U.S. Government Concludes That Processed Critical Minerals Pose A Threat To U.S. National Security: Operation Warp Speed Critical Minerals Edition

The U.S. has finally woken up to how desperately behind it is with regard to critical minerals mining & processing

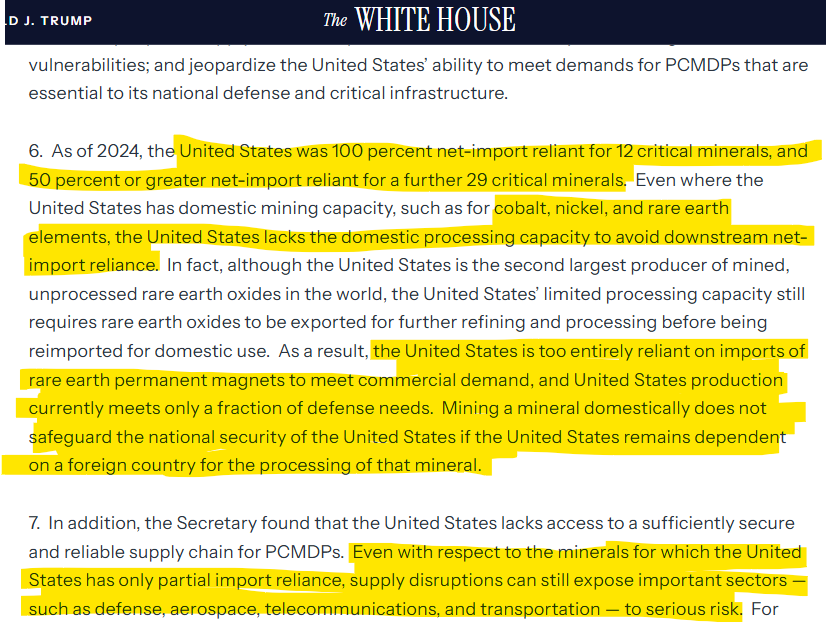

This afternoon, the White House issued a proclamation titled “Adjusting Imports of Processed Critical Minerals and Their Derivative Products Into the United States”. The proclamation arises from a Section 232 investigation by the U.S. Secretary of Commerce into whether imports of processed critical minerals and their derivative products (PCMDPs) threaten U.S. national security.

The Secretary of Commerce (SC) concluded that such imports do pose a threat because they underpin defense, critical infrastructure, and the broader economy.

The SC’s investigation found that:

PCMDPs are essential to virtually every industry, including national defense systems, energy infrastructure, telecommunications, and advanced manufacturing (e.g., rare-earth magnets used in electronics and vehicles).

The U.S. is overly reliant on foreign imports for these materials, with 12 critical minerals 100% net-import dependent and another 29 over 50% dependent.

Even where raw minerals are mined domestically (e.g., rare earth oxides), the processing capacity is insufficient, forcing export of raw materials and re-import of processed inputs.

Weak processing capacity and import reliance create vulnerabilities to supply chain disruption, foreign market manipulation, price volatility, and strategic leverage by other countries.

Domestic production and refining have declined, while demand (from defense, AI, nuclear energy, EVs, etc.) continues to grow.

The proclamation formally agrees with the SC’s finding that current import levels and dependence could impair U.S. national security. This includes risks to military readiness and resilience of U.S. industrial and critical infrastructure sectors. Foreign dominance in processing amplifies strategic risk, even if the U.S. mines the raw mineral domestically.

What’s Next?

The President has directed negotiators to pursue agreements with foreign trading partners aimed at adjusting imports so they no longer threaten U.S. national security. The U.S. Trade Representative and Commerce Secretary must jointly negotiate with trading partners on adjusting imports of PCMDPs. Agreements may include price floors or other negotiated terms to stabilize supply and reduce vulnerability.

The objectives are multi-faceted:

Rebuild domestic processing and refining capacity for critical minerals

Reduce strategic dependence on foreign supply chains

Strengthen U.S. defense and industrial base resilience

Leverage trade tools to manage imports that are seen as posing national security risks

Price floors are a market-structuring tool—in the context of processed critical minerals, they are meant to solve a very specific failure that keeps the U.S. dependent on imports: prices that are too volatile and too low to justify domestic processing investment.

A price floor sets a minimum acceptable price for imported processed critical minerals, or domestic offtake contracts for processed material. If foreign suppliers sell below the floor, penalties or restrictions will apply. Government guaranteed price floors help to create predictable cash flows which allows processors to secure project finance, and in theory reduces their cost of capital.

Which Metals Are The Focus?

The proclamation clearly pinpoints rare earths as being a major strategic vulnerability. Cobalt and nickel are also mentioned as two metals which the U.S. has mining capacity, but remains vulnerable in terms of processing capabilities making it net-import dependent.

The list of metals most critical to U.S. defense and military applications includes rare earth elements, cobalt, and nickel at the top of the list. Other critical metals that are integral to defense are antimony, tungsten, and titanium among many others.

Although the proclamation did not explicitly state them, I did my best to come up with the list of 12 critical minerals with 100% net-import dependence and another 29 metals for which the U.S. is 50% or greater net-import reliant.

