Fed Goes 50bps, Gold Gyrates At All-Time Highs, & A Stock I'm Buying Today

The Federal Reserve surprised many market participants with a 50bps rate cut Wednesday afternoon

It turns out that last week’s Fed whisperers were clued in on what was about to transpire with yesterdays’ FOMC announcement. The Fed reduced the Fed Funds Rate (FFR) by 50 basis points in what was a surprise to some, but definitely not a surprise to readers of this blog.

Two weeks ago, when the Fed Fund Futures market pricing was firmly in favor of a 25bps rate cut, I wrote the following words:

“I view a 50bps rate cut as being a 60/40 proposition at this point, with the recent trends in economic data moving in favor of 50bps over a more modest 25bps cut. I believe the fact that there is no October FOMC meeting puts the odds in favor of Fed choosing to move 50bps. The statement and press conference will also likely make it clear that they are in the process of getting the Fed Funds Rate down to a more neutral level near 4.00% by Q1 of next year.”

To be clear, this was the most uncertain FOMC decision in years. However, as it turned out there was only one dissent among Fed Governors (the vote was 11 to 1 in favor of 50bps, with Bowman preferring a 25bps rate cut). Powell was firm in calling this a “recalibration” due to the fact that inflation has moderated a great deal and there are growing signs of softening in the labor market.

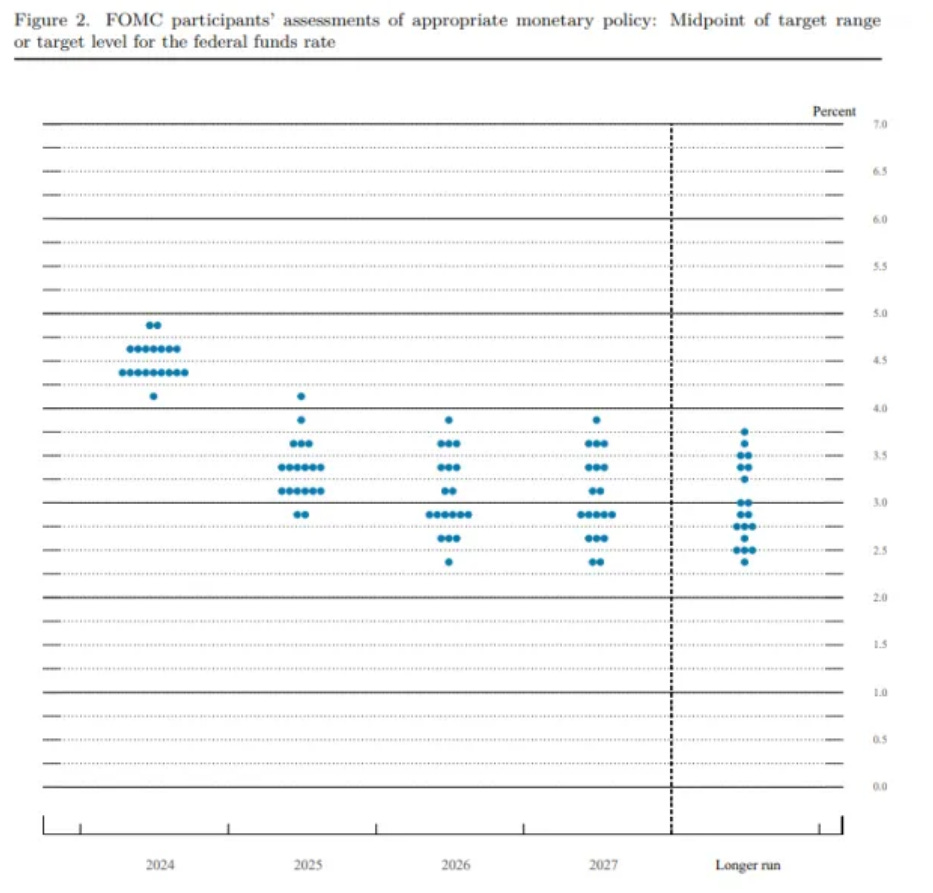

Some went as far as to call yesterday’s move a “hawkish” 50 basis point rate cut due to the fact that the dot plots only show 25bps rate cuts in November and December:

Only one FOMC member sees another 50bps rate cut in 2024. However, through history we know that 50bps rate cuts are reserved for times of economic stress. In fact, the years in which we have seen 50bps rate cuts (2001, 2007, 2008, 2020) are all well known for recessions and market turmoil. That is why it is so unusual that the Fed has reduced the FFR 50bps with stocks at all-time highs, while the Fed Chairman continues to talk up the economy.

