going to announce results, you don't officially have to start announcing things like quarterlies and guidance until you've announced commercial production. And so while we're through the ramp-up phase, that won't be our status. So we'll have some discretion in that ramp-up phase to provide monthly updates, at least on tonnage, throughput, grade and things like that.

I'm not exactly sure at this point, to be honest, how we're going to report the financial side of things. So I don't want to say something there that ends up being wrong. But those are the sort of steps that we'll go through as we get ourselves towards that obvious goal of being in commercial production.

Goldfinger

I’m curious about the process of selling the gold that will be produced. I’ve asked this question to a few other companies over the years. Do you know who you're going to be selling the gold to? Is this going to the mint or somewhere else?

Gwen Preston

That’s a cool question. Where's the gold actually going? So in the province of Ontario, there's only two places that you're allowed to sell your gold. You can sell it to the mint and you can sell it to Asahi Canada.

So it will be one of those two buyers. I don't think we've made a final determination of who it will be, but it'll be one of those two buyers. And so I think another thing to take away from that is that we will be selling our gold in Canada.

So tariff questions don't really pertain to West Red Lake because we will be producing and selling our gold within the same province even.

Goldfinger

Yeah. Don't get me started on that.

Gwen Preston

It's a boat wreck. All I'm saying is that I don't have to be particularly concerned from a corporate perspective about that ball of wax.

Goldfinger

So I know that there's a lot of exploration targets across the property package. You've got an abundance of targets that you could drill and expand the resource. What is happening on the exploration side for the rest of 2025?

Gwen Preston

I love this question. So the answer right now is nothing because we are in the, like right now, the mantra at the mine site is that every ounce of effort has to be put into pulling tonnes of mineralized material out of the ground. That's what all effort at the mine site has to be on right now.

And that's absolutely appropriate. Once we get into the second half of the year, we expect to be able to spread that load a little bit and get into some exploration. So it'll be an H2 project.

And the challenge facing Will, our VP of Exploration, is which of the targets to go after first. So just give me like a few minutes here and I'm just going to run through them because there's so many that are really good. So we start really close to the mine.

Obviously, there's the Fork Deposit that's only 250 meters away, where we realize there's a high-grade core. So we want to drill that. That's not really exploration.

That's like turning known deposits into mine feed. So that'll be one target. Going to the northeast of the mine, along the structure, there's two targets called North Shore and Venus that we drilled last year.

And we have really exciting looking rocks. The alteration looked exactly the way that it usually does around the Madsen deposit. It turns out we didn't get a tonne of gold in there.

We did get some, but we didn't hit a Madsen. But since then, Will's team had gone out and done a lot of soil sampling and mapping in that area. And they were able to refine geochem targets and some of the exact locations of the ultramafic units.

And why that's important is that a lot of the best mineralization in Red Lake, in general, is in the footwall and hanging wall of ultramafic units. So what that all comes down to is that he's realized that where he was drilling is perhaps just a bit east of where the best targets actually are. So he's really excited to go back up to that North Shore and Venus area, just northeast of the mine, one and two kilometers northeast of the mine, to drill those targets that he now has a little bit better resolution on.

Then there's all the Confederation Rock targets. So, right, like the Red Lake District is half Confederation Rocks and half Balmer assemblage. And for many years, the rule of thumb was that the gold is all in the Balmer and that it isn't in the Confederation Rocks.

But Great Bear blew the lid off of that thesis by having their entire situation in the Confederation Rocks. So Will's team also last year did a major geochem and mapping program on the Confederation half of our land package. And we have some really exciting targets that we want to do initial drill passes on, on the Confederation side.

And then the last one is Rowan, if we're just moving out from Madsen, our Rowan project. Rowan, you may remember that we got in there, we did some drilling, we constrained the resource to a more conservative approach. So that means that right at the Rowan deposit, there's a good opportunity to grow that deposit, pulling in some of the intercepts that we excluded from the resource, just because we didn't think the spacing was tight enough, there wasn't enough information.

So there's a good opportunity, we think, to grow the Rowan deposit through exploration drilling. And just like Madsen, and then going along strike to the northeast, North Shore and Venus, at Rowan, the soil sampling and mapping, there's really good rock exposure up there at Rowan, much better than at Madsen. Going along strike from Rowan, Will discovered some really interesting targets there that have never been tested.

So the hard part for Will will be deciding which of those get the priority, but there's a list of targets that we're really excited to get out and test in the second half of the year.

Goldfinger

Thank you, Gwen, I appreciate your time this afternoon.

Gwen Preston

Thank you for having me.

Disclosure: Author owns shares of West Red Lake Gold at the time of publishing and may choose to buy or sell at any time without notice. Goldfinger Capital has been compensated for production, editing, and dissemination of this interview.

Disclaimer

The interview is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Listeners are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The stocks discussed in this interview are high-risk venture stocks and not suitable for most investors. Consult Company SEDAR profiles for important risk disclosures. This interview contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information.