100% Net-Import Reliant

Natural graphite

Gallium

Germanium

Manganese

Rare earth elements (overall or many individual REEs)

Indium

Fluorspar

Scandium

Cesium

Rubidium

Tantalum

Bismuth

50%+ Net-Import Reliant

Cobalt

Lithium

Nickel

Copper (refined inputs especially)

Platinum group metals (platinum/palladium)

Zinc

Chromium

Hafnium

Yttrium

Neodymium (heavy REE subset)

Dysprosium (heavy REE)

Praseodymium (heavy REE)

Europium

Terbium

Lithium

Antimony

Boron

Lead

Potash

Phosphate

Rhenium

Silver

Platinum/Palladium group overlaps with above metals but are often >50% import relied

Magnesium (refined forms)

Tin

Tungsten

Notice the metals on this list: nickel, copper, silver, and tin. These are not fringe commodities—they sit at the core of modern industrial and defense supply chains. And yet, the United States remains structurally exposed across nearly all of them.

Take copper. While the U.S. mines an impressive volume each year, it operates just two copper smelters nationwide. That is a glaring bottleneck in a world where copper is becoming increasingly strategic. Nickel is even more stark. The U.S. has only one operating primary nickel mine—Eagle Mine in Michigan’s Upper Peninsula—and its copper and nickel concentrates are shipped to Canada for smelting and refining. In other words, even when we mine the metal at home, we still rely on foreign processing.

Silver is no exception. Despite being a critical industrial and monetary metal, the U.S. has very limited domestic silver refining capacity. Recent market analysis shows U.S. silver refineries have been backed up for months at various points, a clear signal that demand is running ahead of available refining throughput.

The takeaway is unavoidable: the problem is not just mining—it is processing. And until the U.S. addresses these midstream choke points, it will remain dangerously dependent on external partners for metals that underpin economic and national security.

My Take & Key Conclusions

Because China has the United States over a barrel when it comes to critical minerals, there is a strong sense of urgency to address deficiencies in critical-minerals mining and processing and to put the U.S. on much firmer footing.

The United States must strengthen international partnerships and diversify supply chains. This means forging agreements with allies—such as Australia, Japan, Malaysia, Thailand, and Saudi Arabia—to secure reliable access to critical minerals, while also pursuing G7-led initiatives such as rare-earth price floors and public-private partnerships to build resilient alternatives. This de-risking approach avoids full decoupling from China but may include temporary trade arrangements to ease near-term pressures.

Additionally, the U.S. must expand stockpiling, recycling, and technological innovation. I suspect the federal government may already be actively stockpiling certain critical minerals, potentially including metals like nickel and silver, as well as more obscure elements such as scandium and bismuth.

Strategic-metals stockpiling and friend-shoring agreements are important because they buy the United States much-needed time while it works to rapidly build out a domestic critical-minerals supply chain.

Perhaps most importantly, the U.S. must accelerate domestic mining and processing through regulatory reform and funding. This includes streamlining permitting processes, eliminating burdensome regulations, and allocating billions of dollars in federal funding—such as $2 billion for the National Defense Stockpile and $5 billion for the Industrial Base Fund—to expand exploration, extraction, and refining capacity.

