The Charts Of The Week: Running Bull Market In Gold & The Race Is On For Porphyry Copper Deposits

New 2024 Rally Highs In Gold & Silver Helped To Generate Some Powerful Moves In Select Junior Miners, But Many Stocks Are Still Waiting To Join The Party

Gold futures reached $2772.60 early Wednesday morning, and then proceeded to dump $50/oz over the span of 7 hours. However, the ‘running bull market’ in gold quickly found bids in the $2,720s and continued its ascent, finishing the week back above $2,750:

Gold (30-minute)

Some of the key characteristics of a running bull market are:

Short-lived corrections (often violent but limited in duration).

Regular ‘bear traps’ in which it looks like the top is in; these traps entice short sellers to enter the market, only to trap them when the market reverses higher again - the bears serve as fuel for the market to make higher highs.

They almost always go farther than most market participants can imagine.

The Relative Strength Index (RSI) moves into ‘overbought’ territory (above 70) and can often stay there for extended periods of time.

Investor sentiment is bullish, and can remain bullish for extended periods of time.

The GDX gold miners exchange-traded fund rose 9 days in a row through Tuesday October 22nd, but then proceeded to finish the week with 3 consecutive losing trading sessions for a ~6% correction as of Friday’s close:

GDX (Daily)

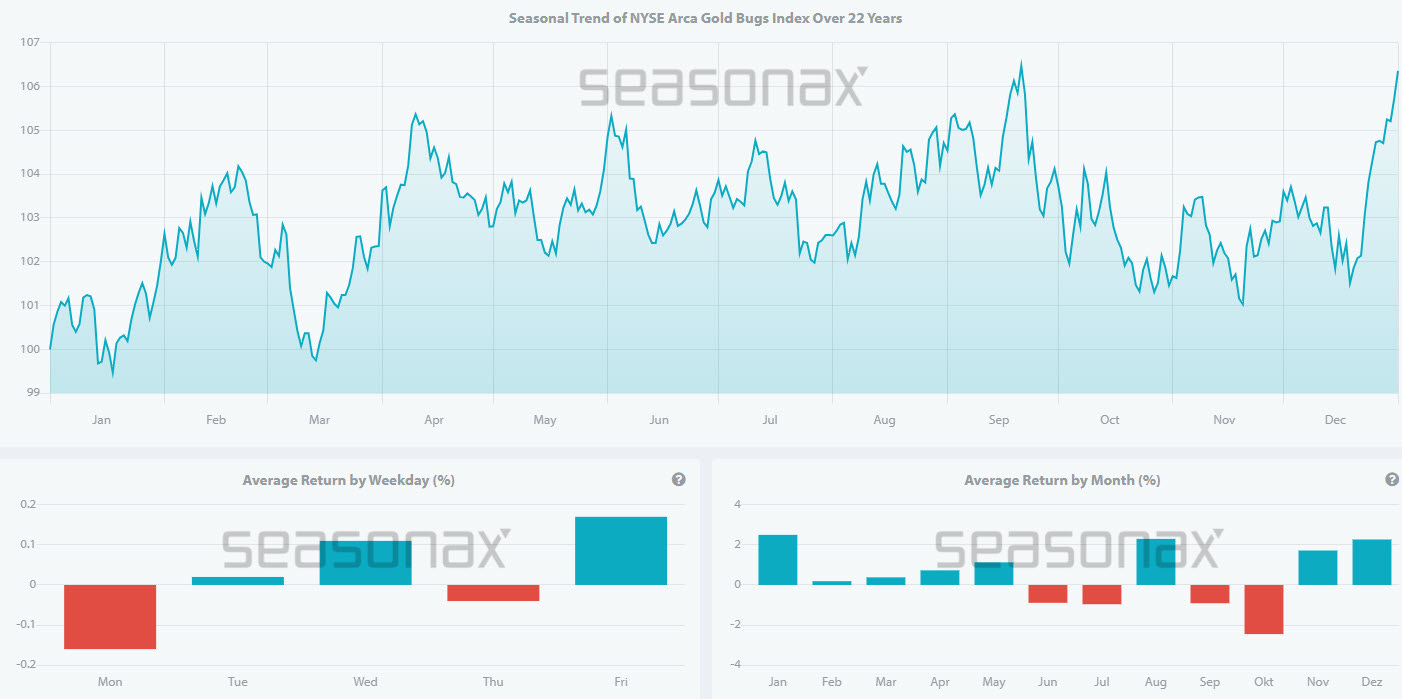

The GDX was heavily dragged down on Thursday by Newmont’s -15% shellacking, but I think we can all agree that a 6% pullback is par for the course and actually quite healthy. A gold sector correction at the end of October offers the potential for a nice entry point in early November, just as seasonal tailwinds begin to kick-in:

Turning to the juniors, we are receiving a heavy dose of corporate news flow, including a number of financing announcements across the sector. Let’s review some of the news & charts that got my attention:

AE.V (Daily)

A remarkable week for American Eagle (+40%) after the company released assay results for five drill holes on Monday Morning. Tuesday afternoon, I conducted a live discussion with the AE team. Some of the technical discussion generated a great deal of interest. In particular, based on Neil Prowse and Charlie Greig’s comments there is optimism that four holes drilled in the Copper Enriched North Zone (holes 24-33, 24-35, 24-37, and 24-38) could deliver some joy.