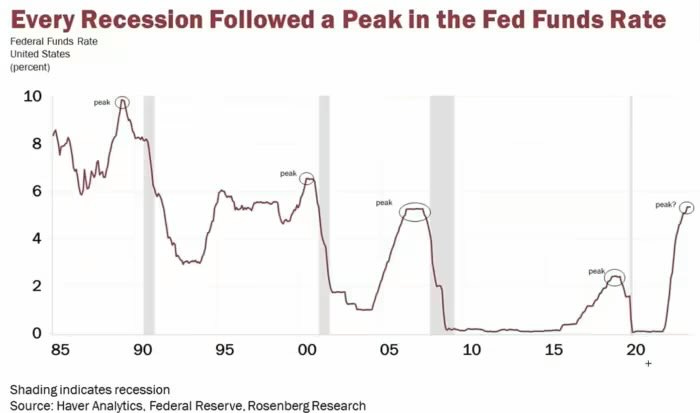

In fact, it would be unprecedented for the US economy to not fall into recession over the next several months:

The recessions of the early 90s, early 2000s, Global Financial Crisis (2007-2009), and the pandemic all were preceded by the Federal Reserve lowering interest rates from a peak level.

In addition, the Treasury yield curve is now steepening after moving out of inversion for the first time in more than two years - a very strong recession indicator with a near perfect track record:

If the data continues to soften over the coming weeks, I believe it will be difficult for Powell to ‘only’ cut the FFR 25bps on November 7th (the next FOMC meeting). The neutral rate is clearly closer to the 3.50%-4.00% range, and by slow-walking the FFR lower the Fed could still be seen as pressing down on financial conditions. Meanwhile, the labor market (as evidenced by the latest JOLTs data and the constant downward revisions to non-farm payrolls) is displaying signs of serious weakness beneath the surface. The US election is likely to only add to the labor market uncertainty as employers hold off on new hiring decisions until they have more economic policy clarity (mid-2025?).

All else be equal, I’d be betting on another 50bps rate cut in November.

All of this adds up to a beautiful set of tailwinds for our favorite yellow metal.

Gold experienced some gyrations in the final 90 minutes of Wednesday’s trading, this was not terribly unexpected given the size of last week’s rally and the natural tendency for fast money traders to sell the news.

For gold investors, the task is now a simple one: To be unmoved by short term noise, be right and sit tight.

Gold (Monthly)

We’re not there yet.

I will conclude today’s missive by sharing the chart of a stock that I believe could be poised to move higher over the coming weeks.

MNMD (Daily)

MindMed (Nasdaq: MNMD) is not a precious metals mining stock. In fact, it’s a clinical-stage biotech company focused on the nascent medical psychedelics space. MindMed is focused on developing novel product candidates to treat brain health disorders. MNMD is developing a pipeline of innovative product candidates, with and without acute perceptual effects, targeting neurotransmitter pathways that play key roles in brain health disorders.

MindMed currently has two candidates in clinical trials, including MM120 (Lysergide D-tartrate) for the treatment of GAD (generalized anxiety disorder) commencing phase 3 by the end of the year:

Earlier this year, MM120 received FDA breakthrough therapy designation for the treatment of GAD.

MNMD currently has roughly US$300 million in cash in its treasury after completing a US$75 million financing at $7.00 per share. MNMD is also one of the most heavily shorted stocks in the US market with 36.3% short interest at last check. Shorts are betting against the company’s ability to achieve FDA approval for one of its product candidates, but it seems to me to be a potentially unwise wager. Especially considering the company’s cash hoard and FDA breakthrough therapy designation for MM120.

Disclosure: Author owns shares of MNMD at the time of publishing and may choose to buy or sell at any time without notice.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This video is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.