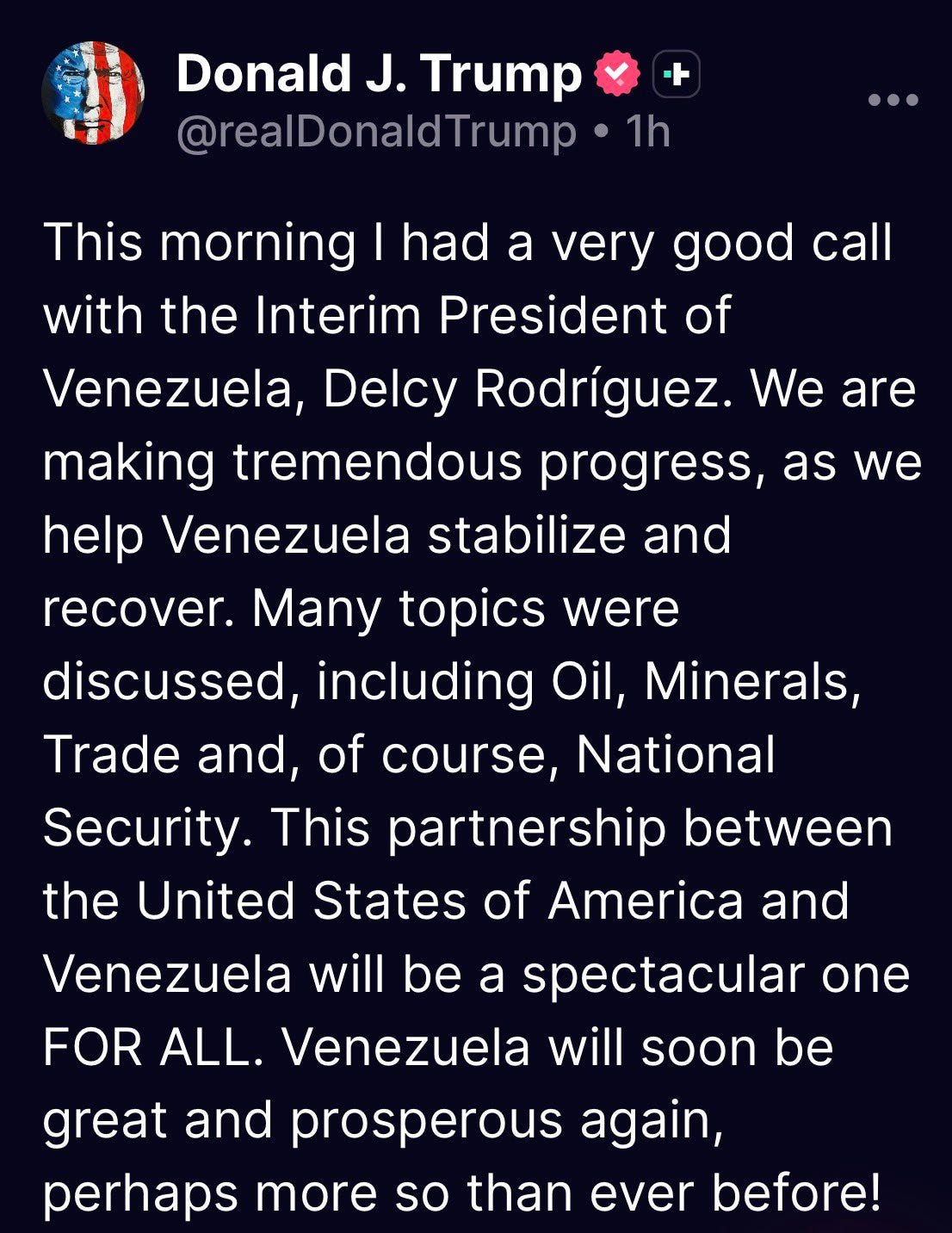

Minerals are on the President’s mind like no other time in history:

I expect that the next six months will be very busy for U.S. critical minerals & mining news flow. We are likely to see more U.S. federal government strategic investments in mining companies. Please note that this process has already resumed in the new year with the Pentagon taking a US$150 million equity stake in Atlantic Alumina Co, a Louisiana-based gallium company (gallium is one of the 12 critical minerals in which the U.S. is 100% net-import reliant). China accounted for ~99% of refined gallium supply in 2025.

In October, I wrote about the U.S. government investment in Trilogy and listed a number of potential candidates for future U.S government investment. This list is still relevant today, and I view Talon Metals (TSX:TLO, OTC:TLOFF) as the company most likely to receive U.S. government investment in 2026. Perpetua Resources (Nasdaq:PPTA), Energy Fuels (NYSE:UUUU), Gunnison Copper (TSX:GCU, OTC:GCUMF), and Ivanhoe Electric (NYSE:IE) are all strong candidates as well.

To be crystal clear, the Venezuela operation (the Maduro arrest) was about preempting China and asserting supreme dominance in the Americas. Trump’s obsession with Greenland is about China. Iran is about China as well—Tehran is a key supplier of crude oil to Beijing—and Trump 2.0’s focus on critical minerals is also about China.

Additionally, I expect to see more detailed initiatives aimed at building new smelting and refining facilities in mineral-rich states. The U.S. will have its own nickel smelter, likely in either Michigan or North Dakota, aligned with Talon Metals’ existing infrastructure initiatives. Beyond reopening the Hayden Smelter near the Ray Mine in Arizona, the construction of a third copper smelter in the Arizona Copper Belt is another no-brainer.

Finally, the Louisiana Gulf Coast is a natural location for “midstream” refining facilities—separation, chemical conversion, and metals/alloy processing. These facilities will predominantly focus on rare-earth separation, graphite anode processing, and lithium carbonate and hydroxide chemical conversion.

Trump 2.0 is embarking on an Operation Warp Speed: Processed Critical Minerals Edition. We haven’t seen anything like this since World War II—and hopefully, this does not mean we are entering World War III.

Disclosure: Author owns shares of Talon Metals and Gunnison Copper at the time of publishing and may choose to buy or sell at any time without notice.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SedarPlus.ca for important risk disclosures. It’s your money and your responsibility.

Im predicting BHP and Faraday will have some sort of agreement this year whether thats a partnership or whether Faraday takes ownership of some assets that BHP currently hold but are deemed non core.

Thank You ... ! Really detailed article ...

BTO and / or ADDED To:

100% Net-Import Reliant

Natural graphite

Rare earth elements (overall or many individual REEs)

Scandium

Cesium

50%+ Net-Import Reliant

Cobalt

Lithium

Copper (refined inputs especially)

Platinum group metals (platinum/palladium)

Lithium

Antimony US

Silver

Platinum/Palladium

. . .

Uranium Miners ... little and then some big

The devil is in the details ... I just think we have a long row to hoe ... China ate our lunch ... and everything we need is still filling their plate their plate ...