Why Trump Is Obsessed With Getting The Fed To Cut Rates & What It Means For Gold

A looming, multi-faceted plan of financial repression ensures that we are in the early stages of the "America First" US dollar bear market.

Why is Trump obsessed with getting the Fed to cut the Fed Funds Rate?

It’s not difficult to figure out the answer.

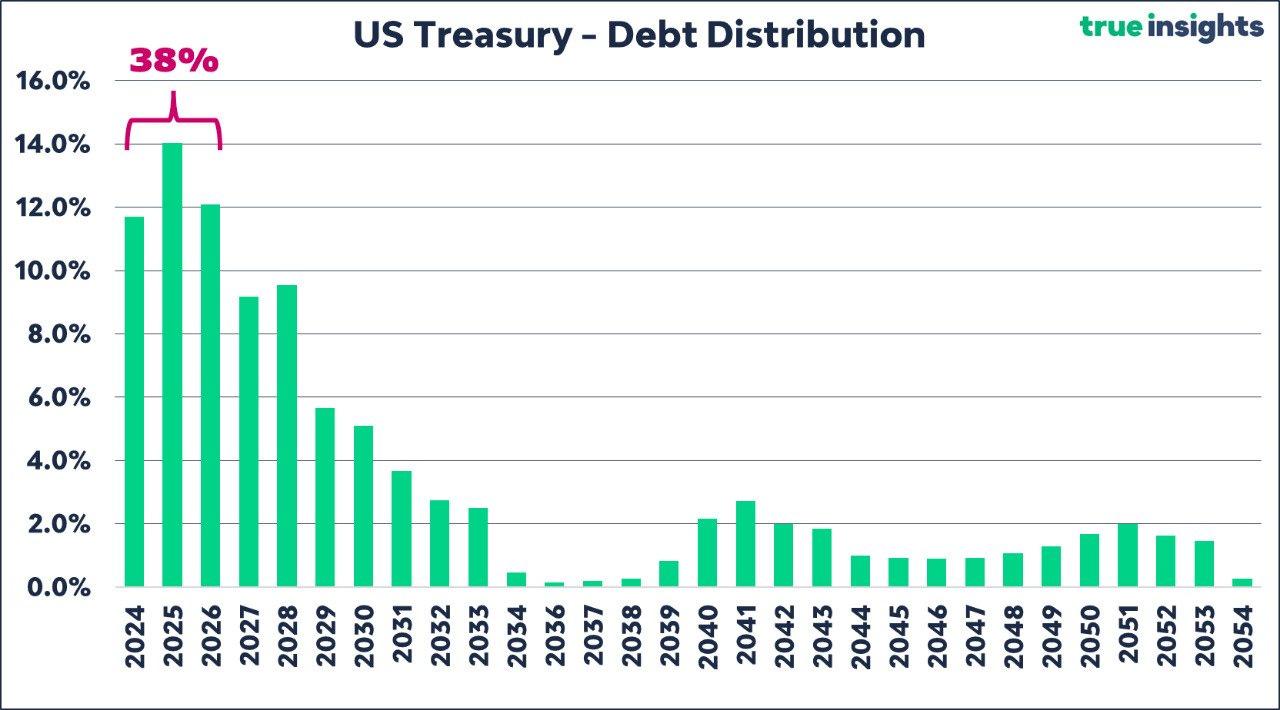

$9.5 trillion of Treasury debt issuance needs refinancing in 2025. When combined with an expected $1.9 trillion federal deficit, gross Treasury issuance is projected to exceed $10 trillion in 2025. In addition, US interest payments on debt are currently more than $1 trillion per annum and will keep rising until the US Treasury 5- year yield (currently ~4.0%) falls below 3.3%.

By holding the FFR at 4.50% Powell is making it more expensive for Bessent to jam a mountain of Treasury issuance into the front end of the yield curve.

2026 is also set to be a year of outsized Treasury refinancing, it is also a midterm election year.

You can be sure that Trump 2.0 has a well constructed game plan for how to manage this mountain of US Treasury issuance without causing Treasury yields to soar.

The plan includes:

SLR rule changes: Potential rule changes include reducing the supplementary requirement or changing how the ratio is calculated.

Stablecoins: Stablecoin bill—passed by the U.S. Senate last week and on its way to the House of Representatives. Stablecoins will be mandated to hold high-quality liquid assets such as Treasury Bills.

“Encouraging” close trading partners/allies such as Japan/UK to buy more USTs as part of new trade deals - the irony of this part of the plan is that the UK has an ailing economy and Japan is one of the largest sovereign debt issuers in the world (~240% debt-to-GDP).

Treasury buybacks (issue T-Bills to fund buybacks at the long end in an attempt to create a flatter yield curve)

Perhaps most prominent of the above plans is the SLR rule change; the U.S. is weighing a regulatory shift that could ease restrictions on the country’s largest banks—potentially boosting their appetite for Treasury securities.

At the center of the discussion is the Supplementary Leverage Ratio (SLR), a Federal Reserve requirement aimed at ensuring big banks hold sufficient capital to cover potential losses, regardless of the perceived riskiness of their assets. Under the current framework, the larger the institution, the more capital it must hold relative to its total exposures—including ‘risk-free’ assets like Treasuries.

The Fed’s Board of Governors is set to review possible adjustments to the rule on June 25th, including options such as lowering the leverage threshold or modifying how the SLR is calculated.

Major banks have long contended that the SLR unnecessarily restricts their ability to hold U.S. government debt, especially since other risk-based capital rules already help ensure financial stability. Treasury Secretary Scott Bessent and newly appointed Fed Vice Chair for Supervision Michelle Bowman are among those backing a more flexible approach. In remarks earlier this year, Fed Chair Jerome Powell also acknowledged that revising the SLR could help banks better accommodate the swelling supply of Treasuries.

The Supplementary Leverage Ratio is a measure of a bank’s capital adequacy, intended to ensure that large financial institutions have enough equity capital to absorb losses.

It is calculated as:

SLR = Tier 1 Capital / Total Leverage Exposure (expressed as a percentage)

Tier 1 Capital includes core capital (common equity, retained earnings).

Total Leverage Exposure includes both on-balance-sheet assets (like loans, Treasuries) and certain off-balance-sheet exposures (like derivatives, loan commitments).

By lowering the SLR leverage threshold, banks will be able to absorb more of the looming Treasury debt issuance:

By reducing the SLR percentage from 5% to 2.5% an additional $2 trillion of demand for US Treasuries could be unleashed.

Suppressing interest rates in an effort to stimulate growth, and to digest trillions of dollars in Treasury issuance, is a form of financial repression.

Artificial demand for government bonds can be created through a combination of monetary and regulatory policy:

If central banks suppress rates (e.g., via QE), they boost the price and reduce the yield of government debt, making it cheaper for governments to borrow.

Combined with regulatory incentives or requirements, banks are nudged to hold more low-yielding government debt.

All of these tactics reduce the ‘price of money’, and in turn are likely to suppress the value of the US dollar. After all, why would foreign investors want to hold US dollars with artificially low interest rates?

The main takeaway here is that Trump 2.0’s strategy to place a looming avalanche of debt refinancing will gradually weaken the US dollar over time and deliver a potent tailwind to hard assets such as gold, silver, and other commodities.

We are in the early stages of the “America First” US Dollar bear market, plan accordingly.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDARplus.ca for important risk disclosures. It’s your money and your responsibility.