Shares of Arizona gold & silver explorer Aztec Minerals (TSX-V:AZT, OTC: AZZTF) rose 26.7% last week:

AZT.V (Daily)

Aztec is in the middle of a fully funded step-out drilling program at its Tombstone Gold-Silver Project located in Cochise County, Arizona. The current phase of drilling at Tombstone is targeting shallow zones identified as prospective for high-grade oxide gold-silver mineralization associated with recently completed surface exploration results and 3D geological modelling.

West Red Lake Gold (TSX-V:WRLG, OTC: WRLGF) announced that it closed a C$29 million bought-deal public offering. The net proceeds of the financing are expected to be used to continue to advance the development of a restart plan for the Madsen Gold Mine as well as for working capital and general corporate purposes.

WRLG.V (Daily)

WRLG shares have solid support at the $.65 level as seen above. The C$29 million bought-deal in combination with a US$35 million loan facility with Nebari gives West Red Lake sufficient capital to advance its Madsen Mine (Red Lake, Ontario) to a production restart scenario in the 2nd half of 2025. Definition & expansion drilling in multiple zones at Madsen is ongoing (South Austin, Upper 8, Austin, etc.). In addition, a test mining & bulk sample program is underway at Madsen - this represents a key de-risking component to the mine restart plan; test mining will provide the WRLG team with important data on how to most effectively mine at Madsen.

ATEX resources (TSX-V:ATX, OTC: ECRTF) jumped 11% after announcing a US$40 million strategic investment in ATEX by Agnico Eagle Mines Limited (NYSE: AEM) on a non-brokered private placement basis.

ATX.V (Daily)

Agnico is purchasing 33.9 million shares of ATEX at a price of C$1.63 per share for gross proceeds of C$55 million (US$40 million). This represents a 15% premium to the closing price on October 18th, 2024. In addition, Agnico gets ~17 million warrants with a C$2.50 exercise price that are good for five years. Once the financing closes, Agnico will have a 13% stake in ATEX.

This is an eye-opening investment by Agnico for a few reasons. First of all, Agnico is the world’s #3 gold producer with annual production of ~3.5 million ounces. However, in the last year Agnico has begun making strategic investments in base metals juniors (Canada Nickel, and now ATEX).

ATEX’s Valeriano Copper-Gold Porphyry Project is located in Chile and hosts a large copper-gold porphyry mineral resource totaling 1.41 billion tonnes at a .67% copper-equivalent average grade. This is a very large porphyry deposit that contains ~9 million ounces of gold, in addition to its ~15 billion pounds of copper. But the tricky part is that the Valeriano ore body is deep in the Earth, more than 1,000 meters deep to be precise:

The depth of the porphyry deposit virtually ensures that if Valeriano does become a mine one day, that it will be an underground block cave operation.

The conventional wisdom has been that a deep deposit, one that is only amenable to block caving, needs more than a one billion tonne ore body with ~1% Cu-Eq average grades in order to be economic. ATEX has not completed an economic study at Valeriano. However, based on the today’s news, Agnico must see the potential for a high-grade underground starter mine closer to surface, with the potential to fast-track development of an underground mining operation at Valeriano.

Perhaps most notably for the copper/gold mining sector more broadly, Agnico’s strategic investment in ATEX is yet another indication that majors are beginning to place their bets on higher copper prices in the future. After all, if ~1% Cu-Eq grades are economic for deep underground mining at US$4/lb copper, what kind of average grades could be economic at US$6/lb or US$8/lb copper prices?

I believe the race is on among the world’s largest mining companies to secure the largest porphyry copper deposits in the best mining jurisdictions globally:

The BHP/Lundin acquisition of Filo Mining for C$4.5 billion was the largest acquisition of a copper junior miner in history. It was also the best copper asset held by a junior globally.

BHP’s failed attempt to acquire Anglo American for US$49 billion was all about expanding its copper asset portfolio.

Barrick’s investment in Hercules Metals (TSX-V:BIG, OTC:BADEF) in November 2023, followed by its aggressive staking program totaling more than 100,000 acres in Western Idaho is another sign that the majors are hungry for copper. The Hercules Copper Porphyry Discovery, and Barrick’s larger staking program are examples of early-stage generative exploration. This is proof that majors are willing to take risks to secure unique assets with large upside potential in good jurisdictions.

It feels like it’s still early in this M&A cycle and there are a lot more deals to come. What are the most attractive porphyry copper assets held by juniors that could become targets for the majors?

Disclosure: Author owns shares of some of the stocks discussed in this article, the author may choose to buy or sell at any time without notice.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The stocks discussed in this article are high-risk venture stocks and not suitable for most investors. Consult Company SEDAR profiles for important risk disclosures. This interview contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information.